Author: Lee Seong-hyun

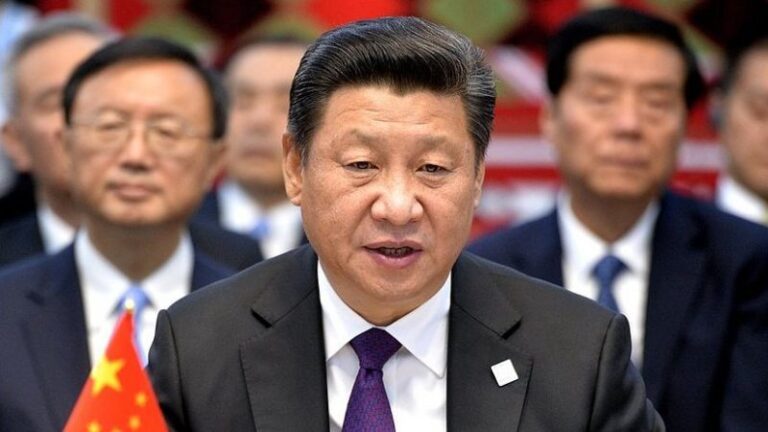

China’s economic woes are rooted in the country’s struggling real estate sector and a strategy premised on a shift to high-tech industries. President Xi Jinping’s national security prioritization and skepticism of market forces have exacerbated the problem, creating tensions between political will and economic imperatives.

China’s struggling real estate sector, once a staggering 30% of the country’s GDP, has fallen sharply from its 2018 peak and is now operating at only half its former capacity due to the COVID-19 pandemic. This decline has hit China’s economic structure hard, with property sales plummeting 20.5% in the first two months of 2024.

Historically, real estate has not only been a financial engine, but also a catalyst for related sectors, driving construction jobs, stimulating retail development, and fueling banking through lending. This relationship has fueled dynamic cycles of economic expansion.

But as China moves toward a middle-class society, Xi’s administration is moving away from this growth model. The government’s “three red lines” policy, designed to mitigate the big risks for many debt-ridden real estate developers, was a half-hearted response that led to a decline in housing investment. The policy signals Xi’s pivot toward more technologically advanced industries, including AI, big data, bioengineering, semiconductors and quantum computing.

The shift reflects a global economic trend prioritizing scientific innovation and smart technology, fits into China’s broader plan to reposition its economy toward high-tech industries and, most importantly, aims to secure victory in the conflict between the United States and China.

Complicating this transition is Xi Jinping’s prioritization of national security over economic flexibility. Xi’s deep-rooted skepticism of market forces, shaped by his experience with corruption and ideological deviation under former President Hu Jintao, continues to influence his economic policy. Xi’s cautious approach reflects an economic policy that prioritizes tight state control over market-driven growth, and he has stepped up oversight and restrictions on large technology companies.

The government’s prioritization of strengthening state-owned enterprises at the expense of the private sector, which has been the cradle of innovation and economic vitality, is a decisive political stance. Yet bureaucratic state-owned enterprises cannot match the vibrant entrepreneurial sector when it comes to cutting-edge innovation. Xi Jinping’s approach weakens entrepreneurial spirit and stifles the private sector’s ability to innovate and compete internationally. There has already been a noticeable shift in career aspirations among young people, who are gravitating towards civil service jobs for stability rather than pursuing entrepreneurship.

While GDP growth is expected to be 5.3% in the first quarter of 2024, the International Monetary Fund suggests that China’s economic recovery will take several years and may slow in the medium term. China’s once-strong manufacturing sector, while showing signs of revival, cannot fully offset the significant decline in the real estate market. China has excelled in the production of solar panels, wind energy, and electric vehicles, but its success has attracted unwanted attention from competition policy analysts in the West and triggered import restrictions. As a result, China is at risk of developing a manufacturing bottleneck.

Meanwhile, consumer confidence remains weak. Retail sales growth slowed to 2.3% year-on-year in April 2024, down from 3.1% in March. This slowdown in consumer spending highlights economic uncertainty and the persistent negative effects of wealth stemming from the slump in the real estate market.

The government faces a dilemma: it must reignite growth without reverting to outdated methods that do not solve the country’s current problems. But Xi Jinping is adamant about maintaining political control and stifling entrepreneurship. The challenge, therefore, is not only to support Xi Jinping’s new economic policy, “New Productive Forces,” which has nothing to do with the real estate sector, but to implement it quickly enough to deliver results. This is crucial to ensure a V-shaped recovery and prevent a recession.

This scenario represents an important test for Xi Jinping’s ideological framework, which favors a Marxist socialist model over the Western capitalist paradigm. Xi’s “shared prosperity” initiative aims to mitigate income inequality exacerbated by decades of disparate economic growth. China’s former leader, Deng Xiaoping, tolerated this inequality in order to optimize economic reform and opening up. Xi’s focus on income equality and regional equality marks an important shift toward a state-led approach.

Some analysts in China and the United States argue that China’s economic situation is not as dire as it is sometimes made out to be. However, while the Chinese government announced several measures to stabilize the real estate sector in May 2024, China’s stance is unprecedented, and doubts remain about its feasibility under the current policy strategy. For Xi Jinping, implementing these policies will require a historically rare balance of political courage and economic acumen.

Under Xi Jinping, governance, ideology and market forces have intertwined, creating an environment in which political decisions have a significant impact on economic outcomes. The challenge is to implement a balanced strategy that promotes economic vitality while upholding ideological commitments.

Known for its economic resilience, China faces a narrowing window of opportunity to recover from a major economic downturn. China must regain momentum before it misses the chance to revive its economy.

- About the author: Dr. Sunghyun Lee is a visiting scholar at the Harvard University Asia Center and a senior fellow at the George H. W. Bush Foundation on U.S.-China Relations.

- Source: This article was published by East Asia Forum