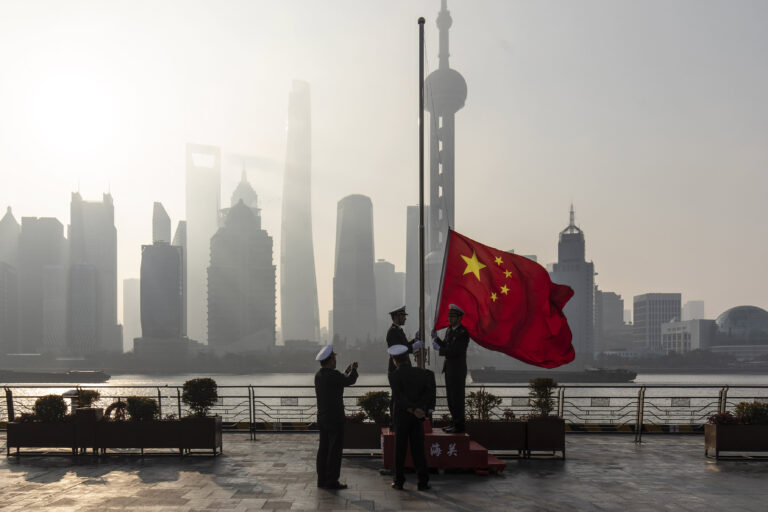

Chinese customs officials raise the Chinese flag during a rehearsal for the flag-raising ceremony in Shanghai.

Shen Qilai | Bloomberg | Getty Images

According to Morningstar, China’s exchange-traded funds have experienced “phenomenal” growth over the past five years, with inflows consistently hitting record highs.

“Over the past three years, annual inflows into China ETFs have surged almost fivefold,” Morningstar analyst Wanda Wang wrote in a June report.

According to data provided by a U.S. financial services company, total annual inflows into China’s ETFs swelled from 127.2 billion CNY ($17.49 billion) in 2021 to 387.2 billion CNY in 2022. In 2023, the figure reached 604.3 billion CNY.

By the end of last year, China’s ETFs’ total assets under management (AUM) had more than doubled from the end of 2020, reaching 1.82 trillion yuan.

“From 2018 to 2023, China ETFs’ annual asset growth rate will be an astounding 40% on average, with total assets under management reaching record highs every year,” the Morningstar report said.

The financial services firm said China’s A-share market as a whole will be “underperforming” from 2022 onwards, with the bright spots only in certain niche industries.

“The growth of China’s ETF market in the past few years has been explosive,” Wang told CNBC.

Against this backdrop, it has become difficult for actively managed funds to deliver outstanding performance, leading China’s ETF market to double its total assets under management to 2 trillion yuan in less than three years.

“Institutional inflows are concentrated in ETFs tracking broad indexes, which is the most important part of the rapid inflow of ETFs in China,” Wang added.

Equity products in particular have gained “significant traction” over the past three years and will account for an overwhelming 96% of China’s total 870 ETFs by the end of 2023.

Inflows and annual assets under management into China’s equity ETFs also hit record highs, Wang wrote. In 2023 alone, annual inflows are expected to reach 575.6 billion yuan, exceeding the total inflows from 2019 to 2022.

What’s more, the rapid growth of the semiconductor sector has led to big inflows into Morningstar’s so-called technology and communications sector stocks, Wang added.

Meanwhile, the equity finance and real estate sectors saw net outflows, the report showed.

Fixed income ETFs, which accounted for 4% of the total ETFs, have seen slower developments in terms of new product launches and growth in assets under management. Commodity ETFs, primarily gold ETFs, accounted for less than 2%.

Morningstar noted that China’s ETF market tends to be concentrated around large providers, including China Asset Management Co., Ltd., E Fund Management Co., and Huatai PineBridge Co., Ltd., the three largest ETF providers by assets under management.

— CNBC’s Evelyn Chen contributed to this report.