(Bloomberg) — Two exchange-traded funds focused on Saudi Arabian stocks debuted in Shanghai and Shenzhen today, giving Chinese investors an option to gain exposure to the oil-rich nation’s shares as ties between the two countries grow stronger.

Most read articles on Bloomberg

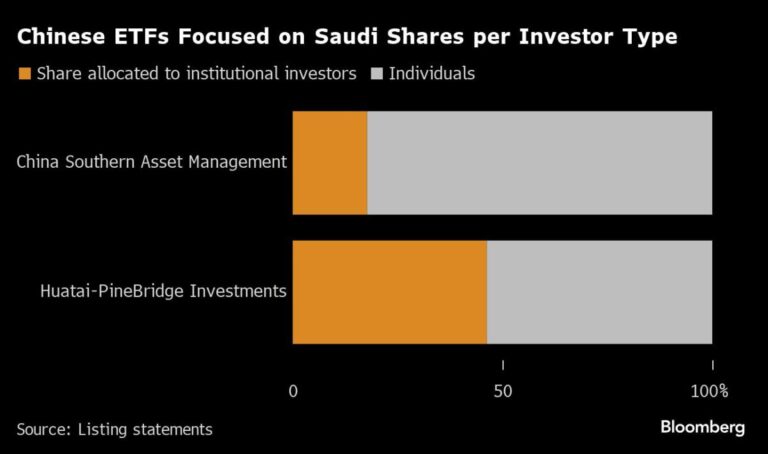

China Southern Asset Management’s CSOP Saudi Arabia ETF QDII listed in Shenzhen after raising 634 million yuan ($87 million). A second fund, Huatai-Pinebridge’s CSOP Saudi Arabia ETF QDII, began trading in Shanghai after raising 590 million yuan. Both funds were trading close to their listing prices as of 10:20 a.m. local time.

The funds will help mainland Chinese investors further diversify their holdings internationally, particularly in regions where they have influence in the energy and oil sectors.The debut of these funds comes as China strengthens ties with Gulf states amid rising tensions with the West and as Saudi investors increase their presence in Asia.

Mao Wei, chief equity investment officer at China Southern Asset Management, said the target investors are “people who have stock market knowledge, demand for global asset allocation and confidence in the energy sector.” Wei added that “compared to investment destinations in the U.S. and Japan, people will pay more attention to Saudi Arabia with an eye on the energy and financial sectors.”

The ETFs indirectly invest in the Saudi market through the Hong Kong-based CSOP Saudi Arabia ETF, which debuted in the Asian heartland last year with more than $1 billion in capital raised and counts the Saudi Arabian sovereign wealth fund as a major investor in the fund, which tracks the FTSE Saudi Arabia index.

The Saudi Arabia-China ETF program aims to facilitate cross-listings of funds and the launch of feeder funds in the two countries.

Melody Hsian Ho, deputy chief executive officer of CSOP Asset Management, said the fund will make it easier for mainland Chinese investors to build exposure to Saudi stocks because they can invest in yuan and get information in Chinese.

About 20,000 individuals and funds invested in the ETF during its seven-day offering period, he said in an interview.

As investment ties between China and Saudi Arabia deepen, Hong Kong “could be the biggest beneficiary of the Saudi-China ETF Connect program as ETFs listed in Saudi Arabia and mainland China could be funneled back into Hong Kong ETFs,” said Rebecca Xin, an analyst at Bloomberg Intelligence in Hong Kong.

“The next step for Saudi-China ETF Connect could be for Saudi asset managers to launch feeder funds,” she added.

Listen to the Asia Centric podcast on China, Saudi Arabia and the Gulf Cooperation Council building closer ties.

–With assistance from Joanne Wong and Christine Burke.

(Adds ETF trading details in second paragraph.)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP