- Most short-term traders have experienced losses and will try to liquidate their positions if the price spikes.

- The $2.8k level is likely to re-emerge as support, but it remains to be seen whether the bulls can hold on beyond that.

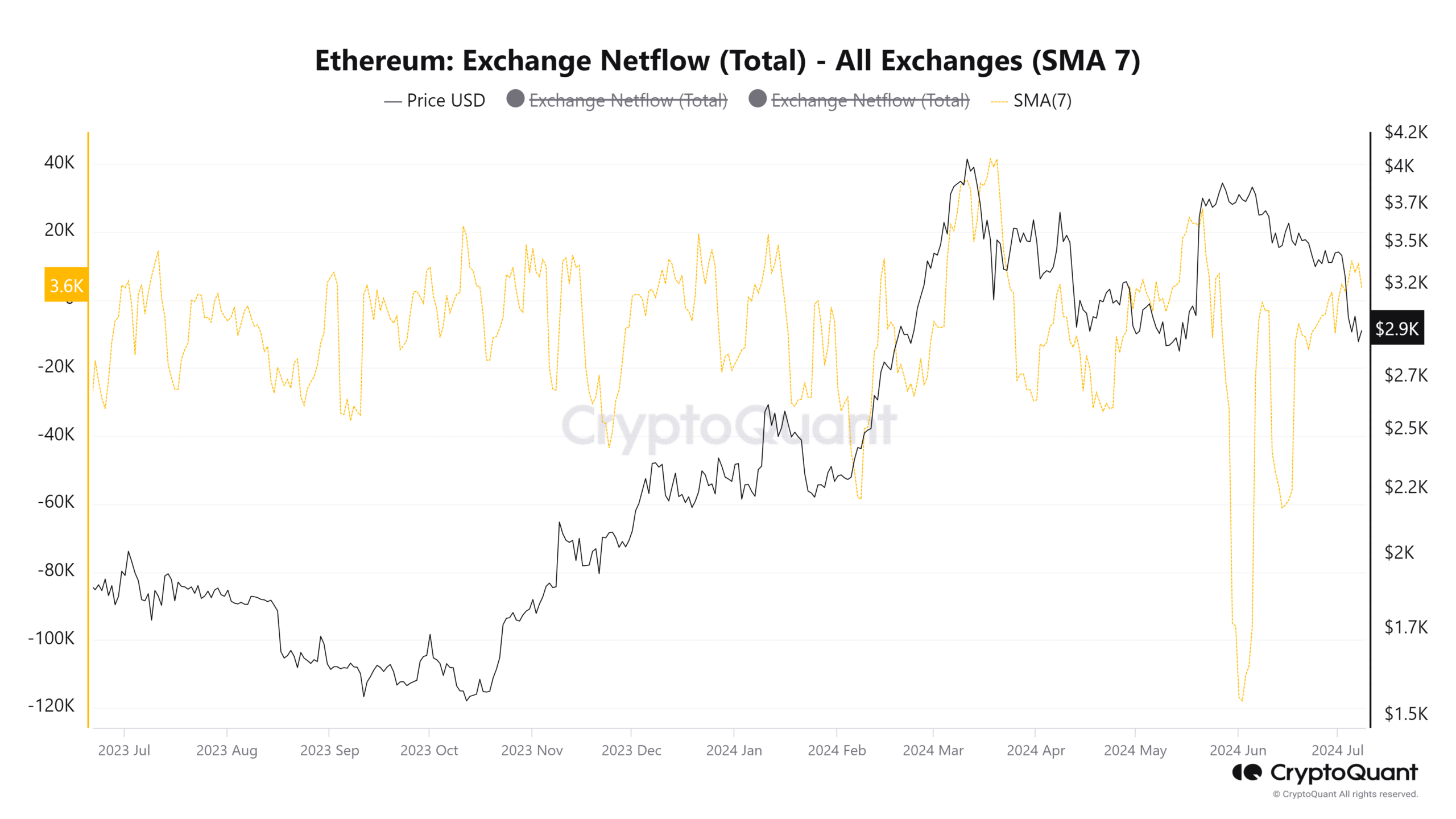

Ethereum [ETH] Exchange inflows recently reversed, turning significantly negative in June, but this did not produce the results investors had hoped for: prices continued to fall rather than rise.

Bearish sentiment was prevalent in the market as evidenced by the price dropping below $3,000, and while this psychological level is likely to be hotly contested, the selling pressure behind ETH is relentless.

Massive whale influx did little to halt the bearish trend

Source: CryptoQuant

In June, the seven-day simple moving average of exchange net flows fell hard into negative territory and remained negative until June 28th.

Over the past 10 days, the price has inched closer to positive territory following the sharp price decline seen in July.

The negative net flows suggest that Ethereum tokens are moving off exchanges and accumulating. Nevertheless, prices continue to fall.

Investors will be hoping that this is the final jolt of pain before the trend turns bullish.

