-

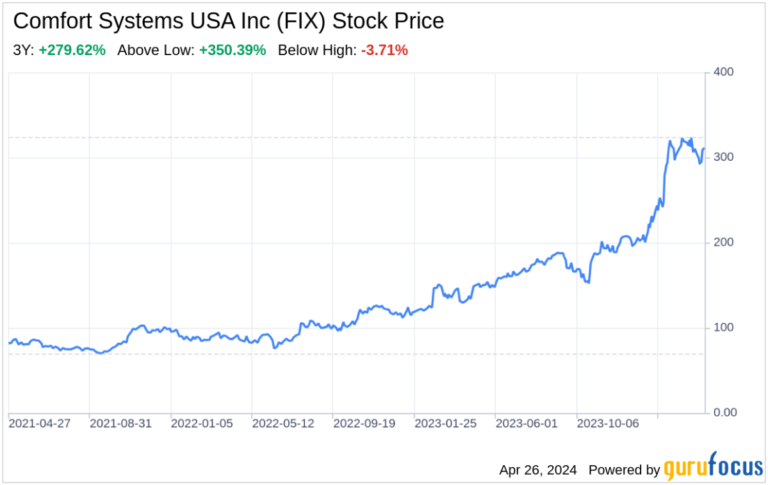

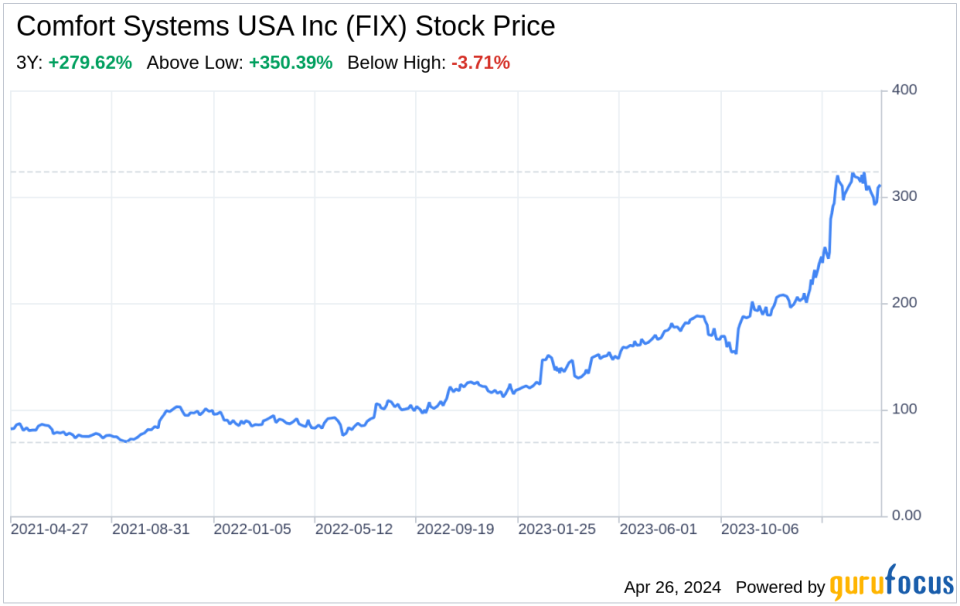

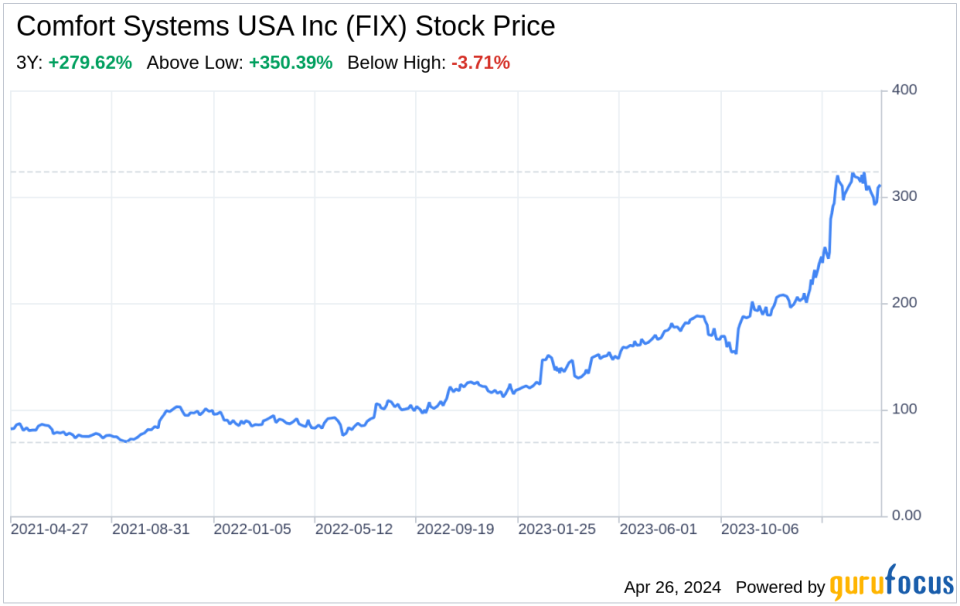

Comfort Systems USA Inc (NYSE:FIX) shows solid revenue growth and solid backlog expansion in its latest quarterly report.

