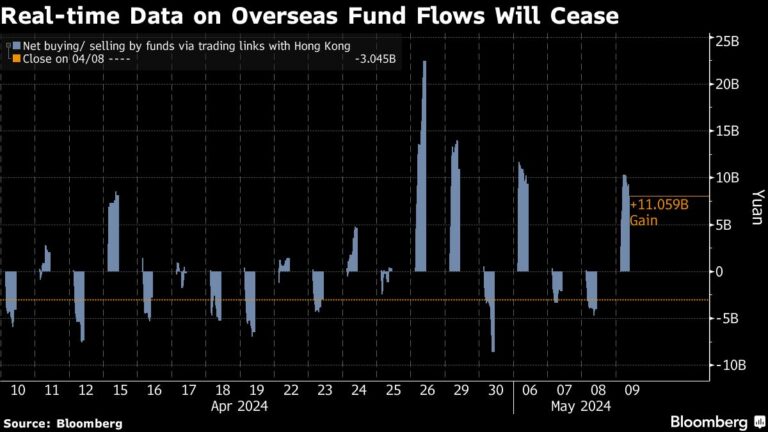

(Bloomberg) — China plans to halt live streaming of overseas flows into stocks as early as Monday, the latest move to boost confidence by eliminating potential sources of negative data. It’s a measure.

Most Read Articles on Bloomberg

Exchanges in Shanghai and Shenzhen will stop displaying real-time figures for local stock purchases and sales through trading links with Hong Kong. Instead, the two stock exchanges will provide sales details on a daily basis, along with the 10 most traded stocks via the northbound channel.

Authorities say this is in line with international practice, but also an attempt to limit the impact of data showing selling in foreign funds on market sentiment. Chinese stocks have risen since the announcement of the move, showing investors are taking it well and focusing on positive factors such as attractive valuations and government efforts to ease the housing crisis. .

“There are certainly some funds that have factored in the short-term flow of investors heading north into their models, and without real-time data, some funds have reduced trading frequency,” said Chen Xi, fund manager at Shanghai Jade. “This could lead to a decline,” he said. Stone Investment Management Co. “But to evaluate investors, it doesn’t really matter whether they release this number every month during the day because it’s mostly just noise.”

Intraday figures showing capital outflows from abroad are believed to be contributing to deteriorating sentiment among Chinese retail investors, who still dominate domestic trading amid several sharp declines over the past year. It will be done. Some participants called on authorities to hide such numbers.

When the two stock exchanges announced their decision on April 12, they did not give an exact date and said the changes would take effect “within approximately one month.” Stock exchange officials in charge of media relations in Shanghai and Shenzhen did not immediately respond to requests for comment.

The Hong Kong Stock Exchange said in a filing on Saturday that adjustments to market data such as Stock Connect’s real-time trading volume and daily allocated balance will take effect from Monday.

The world’s second-largest stock market has risen since February after the Chinese government introduced a number of relief measures, from broader trading restrictions to state-funded purchases and the appointment of a new head of the securities regulator. ing. The economic recovery has gained further momentum in recent weeks, helped by new signs of economic recovery and the flow of foreign funds.

Read: China’s stock rally has many features that point to further gains to come

Northbound investors made net purchases for the third consecutive month in April, the longest in a year when including daily purchases. The inflows continued this month, with an additional 4.8 billion yuan ($664 million). This means that overseas funds have bought back more than half of the money they sold since August.

Global investors’ presence in China’s stock market remains small, while geopolitical tensions, including the US government’s expected decision to impose tariffs on Chinese goods such as electric cars, could again hurt sentiment abroad. In April, the average daily value of land-based stocks traded via exchange links with Hong Kong accounted for about 15% of the total volume of the mainland stock market.

The benchmark CSI 300 index has risen more than 5% since the changes were announced, showing that Chinese investors have largely ignored the upcoming loss of live northbound data.

“Northbound is not the main flow factor in this market, and the intraday numbers reflect sentiment rather than fundamental changes on the day,” said Yang Bo, chief investment officer at Shenzhen Zhuode Investment Management. “There is,” he said. “It helps avoid the volatility brought about by these mood swings and is beneficial for the healthy long-term development of the market,” he added.

–With assistance from Amanda Wang, Alice Huang, and Neha D’silva.

(Adds Hong Kong Exchange announcement in 7th paragraph.)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP