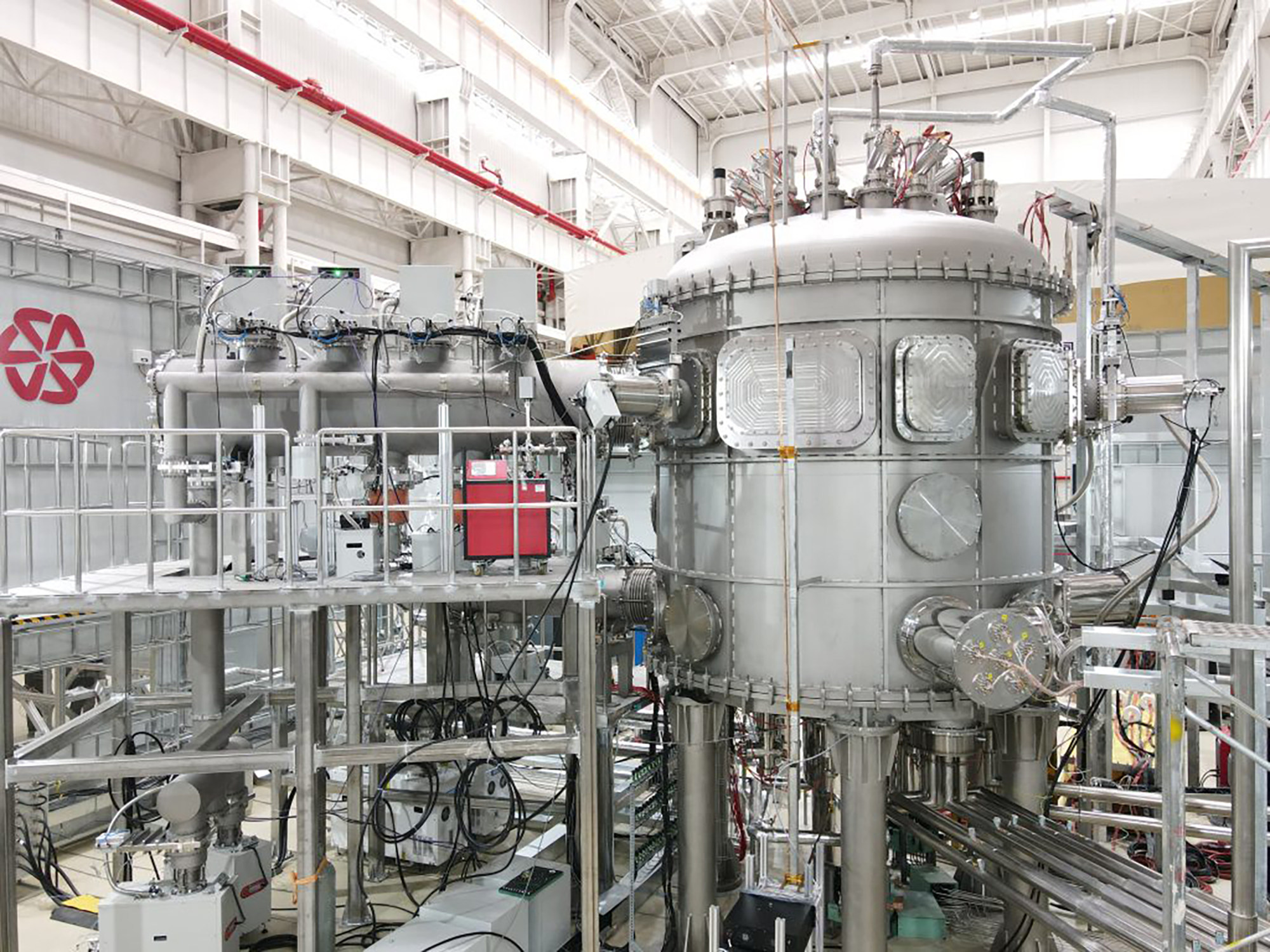

According to the machine’s developer, Shanghai-based fusion energy company Energy Singularity, HH70 also sets another record: the fastest development and construction of a superconducting tokamak machine.

In a recent interview with state-run China Global Television Network (CGTN), Energy Singularity co-founder and CTO Guo Houyang said the HH70 is smaller, cheaper to build and was built in just two years.

This is an achievement that is mainly driven by China’s vibrant industrial chain and engineering strength. The HTS tapes used in the HH70’s magnetic system are supplied by Shanghai Superconducting Co., a domestic company that has become a major global supplier since its establishment in 2011.

While HH70’s achievements won’t immediately translate into commercially produced fusion energy, the industry is already preparing for the next clean energy race.

Yasmin Andrew, a researcher in the Department of Physics at Imperial College London, said that while several private companies around the world are currently working on developing HTS technology for nuclear fusion, HH70 is the first tokamak to achieve plasma.

Although nuclear fusion technology is still in its infancy, the quest to produce solar-like carbon-free energy is gradually becoming an engineering endeavor.

Dennis White, former director of the Massachusetts Institute of Technology’s (MIT) Center for Plasma Science and Fusion Research, told the Post that supply chains and technological development will be important as fusion technology advances.

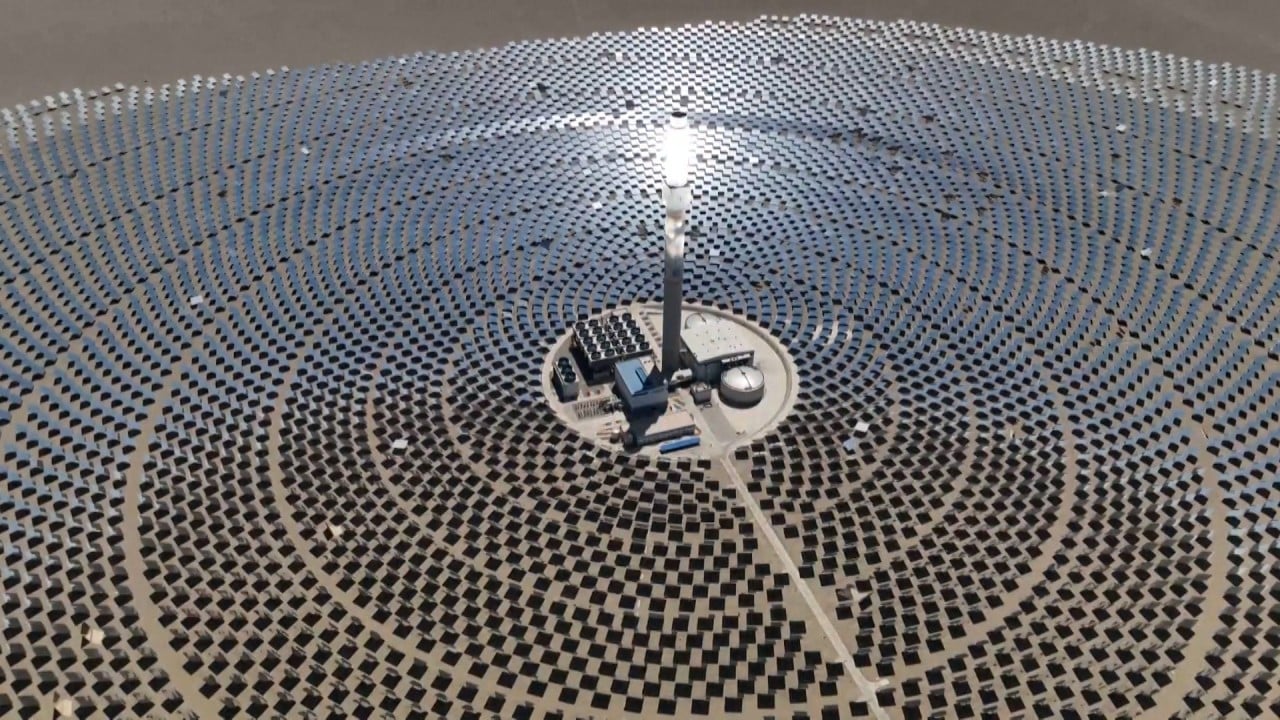

Andrew Holland, CEO of the Fusion Industries Association, a Washington-based nonprofit, told Reuters in an interview in March that he fears fusion could follow the same pattern as the solar power industry, where much of the technology was invented in the United States but manufacturing became dominated by China.

“It’s clear that China has ambitions to do the same in both its supply chains and in its developers,” he said. “It’s time for the United States to meet this challenge.”

This is not an unfounded warning: In areas such as solar power and electric vehicles, Chinese companies with strong manufacturing capabilities have consistently produced products that are more competitive than Western rivals, even though the technologies did not originate in Chinese labs.

The founder of a Chinese nuclear fusion startup agreed with the possibility raised by Holland.

He agreed that it was “highly likely” and said China was really ahead of the curve when it came to integrating technological developments into real-world applications.

But to achieve nuclear fusion, hydrogen atoms need to be heated to extremely high temperatures — over 100 million degrees Celsius (180 million degrees Fahrenheit) — and then trapped for long periods of time before they fuse into heavier atoms.

Nuclear fusion was once considered the stuff of science fiction, but in recent years private companies and research institutions around the world have been working hard to make it a reality.

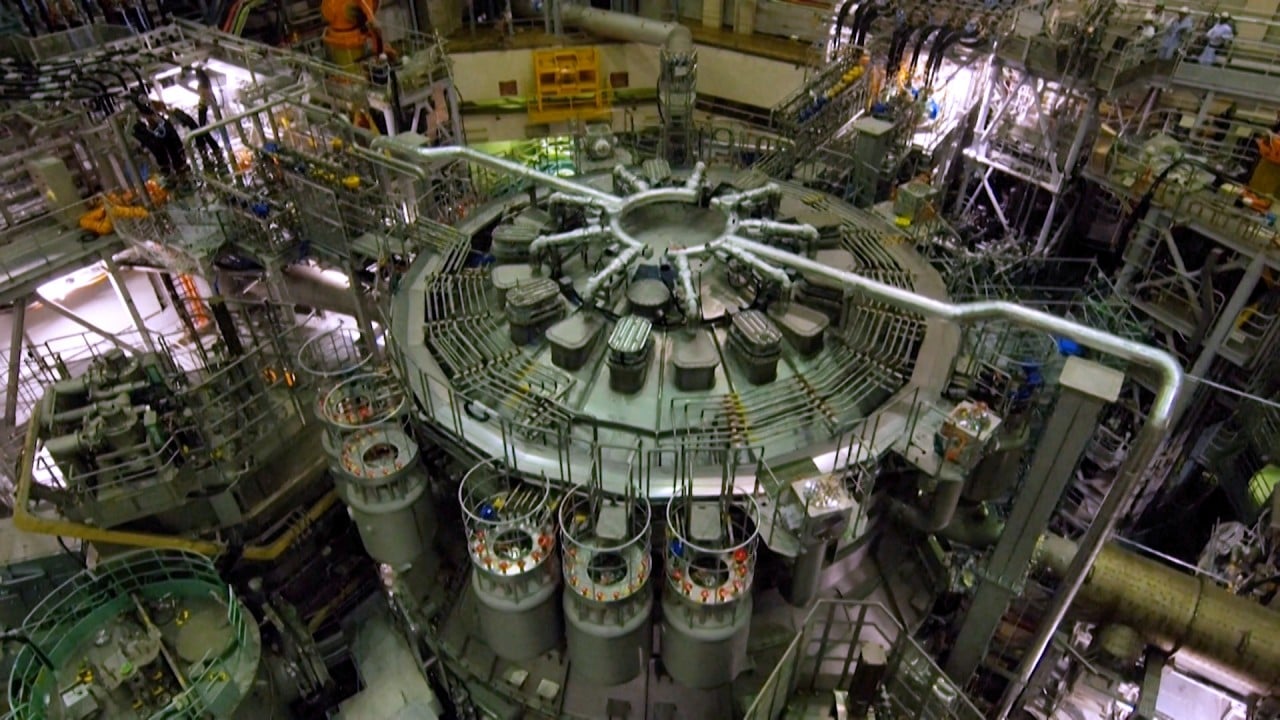

Most efforts so far have focused on “magnetic confinement” techniques, which heat and compress plasma – a hot, electrically charged gas – inside giant, doughnut-shaped reactors called tokamaks, invented by Soviet physicists in the 1950s.

Technically, HH70 is neither the first nor the most powerful device of its kind: in 2013, Tokamak Energy, a company founded in 2009 as a spinoff from the UK Atomic Energy Authority, reported on a similar device made from high-temperature superconductors.

