The EU’s announcement of new tariffs on imports of Chinese-made EVs has left BYD subject to an additional 17.4% tariff, but the EV leader is expected to overcome the impact as BYD is reportedly earning higher profits in the EU than in China on its EV models such as the Seal U.

BYD has announced that it will enter the European auto market in 2020. Following its launch in Norway in 2021, BYD has unveiled an EV lineup that includes the Atto 3, Han and Tang models.

Since then, BYD has strategically expanded in the region, adding models such as the Dolphin and Seal. Last year, the Atto3 was BYD’s best-selling EV in Europe, with 12,363 units sold, followed by the Dolphin (1,079 units), Tan (1,055 units) and Han (849 units).

However, BYD expects sales to accelerate over the next few years as it gains greater understanding of the EU market.

These high expectations come despite the EU imposing new tariffs on EV imports from China, with EU Commission President Ursula von der Leyen announcing an investigation in October after global markets were “flooded with cheap electric cars from China.”

The EU has found that Chinese EVs benefit from “unfair subsidies” and this week pre-announced additional tariffs it plans to impose on automakers.

BYD EV profits still high in EU with tariffs

The additional tariffs on BYD will be 17.4%, effective from July 4, 2024, unless other solutions are found.

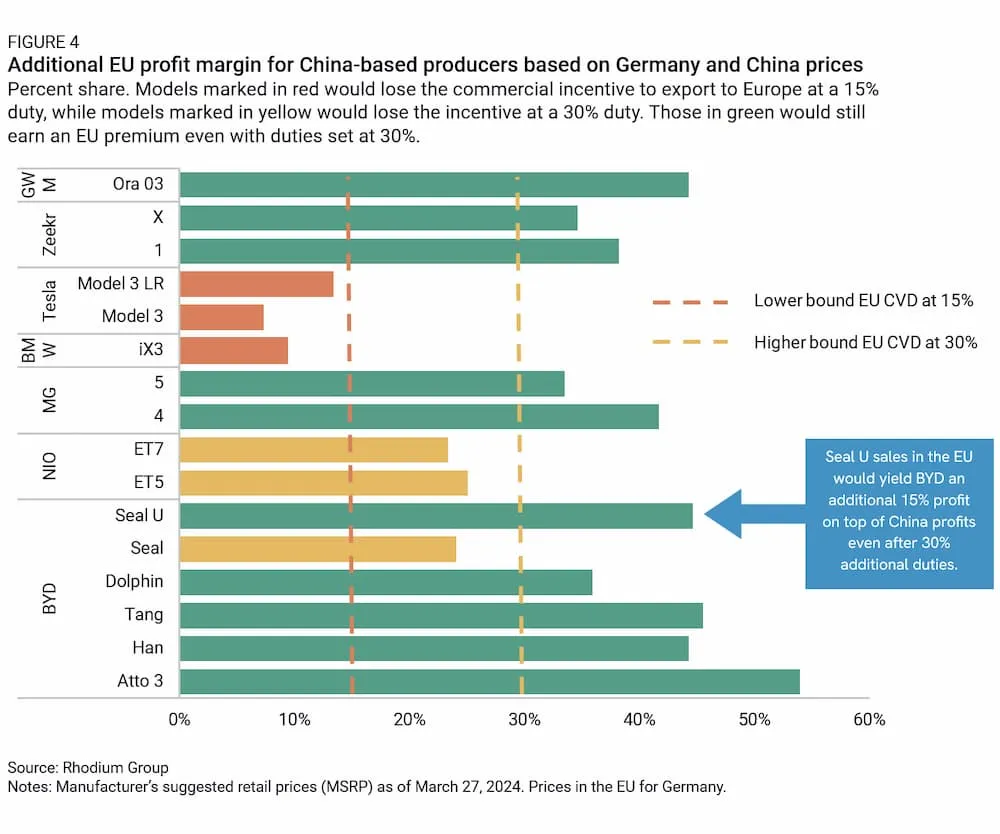

On the other hand, recent studies Rhodium Group The results suggest that tariffs may not be enough to slow the market share gains of BYD and other Chinese EV makers.

