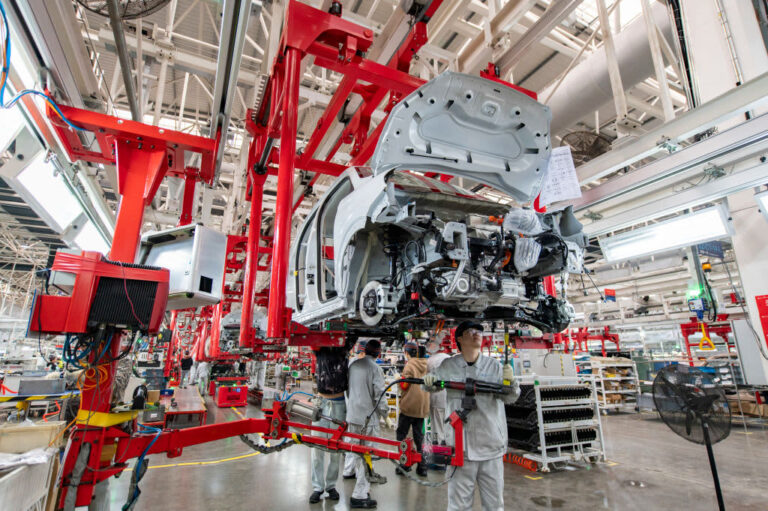

Employees assemble new energy vehicles at electric vehicle company Leapmotor’s intelligent factory in Jinhua, Zhejiang province, China, April 8, 2024.

Vcg | Visual China Group | Getty Images

“In accordance with applicable rules, the final selection of samples was made based on the largest representative volume of production, sales and exports to the EU that could reasonably be inspected in the time available,” Olof Gill, the European Commission’s spokesman for trade and agriculture, said in a statement to CNBC.

Gill said maximum export volume was not the only criterion, the Commission also took into account production and domestic sales volumes. “The Commission considers that the sample was selected in accordance with WTO rules and relevant EU legislation in this regard,” he said.

Major German automakers, which get huge sales from China and have local partnerships, were quick to voice their opposition to the EU’s planned tariffs.

In a statement, Volkswagen Group rejected “countervailing duties,” saying “the timing of the Commission’s decision will have a negative impact on the currently weak demand for electric vehicles in Germany and Europe.”

“The Volkswagen Group confidently embraces increasing international competition, including from China, and sees it as an opportunity, which also benefits our customers,” the German carmaker said.

Volkswagen delivered 3.2 million cars to China last year, more than the 3.1 million it delivered to Western Europe, including Britain. BMW Group also delivered more cars to China than to continental Europe last year.

“Protectionism risks creating a vicious circle: tariffs invite more tariffs and therefore lead to isolation rather than cooperation,” BMW Group CEO Oliver Zipse said in a statement. “From the BMW Group’s point of view, protectionist measures such as the imposition of import tariffs do not contribute to successfully competing on international markets.”

The EU investigation also includes Tesla, which opened a factory in Shanghai in 2019 and exports some China-made cars to other markets. The European Commission said Elon Musk’s car maker could face separate tariffs.

Jin, from the National Development and Reform Commission, added that the EU’s anti-subsidy investigation does not appear to be based on complaints from industries or companies.

“There’s a problem [the EU’s] “I think there are problems with the sampling and there are big problems with the conclusions,” he said in Chinese, translated by CNBC. “The investigation process is not transparent and I think the results are not trustworthy.”

The EU’s Gill said EU rules allow the Commission to launch an investigation without receiving a complaint from industry.

The European Commission announced last week that an investigation had concluded that Chinese-made electric cars “benefit from unfair subsidies which could cause economic harm to EU electric vehicle manufacturers.”

“The Commission is therefore in contact with the Chinese authorities to discuss these findings and explore ways to resolve the issues identified in a WTO-compliant manner,” the EU statement said.

The planned tariffs range from 17.4% on BYD cars to 38.1% on electric vehicles from state-owned SAIC.

Tariffs on BYD would need to rise to 40% to 50% or more to make the European market unattractive for Chinese EV exporters, analysts at Rhodium Group said in an April report.

The Biden administration announced in May that it would raise import tariffs on Chinese-made electric vehicles from 25% to 100%. Senior administration officials cited “rapid growth in exports” and “excess production capacity” as reasons for the new tariffs.

Jin argued that while China’s traditional fuel auto companies have operating rates of 70-80%, BYD and some new energy auto companies have operating rates of 100% or even much higher.

He also pointed to an International Energy Agency report that projects growing demand for electric vehicles if the world is to achieve net-zero emissions in the coming decades — a demand that Chinese automakers are only just beginning to meet, Kim said.

The IEA projects that electric vehicle sales will need to account for about 65% of global auto sales in 2030 to reach net-zero emissions by 2050. That would require an average 23% increase in sales each year until then. The agency said electric vehicle sales in 2023 would increase by about 35% from the previous year.

Jin argued that oversupply is why global trade exists, and that China’s excess production of electric cars means other countries will dominate global exports of liquefied natural gas, agricultural products and high-end semiconductors.

Overall, Jin stressed the need for global cooperation rather than risk aversion, despite short-term benefits for some politicians.

The Chinese government has repeatedly called on the Biden administration to lift U.S. restrictions on the sale of advanced semiconductors to China.

—CNBC’s Rebecca Picciotto contributed to this report.