Key Points

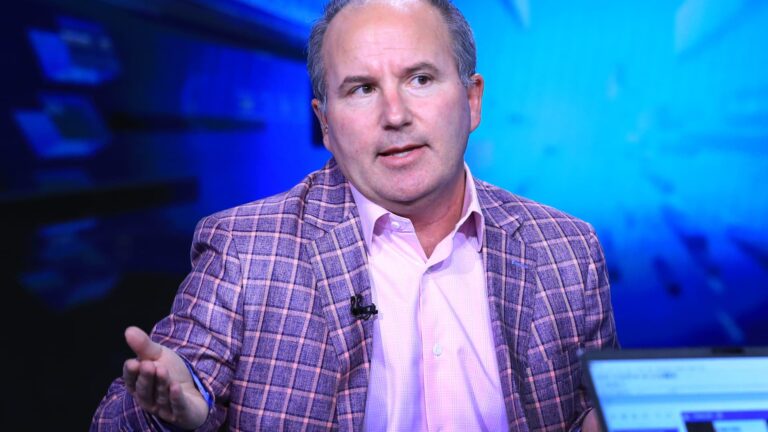

Dan Ives said that, despite “growing frustration” among many investors about Europe’s ability to nurture tech companies, there are some on the continent he’s bullish on. German software giant SAP , chip equipment supplier ASML , buy now pay later company Klarna and music streaming platform Spotify are key European stocks to watch, the Wedbush Securities global head of technology research told CNBC. European public markets have faced criticism from founders and investors in recent times as homegrown tech companies have increasingly looked across the Atlantic to realize their public market ambitions. Ives said the continent faced “a gut check moment” over its ability to compete as a tech hub. He said: “I travel a lot throughout Europe, and there’s growing frustration because investors see what’s happening around the world and they’re like ‘what about us?'” These are the outlooks, according to analysts, of the four European tech companies Ives has his eyes on, despite the challenges. SAP While the German software giant has seen its share price fall 11.4% in 2025, analysts see considerable upside. According to a consensus compiled by LSEG, analysts have set a target price of 286.42 euros ($335.84) for the stock, representing a 35.9% upside. In a note earlier this month, the Bank of America said SAP was one of its “25 stocks for 2026.” “We expect 2026 to see SAP confirming traction of its AI offering, supporting commercial momentum, while delivering further operational efficiency,” it wrote. “Some of the stuff SAP is doing is obviously impressive,” said Ives. ASML The Dutch semiconductor equipment supplier, which makes complex photolithography machines crucial for manufacturing the most advanced chips, has seen a 38.6% stock surge so far this year. Analysts have set a target price of 972.44 euros ($1,140.22), a 2.6% upside, per LSEG data. Bank of America analyst Didier Scemama said the company was his top pick within the semiconductor space, as well as one of his top picks for 2026, earlier this month. He sees ASML’s gross margins expanding in 2027. “ASML is a core player in terms of AI,” said Ives. Klarna While Klarna’s stock has fallen 19% since its debut on the New York Stock Exchange in September, analysts are targeting a hefty upside. Analysts have a target of $45.63 for the stock, according to LSEG data, which represents a premium of 41.1% on today’s price. In November, the buy-now-pay-later company topped Wall Street’s third-quarter revenue expectations in its first earnings report since listing. At the time, Klarna said it was getting a boost from outsized U.S growth. Spotify Spotify’s stock has risen 33.9% in 2025. The music streaming company reported strong third-quarter results that topped Wall Street predictions and saw total revenue increase 12% year-on-year in November. LSEG data shows analysts have set a target price of $754.87, a 26.1% upside. In a note in late November, Deutsche Bank predicted that Spotify could raise the price of its subscriptions in 2026, which it added could result in a 5% increase in revenue.