Tariffs of 40 to 50 percent or more would likely be needed to slow the momentum, according to the study.

The Chinese market is becoming increasingly competitive and aggressively undercutting prices, resulting in many electric cars selling for much more in the EU than they do in China. And this isn’t just a problem for Chinese automakers.

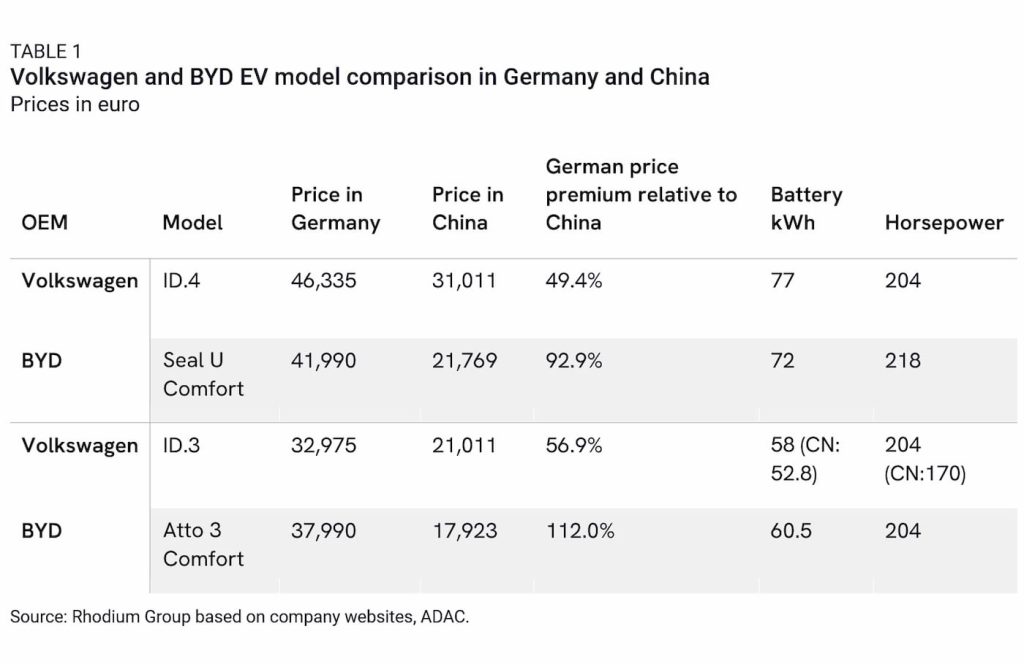

Volkswagen’s ID.4 is around 50% more expensive in Europe than in China (€46,335 vs. €31,011), BYD’s Seal U (Comfort) is nearly 93% more expensive (€41,990 vs. €21,769), and the same is true for other popular models such as the BYD Atto 3 (+112%) and Volkswagen ID.3 (57%).

According to Rhodium’s price analysis, BYD makes a profit of about 14,300 euros ($15,360) on each Seal U model sold in the EU. In China, BYD makes a profit of 1,300 euros ($1,400) on each model sold.

Based on the manufacturer’s suggested retail price (after shipping, customs duties, distribution costs and VAT), BYD stands to earn 13,000 euros ($14,000) more for each Seal U model sold in the EU (the “EU Premium”).

The EU would need to raise tariffs significantly to discourage exports. Even at a 30% tariff, BYD would still have a 15% advantage over China, or 4,700 euros ($5,050).

Tariffs of around 45% to 55% might be needed to cut into profits, but they could be even harder for foreign automakers like BMW and Tesla that export from China.

BYD CEO Wang Chuanfu said last week that the US and Europe are “afraid” of Chinese EVs. “If they are not powerful enough, they will not be afraid,” he added.

Wang said the tariffs are a testament to the strength of China’s auto industry. BYD is due to start production at its first European factory later this year, and the electric-vehicle maker is hopeful it can overcome any potential impact from higher tariffs.

Source: CarNewsChina, Rhodium Group

FTC: We use automated affiliate links that generate revenue. more.