And HH70’s magnetic field, a key benchmark for any fusion device, is 0.6 Tesla, much weaker than a competing device recently built by a team at MIT that exceeds 20 Tesla.

The results mark a major milestone in answering the feasibility question. [high-temperature superconducting’s] use

But Imperial College London’s Andrew said the result was a “significant step for the field” as it provided an important proof-of-principle for future tokamak designs.

“The application of HTS to tokamaks is an area of active research around the world, so these results are a major milestone in answering the question of the feasibility of their use,” she said.

Magnetic confinement fusion technology uses superconducting magnets to generate powerful magnetic fields, and compared to low-temperature superconductors, Andrew said, HTS could potentially utilize stronger magnetic fields, resulting in machines that are smaller, cheaper and quicker to build.

Over the past decade, however, HTS materials have begun to move out of the lab and into the hands of downstream customers in consistent quality and quantity, coinciding with a robust trend in the establishment of private fusion companies in recent years.

“China is a key player in this emerging market,” Andrew said, adding that companies from the EU, US and China are currently leading the high-temperature superconductivity industry.

In the 1980s, a class of HTS materials called REBCO (rare-earth barium copper oxide) was discovered to be capable of carrying extremely high current densities at temperatures up to 20 Kelvin, but it was brittle, so it took researchers almost 30 years to make wires from it.

In 2011, a lab at Shanghai Jiao Tong University became the first in China to produce a 100-meter (328-foot) long wire from the material, and the Shanghai Institute of Superconductivity was established the same year to pave the way for commercial application of this scientific breakthrough.

According to its website, the company is currently one of six international manufacturers capable of churning out more than 100 kilometers (62 miles) of HTS tape per year, and its products are sold to major fusion power developers both in China and abroad.

In 2021, Commonwealth Fusion Systems (CFS), an American startup spun out of MIT and founded in Cambridge in 2018, in collaboration with MIT, successfully developed the world’s first magnet that can be used for nuclear fusion with a magnetic field of 20 Tesla.

The magnets are made from high-temperature superconducting materials, and Shanghai Superconducting is one of the three tape suppliers behind the feat.

As the industrial chain matures, China is accelerating its efforts toward realizing commercial fusion energy.

Startorus Fusion was founded in northwest China’s Shaanxi Province in October 2021. Founder Chen Rui highlighted that the growth of upstream suppliers has made fusion technology more commercially available.

“With the advent of new materials like HTS, it is now possible to design a relatively compact device in two or three years and prove the feasibility of nuclear fusion at a much lower cost, say less than 1 billion yuan. [US$137 million].”

This isn’t just happening in China: The FIA says that since 2018, huge investments have been pouring into the industry, and the number of fusion companies has skyrocketed, especially since 2020.

Fusion is an energy technology that The Diplomat described in a June article as “the next frontier in climate change and great power competition,” inviting major countries to up the ante, from financial investment to political support.

In September, China Nuclear Power Chairman Lu Tiezhong said the first electricity generated by controlled nuclear fusion “must come from our country. We are working towards this goal.”

China aims to build a prototype industrial fusion reactor by 2035 and to have large-scale commercial use of the technology by 2050.

Meanwhile, in December nine organisations signed contracts with the UK Atomic Energy Authority (UKAEA) worth a total of £11.6 million (US$12.7 million) to develop innovative technologies for fusion energy.

Despite efforts by other countries, China has an advantage in the engineering implementation of fusion technology, according to Startras Fusion’s Chen.

He said China’s supply chain integrity, large-scale manufacturing experience, vast workforce and policy support all benefit.

For example, on the supply chain side, China’s production of high-temperature superconducting materials has made great progress, thanks to its large domestic market and manufacturing base, potentially enabling suppliers to further reduce prices and improve performance, which is crucial for tokamak magnet systems.

At the same time, China has participated in the French ITER project for more than 20 years and has cultivated a large talent pool of excellent fusion engineers.

Despite these favorable developments, Chen stressed that China will not dominate the global fusion industry.

“International cooperation, technological innovation and sustainable development strategies will be key factors in determining the future prospects of the fusion industry,” Chen said.