- Whales recently moved a large amount of ETH to the exchange.

- This positive trend has disappeared with the recent decline.

Ethereum [ETH] Whales have made big moves recently, particularly impacting the market’s net flows. This coincided with a decline in ETH prices, and the supply on exchanges gradually increased.

Whale moves over $100 million in Ethereum

recent data look on chain Six Ethereum whales recently revealed that they transferred ETH to Binance and Coinbase exchanges.

The maximum deposit was 10,431 ETH (valued at $32.66 million) and the minimum deposit was 2,000 ETH (valued at $6.28 million) from FTX/Alameda.

A total of 44,000 ETH, worth $140 million, was deposited into the exchange by these whales. Prior to this, another whale had deposited his 11,892 ETH (approximately $38 million) onto the exchange.

Ethereum net flow hits monthly high

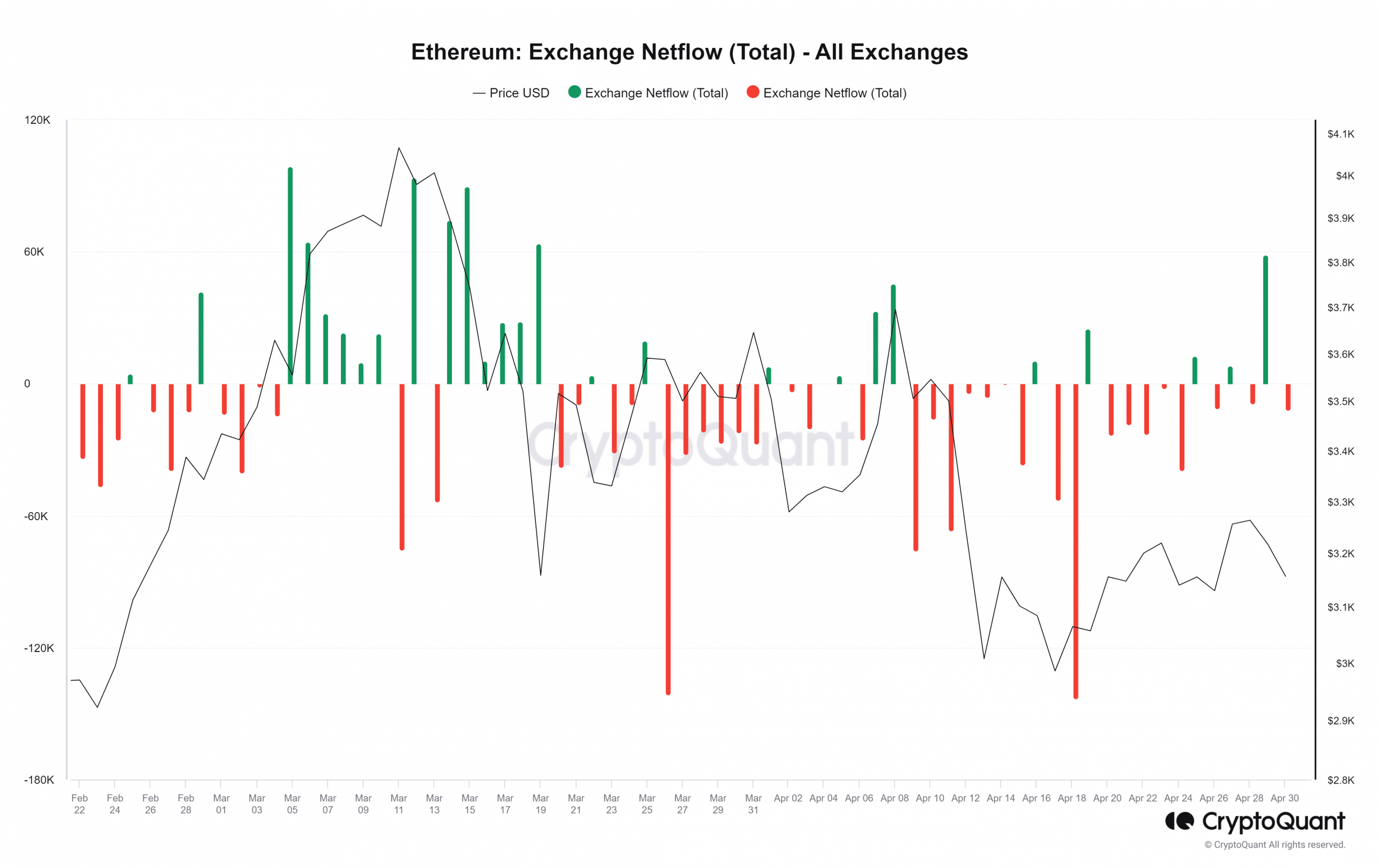

