Dillard’s Co., Ltd. (DDS – The company has maintained a niche position in the market by strictly focusing on providing fashionable products to its customers and adding value through excellent customer care services. We believe that the company’s strategy of featuring fashion-forward and trendy products is what attracts more customers.

Dillard’s is aggressively expanding its customer base through strategic initiatives in its brick-and-mortar stores and e-commerce. Additionally, the company’s efforts at efficient inventory management bode well.

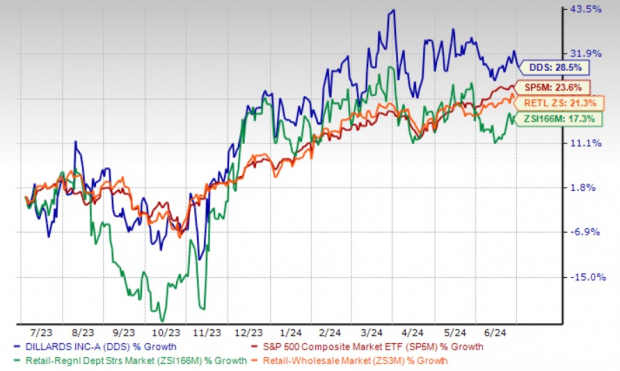

These factors have helped this Zacks Rank #3 (Hold) stock outperform its industry over the past year. DDS has risen 28.5% compared to the industry’s growth of 17.3%. Dillard’s has also performed well compared to the Retail-Wholesale sector’s growth of 21.3% and the S&P 500’s one-year improvement of 23.6%. The VGM Score of A further speaks to this stock’s value.

Image source: Zacks Investment Research

Why is Dillard’s a hot topic?

Dillard’s has benefited from a focus on trending categories and store-related initiatives, and its efforts to capture growth opportunities in its brick-and-mortar and e-commerce businesses have been key to retaining existing customers and attracting new ones.

In stores, efforts such as strengthening brand ties, focusing on trending categories, remodeling stores, and increasing compensation for store associates have been successful. In March 2024, Dillard’s opened a store at the Empire Mall in Sioux Falls, South Dakota, marking the company’s 30th state in the United States. The company’s activewear brand is gaining market share.

The company’s e-commerce business has been growing steadily thanks to strategies such as strengthening its product lineup and streamlining inventory management. Going forward, the company is expected to achieve further growth by focusing on improving the productivity of existing stores, building an advanced omni-channel platform, and strengthening its domestic business.

Dillard’s also demonstrates efficiencies in inventory management, a critical component of retail success. The company has improved its inventory levels over the past few quarters through ongoing inventory management efforts. The company ended the first quarter of fiscal 2024 with $1.4 billion in inventory as of May 4, 2024, down 1.6% year over year. Inventory reductions have led to reduced markdowns and improved gross margins.

Consolidated gross margin increased 90 basis points (bps) to 44.6% in the first quarter compared to the same period last year. Retail gross margin was 46.2%, representing an increase of 60 bps compared to the same period last year, driven by modest gross margin increases in the home goods and furniture, women’s accessories and intimates, men’s apparel and accessories, women’s apparel, and juniors’ and children’s apparel categories, although gross margins in the beauty and footwear categories remained relatively flat.

Dillard’s remains focused on maintaining a strong balance sheet and liquidity. Highlights of the company’s financial position include a lower rental burden compared to the industry as the company owns 90% of its retail stores and 100% of its headquarters, distribution and fulfillment facilities.

Tough retail backdrop creates obstacles

Dillard’s continues to be impacted by a challenging retail environment due to cautious consumer purchasing behavior for some time. This impacted revenue and same-store sales (comps) and led to increased operating expenses in the first quarter of fiscal 2024. The company’s comps decreased 2% year over year, and total retail sales decreased 1.5%. Retail sales were impacted by the challenging sales environment during the quarter.

summary

Despite the challenges, Dillard’s strategic focus on inventory management, store and e-commerce development, and on-trend product offerings has positioned the company well in the competitive retail industry. These efforts highlight Dillard’s resilience and ability to adapt in a dynamic marketplace.

Three promising stocks

There are a few brands that rank high. Macy’s Inc. (Ma – Free Report) Abercrombie & Fitch Co. (National Library of Australia – Free report) and Gap Inc. (GPS – Free Report)

Macy’s is an omnichannel retail organization that operates stores, websites and mobile applications under three brands: Macy’s, Bloomingdale’s and Bluemercury. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimates for Macy’s earnings and revenue for the current fiscal year indicate declines of 1.7% and 20.3%, respectively, from the prior-year reported figures. M’s average earnings estimate for the past four quarters is 57.1%.

Abercrombie is a specialty retailer of upscale, high-quality casual apparel. The company currently carries a Zacks Rank #1.

The Zacks Consensus Estimates for Abercrombie’s current fiscal year sales and earnings are suggesting growth of 10.4% and 47.3%, respectively, from the prior-year reported figures. ANF’s average earnings surprise over the trailing four quarters is 210.3%.

Gap is a leading international specialty retailer offering a diverse range of clothing, accessories and personal care products and currently holds a Zacks Rank #1.

The Zacks Consensus Estimates for Gap Inc.’s earnings and revenue for the current fiscal year are projecting increases of 0.2% and 21.7%, respectively, from the prior-year reported figures. Gap Inc.’s average earnings estimate for the past four quarters is 202.7%.