KARACHI:

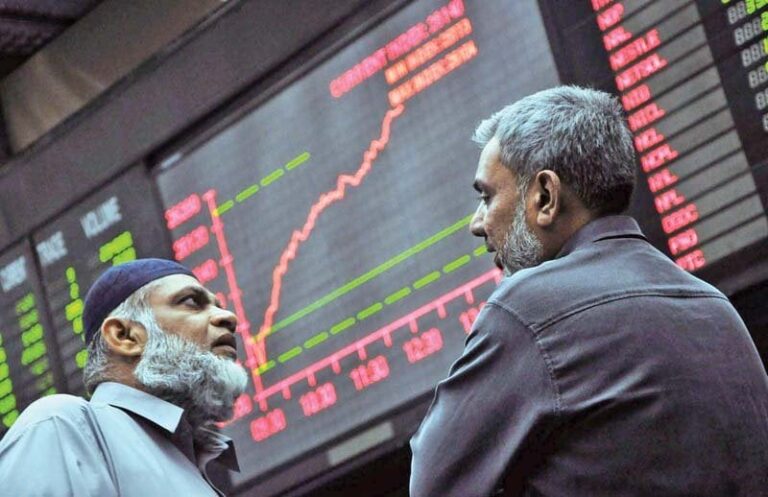

Pakistan Stock Exchange (PSX) on Wednesday saw a significant upswing, where the KSE-100 index gained over 1,100 points, driven by investor optimism following a staff-level agreement with the International Monetary Fund (IMF).

The surge was aided by strong performances across key sectors such as commercial banks and oil and gas exploration companies. Reports of potential reserves of $60 billion in the Reko Diq copper and gold mine also lifted the market.

The signing of a 28-month arrangement by Pakistan and the IMF under the Resilience and Sustainability Facility (RSF), amounting to $1.3 billion, significantly boosted investor confidence, driving the market to the intra-day high of 118,221 points.

Arif Habib Corp MD Ahsan Mehanti wrote that stocks closed bullish after the IMF reached a deal to unlock $1.3 billion under the RSF and $1 billion under the existing Extended Fund Facility (EFF) and due to the government’s reduction in March 2025 inflation forecast to 1%.

Surging global crude oil prices and an updated feasibility study confirming $60 billion worth of Reko Diq reserves were the additional catalysts for bullish close at the PSX, he added.

At the end of trading, the benchmark KSE-100 index posted a handsome rise of 1,139.14 points, or 0.98%, and settled at 117,772.31.

Topline Securities reported that the stock market performed strongly, with the benchmark index reaching a high of 1,588 points. The surge was fuelled by investor optimism following a staff-level agreement with the IMF, which boosted market confidence.

The rally was primarily driven by United Bank, Oil and Gas Development Company (OGDC), Pakistan Petroleum, Mari Petroleum and Meezan Bank, it said.

Arif Habib Limited (AHL) stated that the KSE-100 saw more gains after testing the 115-116k support. A total of 60 shares rose while 33 fell, with United Bank (+5.79%), OGDC (+3.82%) and Pakistan Petroleum (+4.22%) leading the gains. Conversely, Bank Alfalah (-2.22%), Engro Fertilisers (-0.68%) and Service Industries (-2.95%) were the major drags.

AHL pointed out that Pakistan and the IMF reached a staff-level agreement on the first review of the ongoing 37-month, $7 billion EFF, which is subject to the executive board approval, following which $1 billon would be disbursed.

In addition to that, Pakistan and the IMF also signed a new 28-month arrangement under the RSF, amounting to $1.3 billion. AHL expects the market to continue trending higher, potentially reaching the 120k range.

JS Global analyst Muhammad Hasan Ather said bulls took charge of the trading floor as sentiment improved following the IMF’s staff-level agreement. Additionally, optimism was fuelled by a feasibility study conducted by Oil and Gas Development Company and Pakistan Petroleum on the Reko Diq mine potential.

Buying activity was primarily concentrated in the oil and gas and banking sectors. Looking ahead, Ather asked investors to capitalise on gains at higher levels, particularly ahead of Eid holidays.

KTrade Securities, in its market wrap, observed that the upward momentum was driven by Pakistan’s progress in unlocking the IMF review, paving the way for a second loan installment along with additional funds for battling climate change.

Oil and gas, banking and power sectors led the index’s rise, with United Bank, OGDC, Pakistan Petroleum, Meezan Bank, Mari Petroleum and Hub Power being the top contributors.

Overall trading volumes increased to 356.7 million shares compared with Tuesday’s tally of 268.1 million. Shares of 438 companies were traded. Of these, 206 stocks closed higher, 167 fell and 65 remained unchanged. The value of shares traded during the day stood at Rs37.5 billion.

Pak Elektron was the volume leader with trading in 29.2 million shares, gaining Rs1.58 to close at Rs47.48. It was followed by Pakistan State Oil with 26.9 million shares, gaining Rs1.06 to close at Rs419.93 and Cnergyico PK with 17.5 million shares, rising Rs0.06 to close at Rs8. Foreign investors bought shares worth Rs650.9 million, the NCCPL reported.