Circular debt is a major financial problem in Pakistan’s energy sector, created by a mismatch between the cost of generating electricity and the revenue collected from consumers. It involves a complex chain of payments between different stakeholders, including power generation companies (IPPs), suppliers, distributors (Discos), gas utilities, and the government.

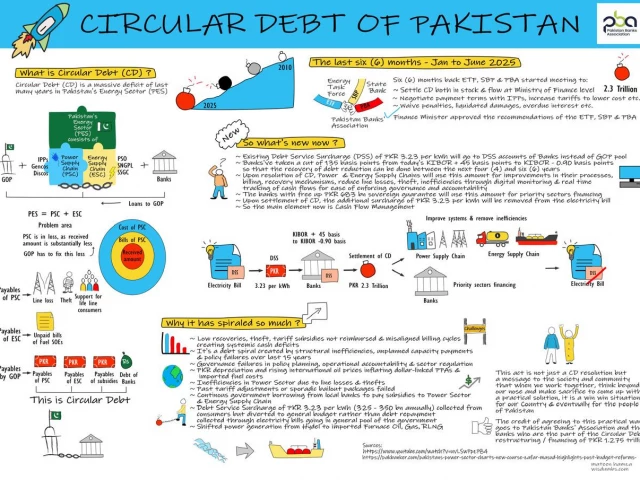

As of now, Pakistan’s energy sector faces a massive deficit, with circular debt accumulating to around Rs2.3 trillion. This growing debt has significant economic implications, leading to inefficient power supply, higher electricity costs, and fiscal stress on the government.

What is Circular Debt?

Circular debt refers to the financial shortfall in Pakistan’s energy sector, where various entities involved in electricity generation, supply, and distribution owe large amounts of money to each other. The problem is rooted in poor management, delayed payments, and inefficiencies in revenue collection.

The key players involved in this circular chain include the federal government, independent power producers (IPPs), government-owned power supply companies (Gencos and Discos), energy suppliers, and the financial institutions that finance the sector. These players often fail to pay one another on time, causing the debt to spiral out of control.

How Circular Debt Has Grown

Circular debt in Pakistan’s energy sector has grown significantly over the years due to several factors:

Low Recoveries & Theft: Power companies struggle to recover payments from consumers, and widespread theft further exacerbates financial losses.

Unreimbursed Tariff Subsidies: The government has failed to fully compensate power companies for the tariff subsidies, increasing the debt burden.

Misaligned Billing Cycles: Billing inefficiencies and long delays in the collection process lead to a backlog of unpaid dues.

Capacity Payments: IPPs are required to make large capacity payments, regardless of whether electricity is generated or consumed. This contributes to the increasing debt as power plants get paid without generating enough electricity to cover costs.

As a result, the total circular debt has reached staggering amounts, leading to an unbalanced energy market where costs are passed down to consumers and institutions that are unable to meet their obligations.

Key Components of Circular Debt

The circular debt issue in Pakistan is divided into three main components:

Payables of PSC (Power Supply Chain): These are the costs incurred by the power supply chain, including losses from electricity theft, unpaid bills, and support for life-line consumers.

Payables of ESC (Energy Supply Chain): The ESC is burdened by unpaid fuel bills, especially for gas and other essential energy resources.

Payables of GOP (Government of Pakistan): The government owes significant amounts due to subsidies for power generation and distribution, as well as unpaid payments to energy companies.

Government’s Response and Proposed Solutions

To address the growing circular debt, the Government of Pakistan has begun implementing several measures to resolve the issue. These steps focus on managing the debt more effectively, streamlining payments, and negotiating better terms with stakeholders.

Debt Settlement Efforts: The finance ministry has started discussions with IPPs and other stakeholders to settle the existing circular debt. Negotiations include restructuring payment terms and adjusting tariffs to lower the debt.

Debt Service Surcharge (DSS): A new DSS of Rs3.23 per kWh has been introduced, which will be added to electricity bills. This surcharge will help generate funds to pay off the outstanding debt to banks and other financial institutions.

Interest Rate Adjustments: The KIBOR (Karachi Interbank Offered Rate) has been adjusted to ease the debt burden, which will reduce the overall financial pressure on the sector.

Improving Cash Flow Management: The government has stressed the importance of transparent and real-time tracking of financial flows to better manage the circular debt and ensure timely payments.

Why Circular Debt Has Spiraled

The circular debt crisis in Pakistan’s energy sector has spiraled out of control for several reasons:

Low Payment Recoveries: One of the main causes of the growing debt is the inability of power companies to recover payments from consumers. This is exacerbated by inefficiencies in billing and distribution.

Theft and Mismanagement: Power theft is rampant across the country, leading to significant financial losses. Poor management and a lack of accountability have only worsened the situation.

Structural Inefficiencies: The energy sector suffers from misaligned tariff structures, inadequate infrastructure, and weak planning, which causes delays in generating sufficient revenue to cover costs.

Governance Failures: A lack of effective governance and sector regulation has led to inflation in power tariffs and inefficiencies that have compounded the financial crisis.

Solutions and Future Roadmap

Moving forward, the Pakistani government must focus on comprehensive reforms to tackle circular debt in the energy sector:

Improving Billing and Collection Systems: The government needs to reform the billing process to ensure timely payments and minimize losses due to inefficient systems.

Better Financial Management: Effective cash flow management, including real-time tracking of payments, will help reduce inefficiencies and increase accountability.

Addressing Structural Inefficiencies: Tariffs must be reviewed and aligned with actual costs to ensure the sector remains financially viable in the long term.

Governance Reforms: Stronger governance and accountability measures will help improve sector management, reduce financial mismanagement, and ensure that funds are used effectively.

The circular debt problem in Pakistan’s energy sector is a complex challenge that requires a multi-pronged solution. While the government has made strides in addressing the issue, long-term success depends on structural reforms, improved financial management, and better governance. By implementing these measures, Pakistan can begin to reduce its circular debt, improve energy supply, and create a more sustainable energy market for the future.