-

The company’s strategic acquisitions have significantly contributed to improving its market presence and financial performance.

-

Despite market challenges, Comfort Systems USA Inc (NYSE:FIX) has maintained a strong balance sheet with strong net income growth.

-

FIX is committed to technology investments and market diversification, positioning it well for future growth opportunities.

April 25, 2024 Comfort Systems USA Inc. (NYSE:FIX), a leading provider of mechanical contracting services, released its 10th quarterly report, highlighting comprehensive financial performance and strategic positioning. The company reported a significant increase in revenue, jumping from $1.17 billion in Q1 2023 to $1.54 billion in Q1 2024, marking a 30.8% year-over-year growth. did. Gross profit followed suit, increasing from $205.4 million to $297.4 million. Net income increased significantly from $57.2 million to $96.3 million, and earnings per share improved from $1.60 to $2.70. These numbers highlight FIX’s financial resilience and operational efficiency and set the stage for a detailed SWOT analysis to help investors make decisions.

Strengths

Solid financial growth: Comfort Systems USA Inc (NYSE:FIX) has shown strong financial performance, with its latest quarterly report showing significant increases in revenue and net income. The company’s revenue reached $1.54 billion, an increase of 30.8% year-on-year, and its net income increased significantly from $57.2 million to $96.3 million. This financial strength demonstrates the company’s ability to capitalize on market opportunities and effectively manage its operations.

Strategic acquisition: FIX’s growth strategy includes strategic acquisitions, which have helped expand its market presence and service offerings. The recent acquisitions of Summit Industrial Construction, LLC and J&S Mechanical Contractors, Inc. not only contributed to revenue growth but also strengthened the company’s capabilities in the mechanical and electrical services sector. These acquisitions have allowed FIX to diversify its portfolio, enter new markets and strengthen its competitive position.

Extending the backlog: The company’s order backlog, an indicator of future earnings potential, has shown a notable increase. As of March 31, 2024, the backlog was $5.91 billion, an increase of 14.6% from the end of the previous year. This backlog growth suggests a healthy pipeline of projects and strong demand for FIX’s services, providing visibility into the company’s future revenue streams and stability.

Weakness

Operational risks: Comfort Systems USA Inc (NYSE:FIX) operates in industries that are subject to a variety of operating risks, including fluctuations in material costs and labor costs. Reliance on a skilled workforce and sourcing materials at competitive prices are essential to the company’s success. Disruptions in these areas can impact project schedules and profitability, and challenge a company’s operational efficiency.

Debt management: Although FIX maintains a strong balance sheet, it is not immune to the risks associated with debt management. The company reported long-term debt increased from $39.3 million to $77 million. While this level of debt is manageable given the company’s earnings, it is essential that FIX continues to monitor and effectively manage its debt to maintain financial flexibility and investor confidence.

Market competition: The mechanical and electrical services industry is highly competitive, with numerous players vying for market share. FIX operates in a price-competitive market and our ability to secure and execute contracts efficiently is critical. Businesses must continually innovate and enhance their service offerings to stay ahead of competitors and maintain their market position.

opportunity

Technology investment: Comfort Systems USA Inc (NYSE:FIX) has an opportunity to leverage technological advances to improve operational efficiency and service quality. Investing in construction-focused technology and digital tools can streamline project management, enhance customer engagement, and reduce costs. Embracing innovation will help FIX differentiate itself in the market and capture further growth opportunities.

Market diversification: The company’s recent acquisitions have opened the door to new markets and sectors, providing further diversification opportunities. By expanding its service offering and geographic footprint, FIX aims to develop new customer segments and reduce dependence on a single market or sector, thereby reducing risk and driving sustainable growth. I can.

Regulatory tailwinds: With the enactment of anti-inflation laws and other regulatory developments, there is a potential opportunity for FIX to benefit from increased spending on infrastructure and energy efficient systems. The company can capitalize on these tailwinds by positioning itself as a provider of sustainable and compliant solutions and appealing to a growing segment of environmentally conscious customers.

threat

Economic fluctuations: Comfort Systems USA Inc (NYSE:FIX) operates in a cyclical industry. An economic downturn could reduce construction activity, which could reduce demand for FIX’s services. The company must remain vigilant and adaptable to navigate periods of economic uncertainty and maintain financial stability.

Supply chain disruption: Global supply chains have faced significant disruption in recent years, impacting the availability and cost of materials. FIX is not immune to these challenges, and prolonged supply chain issues can impact your ability to complete projects on time and on budget, negatively impacting your reputation and financial performance.

Corporate compliance: The mechanical and electrical services industry is subject to strict regulations and compliance requirements. changes in laws,

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.