A recent analysis of Ethereum inflows on CryptoQuant showed that over 281,000 ETH was deposited into the exchange on April 29th. While this was significant, it was not the largest influx observed this month. This record was set on April 13th with over 401,000 ETH deposited.

However, an examination of the exchange’s net flows reveals an interesting trend. On April 29th, the net flow of ETH to the exchange exceeded 58,500, with inflows exceeding outflows. This marked the largest influx this month, and his last such notable activity was on March 19th.

These trends suggest that selling pressure is increasing as more traders are selling ETH rather than buying it. At the time of writing, there were inflows of over 57,000 ETH, while outflows totaling approximately -8,900 ETH dominated the netflow.

Source: CryptoQuant

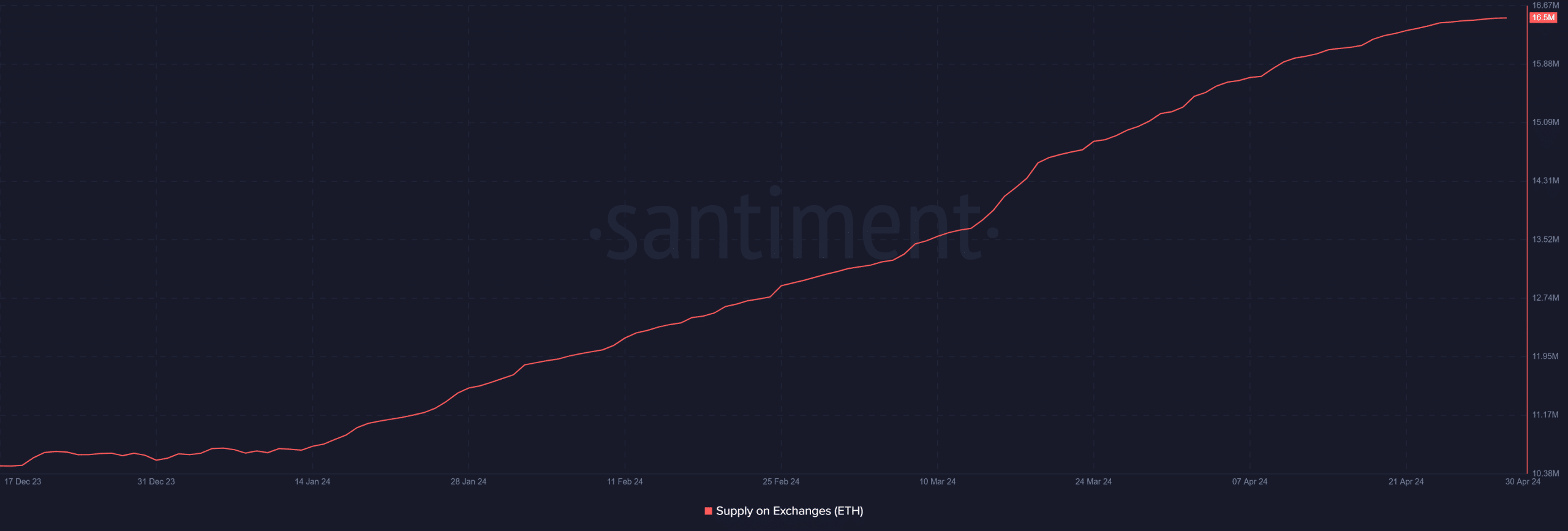

More Ethereum will be supplied to exchanges

Analysis of exchange supply metrics reveals that the amount of Ethereum held on exchanges is gradually increasing. As of the beginning of the month, the supply of ETH on exchanges was approximately 15.31 million.

However, as of this writing, this amount has increased to approximately 16.5 million.

Source: Santiment

ETH returns to bearish trend

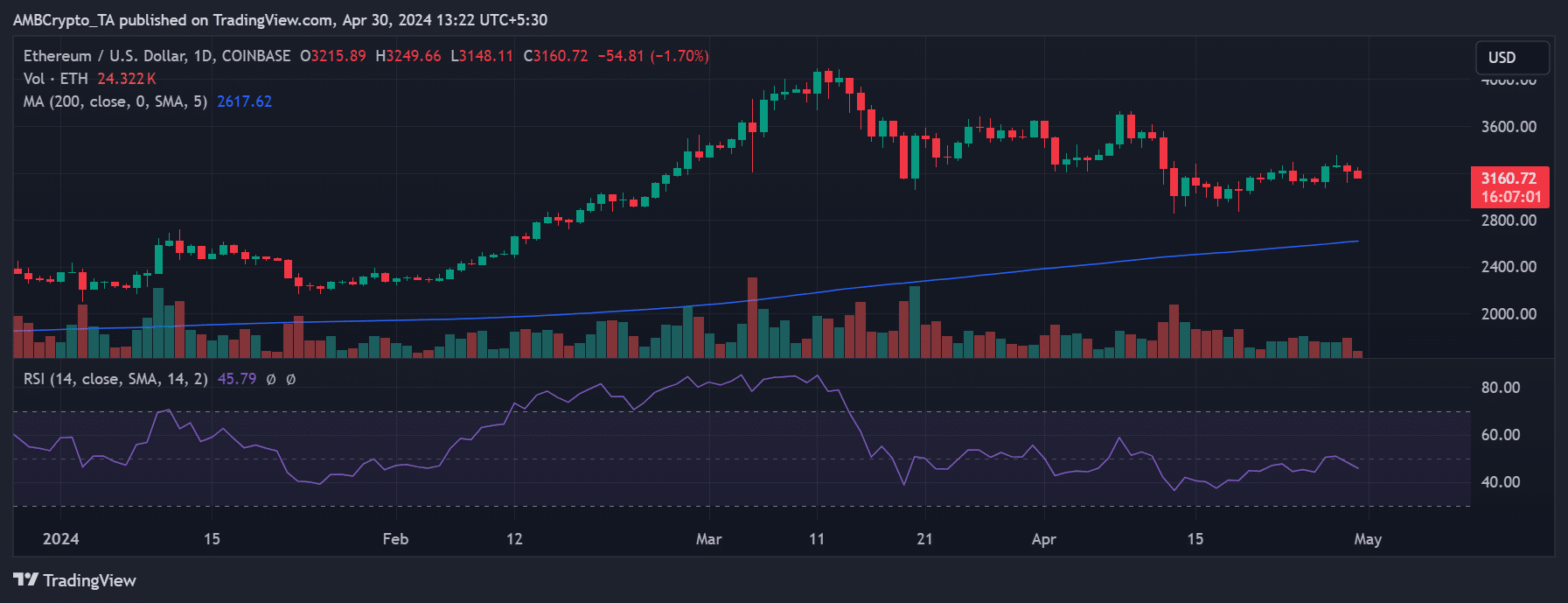

Analysis of AMBCrypto’s daily timeframe chart reveals that Ethereum price fell on April 29th. Trading at around $3,215, ETH fell 1.44%, reversing the slight uptrend seen the previous day.

Read Ethereum (ETH) price prediction for 2024-25

The chart showed that this decline pushed Ethereum’s Relative Strength Index (RSI) below the neutral line, suggesting a return to a bearish trend. At the time of writing, ETH is trading around $3,160, reflecting a further decline of around 1.7%.

Furthermore, the RSI was further below the neutral line.

Source: TradingView