Chinese EV manufacturers, including BYD, account for more than 40% of Germany’s EV imports through April 2024. China remained Germany’s largest EV importer even in the face of the new EU tariffs. Can China maintain this momentum with additional tariffs of up to 38.1% on EV imports?

Despite a 15.7% fall in imports of Chinese-made electric cars in Germany in the first four months of 2024, their market share still increased.

According to data released by the German Statistics Office on Tuesday ( Reuters), and BYD, German EV imports from Chinese automakers will reach 31,500 units by April 2024. China accounts for the largest share of EV imports in the region, at 40.9%.

The statistics bureau attributed the decline in imports to weakening domestic demand: China’s EV imports fell slightly, while other countries, such as South Korea, saw their EV imports fall by almost 50%.

“Chinese imports of electric vehicles fell much more slowly than total imports of electric vehicles,” the German statistics office said.

The market share increase comes after the EU announced last week it would impose additional tariffs on EV imports from China.

Will the new EU tariffs affect BYD and Chinese EV imports?

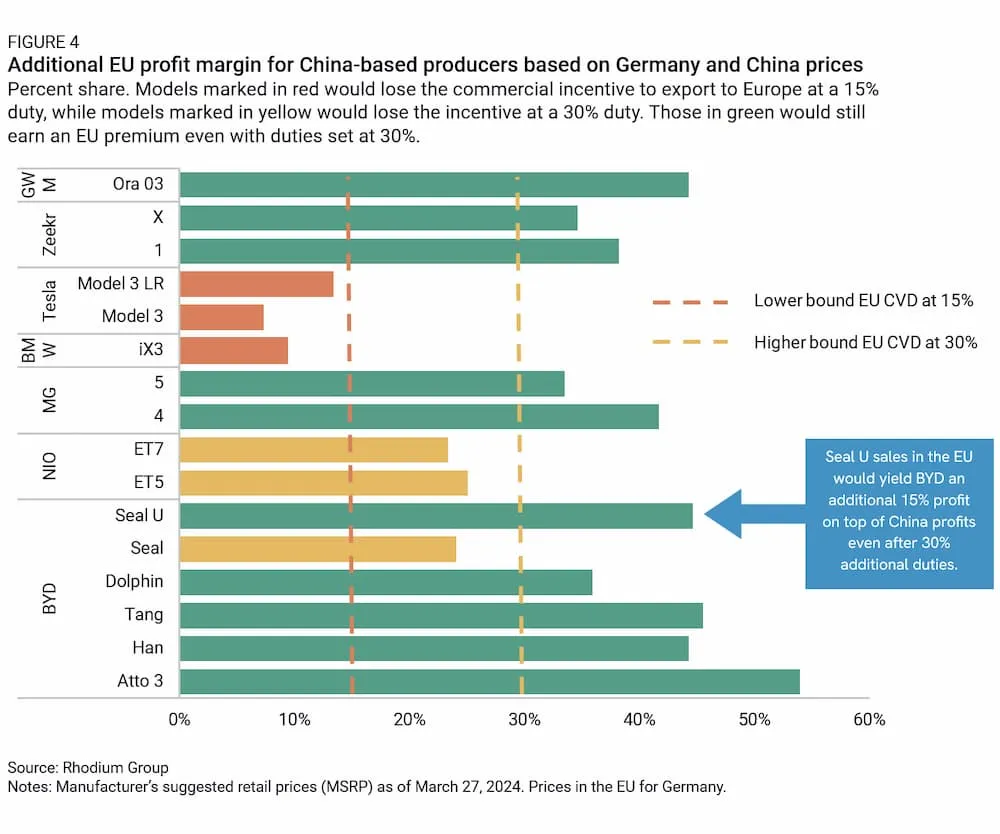

If no solution is found by July 4, 2024, BYD will face additional tariffs of 17.4%, Geely 20% and SAIC 38.1%. Other Chinese EV makers, such as NIO, will face an additional tariff of 21% on EV imports from Europe.

But the extra costs may not be enough to stop Chinese automakers from selling EVs overseas.

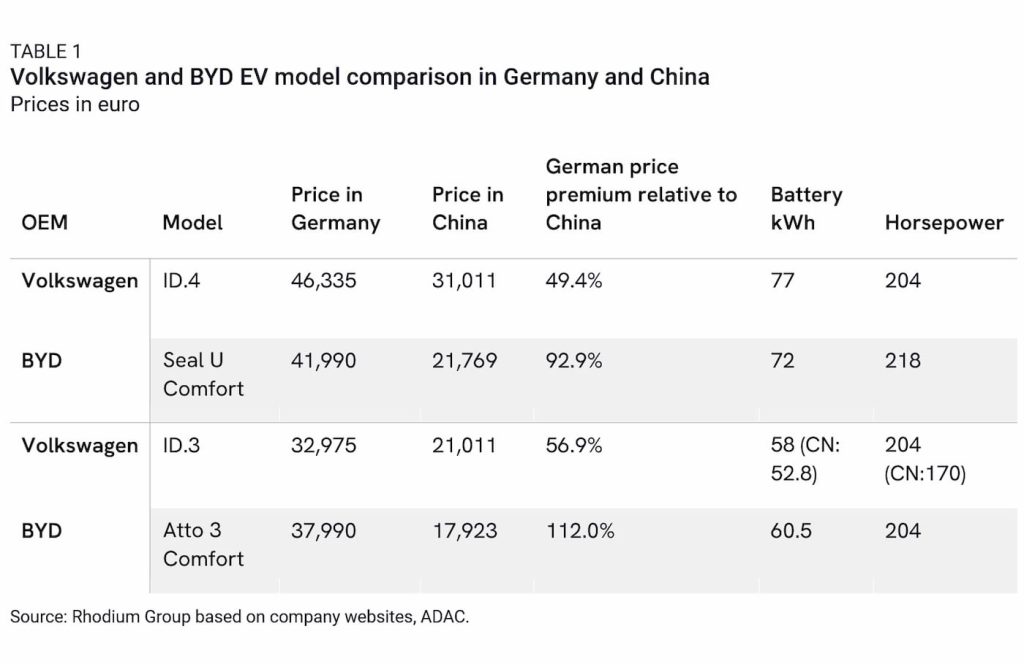

From the research Rhodium Group Even with the 30% tariff, BYD is still able to make 15% more profit on the Seal U sold in the EU than in China.

BYD’s Seal U is nearly 93% more expensive in Europe than in China (€41,990 vs. €21,769), and compared to other automakers such as Volkswagen, which is offering a 50% price increase for the ID.4, BYD enjoys a larger “EU premium” for its EVs.

Studies suggest tariffs may need to be raised by 40%, 50% or more to slow the momentum.

Electrek’s take

Several Chinese automakers, including BYD and NIO, remain focused on expanding their brands in Europe despite the potential tariffs.

Recent studies have shown that automakers such as BMW will be the hardest hit: Even with the tariffs, BYD’s cheapest electric car, the Seagull, is expected to sell for less than $21,500 (€20,000).

In China, BYD’s Seagull EV is priced from $9,700 (69,800 yuan). In overseas markets such as Brazil, the low-cost EV starts at $20,000 (99,800 Brazilian real).

BYD CEO Wang Chuanfu said earlier this month that the EU and the US are “afraid” of Chinese EVs. “If we’re not strong enough, they won’t be afraid,” Wang explained. The BYD leader said the new tariffs are a testament to the strength of China’s auto industry.

What do you think? Will BYD and other Chinese EV makers be able to maintain their momentum with the new tariffs? Let us know your thoughts in the comments section.

FTC: We use automated affiliate links that generate revenue. more.