(Bloomberg) — China’s exports rose more than expected in May, raising hopes that the world’s second-largest economy can maintain momentum by relying on overseas markets even in the face of the threat of new tariffs.

Most read articles on Bloomberg

Exports rose 7.6% in dollar terms from a year ago, while imports rose 1.8%, helping to create a trade surplus of nearly $83 billion this month. Economists had expected exports to rise 5.7% and imports to rise 4.3%.

Beijing has been banking on overseas sales to make up for weak domestic consumption as slumping property prices encourage households to save. Friday’s figures showed the strategy is working so far this year. Strong global demand is also providing a boost to other Asian trading nations. South Korea’s exports rose to their highest level in nearly two years in May, driven by semiconductor sales.

“China’s competitive products are taking a bigger share of the global market,” said Bruce Pan, chief economist for Greater China at Jones Lang LaSalle, who said the momentum was likely to continue, buoyed by a stronger dollar and price cuts by exporters.

Still, Chinese companies face obstacles that could make it difficult to rely on exports to drive economic growth, such as in high-tech industries like electric vehicles, where developed countries such as the United States and the European Union have imposed trade barriers.

Chinese auto exports have not yet been affected — data on Friday showed overseas sales in May were the second-highest on record, down only slightly from April’s $10.7 billion — but new tariffs on Chinese-made electric vehicles are due next month, making access to the massive European market increasingly difficult.

For now, Chinese exporters “continue to bring forward shipments or reroute exports through third countries” to avoid tariffs, Pan said.

Exports to the United States increased 4.8% year-on-year, the highest level in three months, while exports to Asian ASEAN countries increased 25% and exports to the EU decreased 0.7%.

Bloomberg Economics’ take…

Strong overseas demand is expected to continue to drive shipments in the coming months, with favorable base effects helping to lift the numbers, but the boost is unlikely to be strong enough to offset weakness in domestic demand accentuated by weaker imports.

— Eric Chu, Economist

Read the full story here

Steel exports, measured by volume, recorded the second-highest monthly total since 2016, with 9.6 million tonnes sold last month. Shipments continue to decline in value. Data for May is not yet available, but steel export prices have been falling since the second half of 2022, along with those of many other commodities.

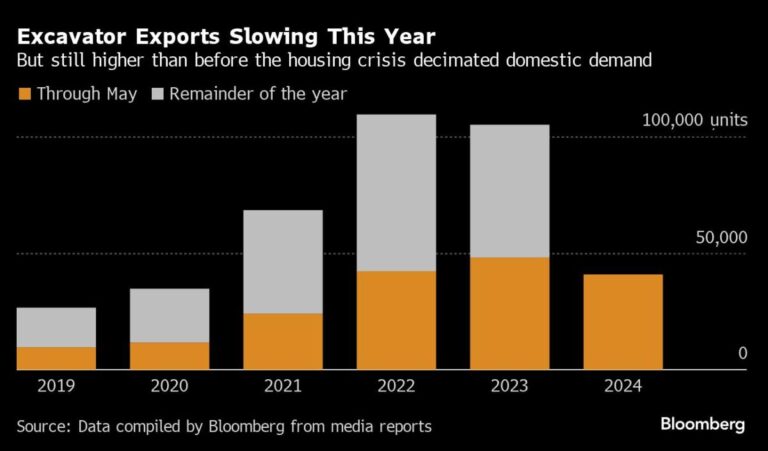

Weak domestic demand has led many Chinese manufacturers, including in industries such as steel and building equipment, to look to markets overseas after they lost domestic customers when the housing bubble burst and construction stalled.

The changes have boosted exports of lower-value products in addition to the high-tech industries prioritized by Beijing, threatening to spark new backlash from trading partners, developed and emerging, as they seek to protect their own industries.

Still, the impending tariffs “are unlikely to pose an immediate threat to exports,” according to a report by Huang Zijun of Capital Economics. “Instead, they may see a slight boost to exports as companies accelerate shipments to get ahead of the tariffs.”

Chinese stocks broadly held on to the previous day’s losses after the trade data was released, with the domestic benchmark CSI 300 down 0.7% at the midday break and a Hong Kong-listed China stock index down 0.9%.

–With assistance from Zhu Lin and Yujing Liu.

(Updated regularly)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP