Hu Xijin, who has more than 20 million followers on the social media platform Weibo and was editor-in-chief of state-run tabloid Global Times until his retirement in 2021, is one of millions trying to recover from a $1.3 trillion loss.

In a social media post last week, Hu revealed that he had an unrealized loss of 100,000 yuan ($13,792) on a stock portfolio worth 700,000 yuan.

Hu first attracted attention in June last year when he announced his decision to invest in stocks with an initial investment of 200,000 yuan.

“The logic of the stock market is constantly changing and it’s hard to keep up with the trends,” Hu said in a recent social media post. “Although my performance has been very poor, I want to go on record as a sample of Chinese retail investors.”

Jia Yuer, a 46-year-old engineer at a technology company in Shanghai, has seen his stock portfolio fall 15% so far this year, and he blames the losses on economic downturns and rising geopolitical risks caused by “black swan” events – unpredictable events that could have severe consequences.

“There is a big risk to long-term investments right now,” he said. “There is no confidence in the market and investors are choosing to cash out any profits they make the next day, even if they are small. There is no fundamental support for the stock market as growth stabilization is still not in sight.”

The lack of investor confidence has been a thorn in Wu Qing’s side since he was suddenly appointed chairman of the China Securities Regulatory Commission in February to oversee the $8.2 trillion stock market. His mission to restore investor confidence met with some initial success, as he promised to crack down on price manipulation, limit short selling, tighten the supply of new shares and improve the quality of listed companies. Stocks have recovered, thanks in part to government-led buybacks.

But the momentum has not been sustainable, and investors are now turning their attention to the outlook for economic growth and corporate earnings. China’s economy grew at a slower-than-expected 4.7% in the second quarter, weighed down by weakness in the property market and retail sales, according to Huaxi Securities. Meanwhile, profits at China’s listed companies fell an average of 0.9% year-on-year in the April-June period, marking a second consecutive quarter of decline.

The gloomy outlook has been compounded by volatility in global markets and further uncertainty after U.S. President Joe Biden withdrew from the presidential race and a collapse in an artificial intelligence (AI) deal.

Amid the pessimism, any recovery may be short-lived as disappointed investors hold off on selling battered portfolios.

Yang Xiaoxen, whose 500,000 yuan he invested in stocks and mutual funds in 2018 fell 40 percent, said he would sell if the Shanghai Composite Index, a favorite among retail investors, rebounds and tops 3,000 points. The index closed at 2,890.90 on Friday.

“We’ve lost faith in the domestic economy and listed companies,” said the 47-year-old sales manager at a Shanghai-based kitchen appliance manufacturer. “The market is facing a crisis of confidence and we won’t be able to recover our losses in the next one or two years.”

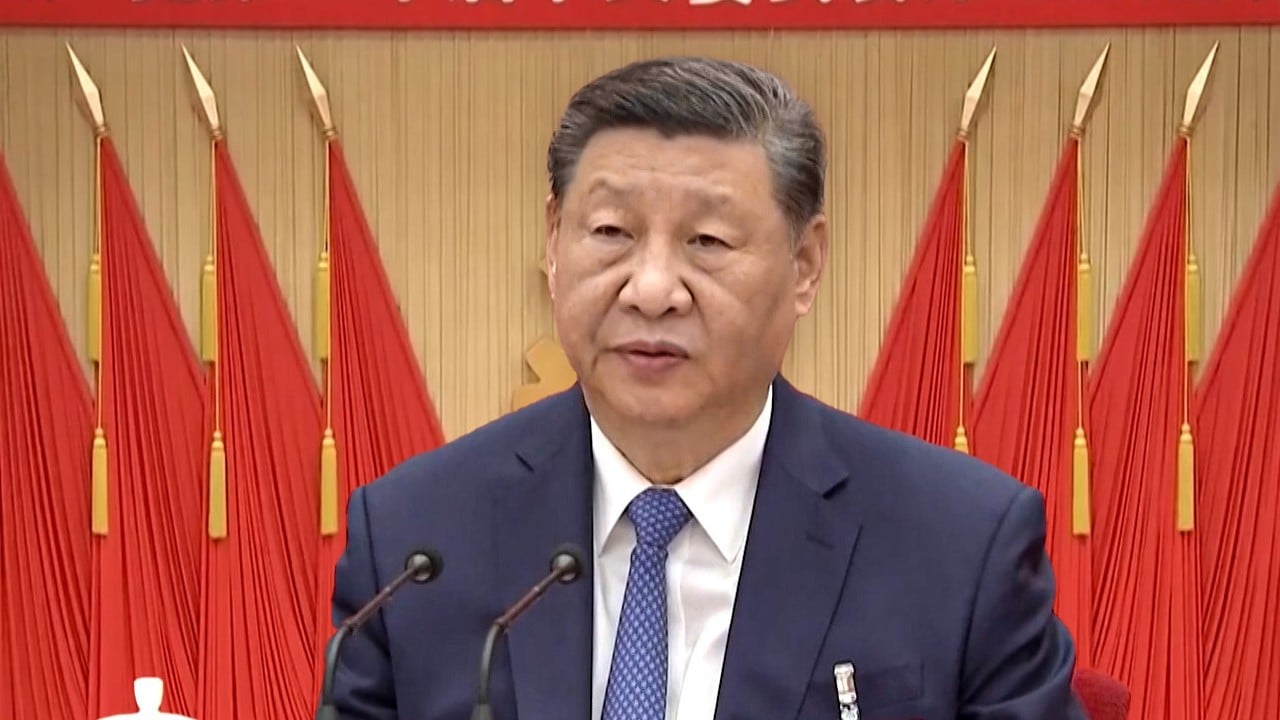

A potential catalyst for a rise in stock prices could be a meeting this month of the Politburo, where Communist Party President Xi Jinping and his colleagues are expected to set the tone for economic policy for the rest of the year.

If the meeting conveys a message of stabilizing growth, the market could stabilize or even rebound, said Song Yiwei, an analyst at Bohai Securities in Tianjin.

Still, that may not be enough to lure investors reeling from four years of bear markets and reeling from the nightmares of the 2015 market collapse.

Shishi Liu, a housewife in Shanghai, has turned her back on stock trading since selling all her shares in 2018. She now prefers to park her money in fixed-term deposits, even though they offer a one-year maturity and an annual interest rate of 1.35%.

“My decision to get out of the stock market was the right one,” she says. “Why would I want to invest in a market that’s not that different from a casino?”

Additional reporting by Daniel Wren