(Bloomberg) — China’s bullion imports slowed last month as demand in the world’s biggest consumer began to fall in the face of record prices.

Most Read Articles on Bloomberg

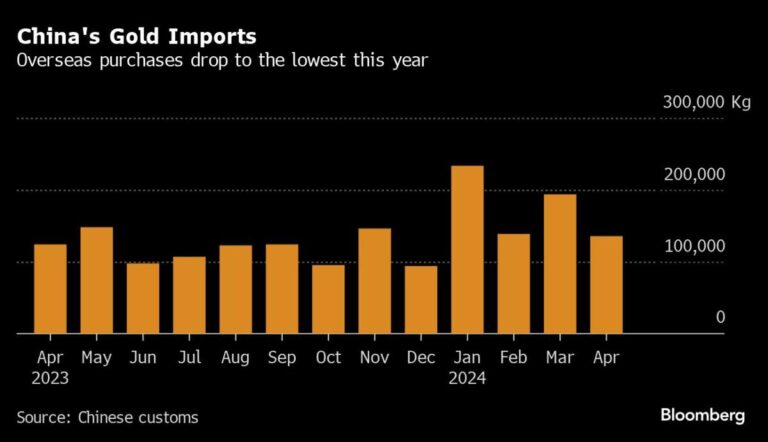

The latest customs data shows overseas physical gold purchases fell to 136 tonnes in April, down 30% from the previous month and the lowest total for the year.

While prices are heavily influenced by U.S. interest rates, bullion’s recent strength is largely due to strong consumption in China, where investment options are more limited than in other countries. As households and investors grapple with a protracted crisis in the real estate sector, a volatile stock market and a weakening yuan, money has flowed into assets seen as safer, fueling gold’s rise to an all-time high. .

The People’s Bank of China has also shown consistent appetite for gold, with gold holdings increasing for 18 consecutive months as it diversifies its foreign exchange reserves and hedges against currency depreciation, but in April The pace of gold purchases also slowed.

If imports are curbed, gold bulls might think twice. Soni Kumari, commodity strategist at ANZ Group Holdings, said Chinese demand is likely to remain strong in 2024, but is expected to be flat.

Chinese authorities’ warnings against excessive speculation have further eroded the appeal of precious metals. In the latest move to curb risk-taking in the market, the Shanghai Gold Exchange raised margin requirements for some contracts again starting Tuesday.

on the wire

We should be able to see the end of coal, the world’s dirtiest energy source. In the eight years since the Paris Agreement was signed, new coal-fired power plants planned around the world have fallen by nearly 70%. However, two of the three largest emitters, China and India, are bucking this welcome trend.

President Vladimir Putin’s visit to China was an opportunity for the Russian president and President Xi Jinping to showcase their “boundless” friendship. Just don’t get into the small issue of a stalled 2,000-mile pipeline project. The truth is that China is not that involved in Putin’s gas pipeline.

This week’s diary

(All times are in Beijing unless otherwise noted.)

Tuesday, May 21st:

-

April production data of China’s base metals and petroleum products

-

IGU Gas Industry Development Forum, Beijing, 09:30

Wednesday, May 22:

Thursday, May 23rd:

Friday, May 24th:

-

China’s weekly iron ore port stockpiles

-

Shanghai exchange weekly product inventory, ~15:30

-

Chalco Online Financial Results Briefing 16:00

–With assistance from Sybilla Gross.

(Updates with analyst comment in fifth paragraph)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP