(Bloomberg) — China’s housing market slump deepened in May, renewing calls for the government to pump more money and credit into the economy, while industrial production, which had been poised for growth, fell short of expectations.

Most read articles on Bloomberg

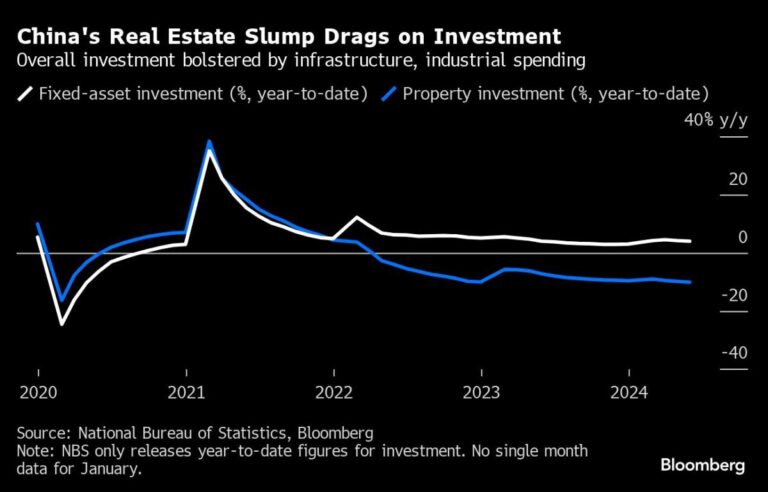

Among a flood of data released on Monday, analysts focused on bad news from China’s real estate market, which has been the biggest drag on economic growth. Falls in property investment and home prices both accelerated last month.

Industrial production grew 5.6% from a year earlier, according to the National Bureau of Statistics, slowing from April and below the median forecast in a Bloomberg survey. Retail sales rose more than expected, providing some encouragement, but Chinese shoppers are still far from regaining their pre-pandemic momentum.

Most economists say the figures suggest the recovery is still fragile, and reaching this year’s 5% growth target will likely require further steps from Beijing to spur consumer demand and address imbalances. That could take the form of more government spending or stepped-up central bank efforts to shore up the housing market and get credit flowing.

“Most disappointing”

“The most disappointing thing about May’s data is that property sales barely improved despite a lot of support measures,” said Jacqueline Rong, chief China economist at BNP Paribas. She said Chinese authorities need to find ways to lower interest rates on existing mortgages and close the gap with rates on new mortgages.

The People’s Bank of China on Monday kept its key policy interest rate unchanged for a 10th straight month, and economists say the need to support the yuan means it has limited room to cut rates, as the currency faces downward pressure as the U.S. Federal Reserve continues to push for higher, longer-term interest rates.

Bloomberg Economics’ take…

“Policy support could make a big difference, but with the People’s Bank of China focused on currency stability, interest rate cuts seem unlikely, at least until the Fed acts. This means the main support will come from recent policies to support the property market and government spending on large investments.”

— Economists Zhang Shu and David Qu

Read the full report here.

Chinese stocks fell, with the domestic benchmark CSI 300 index closing down 0.2%. A gauge of China property developers was down 3.2% as of 3:08 p.m. local time.

Overall fixed asset investment grew 4 percent in January-May, but down from 4.2 percent in the first four months of the year, despite increased government bond issuance to fund infrastructure spending.

China’s economic growth “remains highly uneven, driven by exports and new-energy capital investment and dragged by consumption and real estate,” according to economists including Larry Hu of Macquarie Capital. But the slowdown is not severe enough to threaten growth targets, and while policymakers could take limited steps, “there is little urgency for large-scale stimulus,” they wrote.

Consumption is rising

This is the first acceleration in retail sales since November, and even as social and economic life has largely returned to normal, the 3.7% increase is less than half the 8% growth that was typical before the pandemic.

Those gains may be short-lived, according to Michelle Lam, Greater China economist at Societe Generale SA. “It remains to be seen whether the positive momentum in retail sales is sustainable,” she said.

As households became more cautious about spending, China turned to export-led growth. A boom in factories offset a housing slump, helping to get the economy back on track. But that strategy is facing growing uncertainty as key partners raise new trade barriers, threatening the export engine. Last week, the EU followed the U.S. in imposing steep tariffs on Chinese-made electric cars.

Some analysts aren’t too worried about the impact. BNP’s Long says China’s EV exports to the EU account for just 0.4% of the country’s total exports, and automakers can absorb the tariffs because selling prices there are much higher than at home. He expects the tariffs to reduce China’s export growth rate this year by just 0.1 percentage points.

China launched a program in April to encourage businesses and households to upgrade old equipment in an effort to shore up domestic demand, part of the plan also including government subsidies for new car buyers.

Data on Monday suggested the impact will be limited: Auto retail sales fell 4.4% in May from a year earlier, only a slight improvement from the previous month.

Housing Relief

China also unveiled a wide-ranging rescue package late last month to shore up home sales as a credit crunch hit some of the country’s biggest property developers. It eased mortgage rules and encouraged local governments to buy up unsold homes. Many investors and analysts have warned that the financial incentives aren’t enough and that pilot programs in some cities have shown progress may be slow.

Weak domestic demand and a worsening foreign trade environment have weighed on business confidence, discouraging companies from investing and leading some to move production overseas. Credit growth has been sluggish, and the M1 money supply index recorded its fastest contraction since 1996 in May.

In a survey of more than 400 executives conducted by UBS Group AG over about a month through mid-May, companies reported weaker outlooks for orders, revenue and profit margins compared with the same period in 2023. The share of respondents planning to increase capital spending in the second half of the year fell.

“New stimulus still needs to be put in place,” Helen Zhao, chief China economist at Bank of America Global Research, said in an interview on Bloomberg Television. “Otherwise, growth momentum could weaken significantly.”

–With assistance from Yujin Liu and Lucille Liu.

(Updates with analyst commentary on policies, tariffs.)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP