Most Americans would agree that your 20s should be a time of new experiences, growth, and discovering your career path.

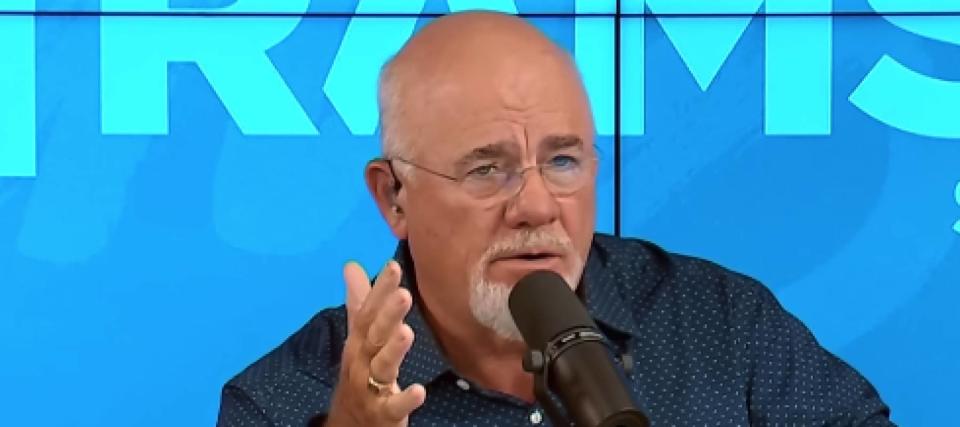

Now may be a great time to take risks and make some big bets, but diving in without a safety net isn’t just risky — it’s reckless. At least, that’s what personal-finance guru Dave Ramsey recently warned 27-year-old Michael.

do not miss it

Michael, a native of Atlanta, Georgia, was at a crossroads and called into Ramsay’s show to ask for advice: he could choose to either continue working for someone else or buy an ice business and become a small business owner.

But as Ramsey tells him, before you even think about starting a business, you need to make sure your financial foundation is solid. Here’s what Michael (and other young Americans in his position) should do before thinking about taking that big step:

Small business is work

Michael tells Ramsey he is seeking advice on how best to secure financing to buy the company from the owner of the ice shop where he currently works. However, Michael explains that the owner has indicated that he would like to sell the company, including the building with its existing tenants, within the next two years for an asking price of $1 million. He is considering obtaining a loan of $1 million to buy the smaller company.

Michael is interested in taking over the business, but needs the capital to buy it himself.

Although the hosts were skeptical of Michael’s passion for the ice business, he said he is happy to have landed the job at such a young age as he sees great opportunities in the field.

He also said that technically bad Michael and his wife have been working hard to pay off their debts and improve their overall financial situation, but because Michael is 27, still living at home and has no significant assets, Ramsay doesn’t think he’s ready to take this step. Ramsay tries to convince Michael, and co-host John Deloney backs him up, warning him that this is a “trap” rather than an opportunity.

“No bank will lend to you for this,” Ramsay said bluntly. “You have no assets, no revenue. No bank will give you a loan. Buying and running a small business is like gutting your bones. You’re worn out and squeezed like yesterday’s rag.”

Ramsay’s overall view is that it’s absolutely crucial to be financially stable and debt-free before deciding to buy and own a small business — the same advice he gives to his own son.

“I think I need to be on a firmer personal financial footing before I can even start talking about buying and running a small business,” Ramsey said. “I have car payments, I live with my mom. I’m not ready for that yet.”

read more: Wealthy young Americans are losing faith in the stock market and betting on these assets instead. Get in now for a strong long-term tailwind.

Prioritize financial stability

According to a report from the U.S. Chamber of Commerce, there are 33.2 million small businesses in the United States, which collectively account for 99.9% of all businesses in the U.S. as of 2023 (that’s a pretty impressive metric).

At the same time, nearly half of American adults (a shocking 49%) admit that they would not have enough cash to cover a $1,000 emergency in 2023.

One way to finance a small business acquisition is through an SBA (Small Business Association) loan. Loan amounts typically range from $500 to $5.5 million. However, there are some drawbacks and risks.

-

Borrowers are usually required to make a down payment

-

Borrowers with low credit scores typically won’t qualify.

-

You may be required to provide collateral

-

The approval process is usually slow

-

If the company defaults on its debt, you may be held personally liable.

If you are considering joining the tens of millions of Americans who have embarked on the journey to becoming an entrepreneur, make sure you don’t end up among the 49% who can’t cover emergency expenses. Personal financial stability is paramount when starting any business.

What to read next

This article is for informational purposes only, should not be construed as advice, and is provided without warranty of any kind.