Focus on ESI The July 2024 eDiscovery job market has brought new trends that everyone has been waiting for. Jared Coseglia, Founder and CEO of TRU, and Maribel Rivera, VP of ACEDS, discussed the shifts, changes, surprises, and predictions for job seekers and employers in the current eDiscovery job market.

Coseria: The free 2024 eDiscovery Jobs Report remains available on the TRU website. While industry data changes monthly, the information in this report is timely and relevant. It’s a great resource, especially for hiring managers looking for job market endorsements and data points to help them secure recruiting budgets or resolve hiring roadblocks.

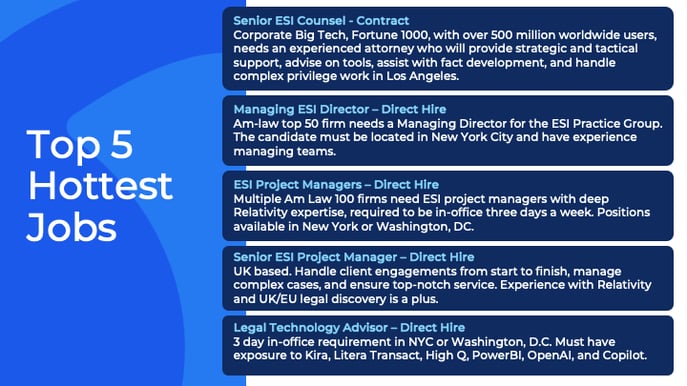

We’ve added a new segment to this webinar to show you the diversity of jobs that are hot right now. We have contract, direct hire, and leadership opportunities as well as traditional mid-market project management roles. Also, notice at the bottom that we’re starting to see new types of roles emerge around emerging technologies, such as using eDiscovery technology for purposes other than eDiscovery. If any of these roles interest you, we’d love to hear from you!

Key trends for June include:

Compared to last year, TRU recruiters filled 30% more positions in the first half of this year than they did in the first half of last year, indicating that organizations are hiring more talent and doing so quickly, and that there were more job openings in the eDiscovery field this year than the same time last year.

June stood out as a month where many job seekers turned down multiple offers. This is important because the most popular job seekers received multiple offers at the time of hiring. This means one employer will be happy and three or four will be disappointed. And according to the last point on the slide above, after being a very strictly employer market for the past 18 months, we are slowly returning to a job seeker market.

Increased Adoption of Enterprise eDiscovery

The third trend is the increase in corporate adoption of eDiscovery, most of which is contract work. Some are permanent, most are remote. If you prefer working in-house within a corporate environment, a contract or contract-to-hire switch may be your best option. At TRU, we have seen people leave full-time positions for these coveted corporate roles. Corporate roles offer a more unique environment and the opportunity to play a variety of roles in a smaller ecosystem.

Law firms embrace remote work flexibility

Another very significant trend in June was that more law firms moved from a three-day to one-day-a-week office requirement. This shows that law firms are realizing they need to become more flexible to attract top talent. As soon as a firm makes that transition, the number of candidates interested in their open positions increases exponentially.

Interestingly, three in four ESI job seekers would prefer a fully remote contract role over a direct hire role that requires three or more days in the office. We know that eDiscovery professionals are more likely to leave full-time roles to take remote contract roles rather than in-office positions, which is indicative of current job seeker mindsets.

eDiscovery burnout motivates job change

As of the end of Q2 2024, burnout is the top motivator for eDiscovery professionals to go out in the market for new roles. This trend began in Q4 2023 and continues to rise. Organizations continue to be understaffed and teams are overworked, which is why people are sticking with remote work. Remote work gives people some control over their careers. This trend is having a major impact across the industry. People are burned out and in need of a change, so they are willing to part with tens of thousands of dollars to take on lower-paying contract positions.

Hiring of eDiscovery Lawyers Hits 12-Month High

And as of the end of June, hiring of ESI lawyers hit its highest point in the past 12 months. It’s no longer just a techie market. There’s a growing demand for ESI lawyers to negotiate, advise, and litigate significant ESI matters. Organizations are looking for lawyers who have a deep understanding of case law and know how to argue case law to avoid certain judicial outcomes — not by performing large-scale document reviews.

Looking ahead, here are some data points that have changed over the past month: Likelihood of offer acceptance has been one of the most dramatic changes. Employers now see only a 50% chance of accepting a first offer. Candidates wait weeks to see how many offers there are and which one is the best. Being early and first to make an offer is no longer important. Now, you need to submit the best offer to get the best candidates. Despite many job openings, talent shortages are starting to have an impact. This is a very similar trend to 2022.

Above you can see the trend of contract vs direct hire based on accepted offers. In June, direct hires increased from a 50:50 split. This indicates that the demand for direct hires is increasing. We expect this trend to remain the same between now and the end of the year. However, the only thing that would change this forecast is that if project work becomes extreme, we will see a higher proportion of contract work as staff will be needed to fill roles for a period of time..

Above you can see the trend of contract vs direct hire based on accepted offers. In June, direct hires increased from a 50:50 split. This indicates that the demand for direct hires is increasing. We expect this trend to remain the same between now and the end of the year. However, the only thing that would change this forecast is that if project work becomes extreme, we will see a higher proportion of contract work as staff will be needed to fill roles for a period of time..

Job seeker motivations are always an interesting slide. Forms of burnout are ranked 1st to 3rd. Burnout can mean many different things to ESI professionals. It can mean people are overworked or under too much stress. Regarding the second point, the inability to take on new business affects the huge number of sales professionals who come to TRU looking for new roles. If an organization cannot take on new work, sales professionals will want to change jobs to keep making money. Regarding the third point, a toxic culture can creep in due to a lack of vision and a lack of empathy for employees..

US Law Firm ESI Average Salary by Region

Above is the salary slide, but there is a notable change: Law firms have seen a substantial increase in salary averages across mid-market firms, indicating that law firms are increasing salaries to retain top talent.

On the vendor side it’s a little different.

US Service Providers ESI Average Salary by Region

While salaries for some roles are falling, review manager salaries are rising, primarily because there are fewer review managers available: vendors want more sophisticated review leadership and are willing to pay for it, and they are also focusing on acquiring cheaper mid-level talent.