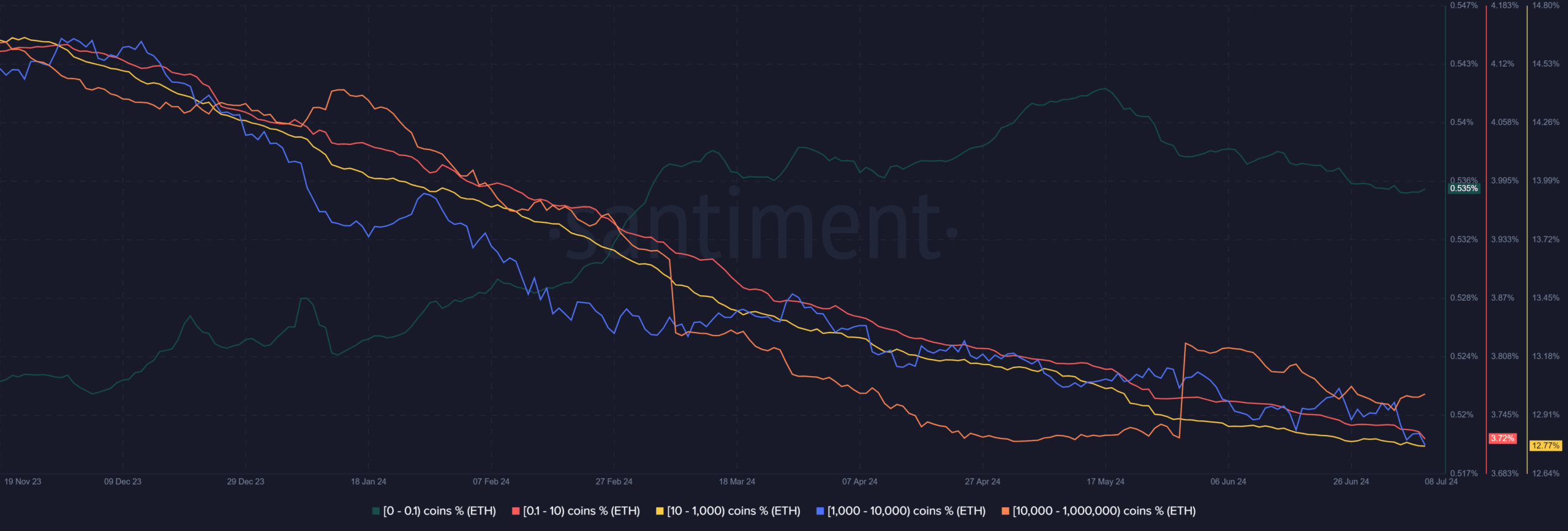

Source: Santiment

Supply distribution analysis shows that 10,000-1 million ETH holders have been increasing since mid-May. 1,000-10,000 ETH wallets rose towards the end of June but have fallen again over the past week.

Taken together, we can see that there are some large whales holding over 10,000 ETH, while most other wallets are reducing their holdings.

Where can traders expect prices to stabilize?

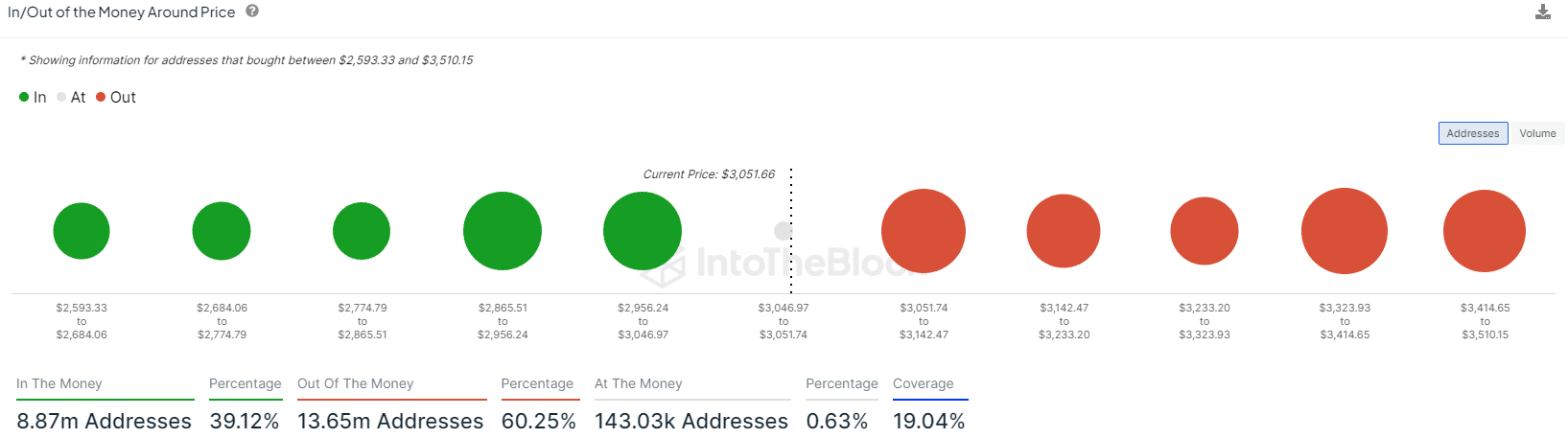

Source: IntoTheBlock

AMBCrypto noted from in/out-of-the-money data that the $2,850 to $3,000 zone, depending on the number of holders, is a strong support zone.

In the past three days, the price has bounced back to $3,000 after falling as low as $2,800, but it is unclear whether buyers can withstand the sellers’ onslaught for much longer.

Around the current market price, 60.25% of addresses are out of the money, meaning that higher prices will likely result in selling as holders look to breakeven, which could increase downward pressure.

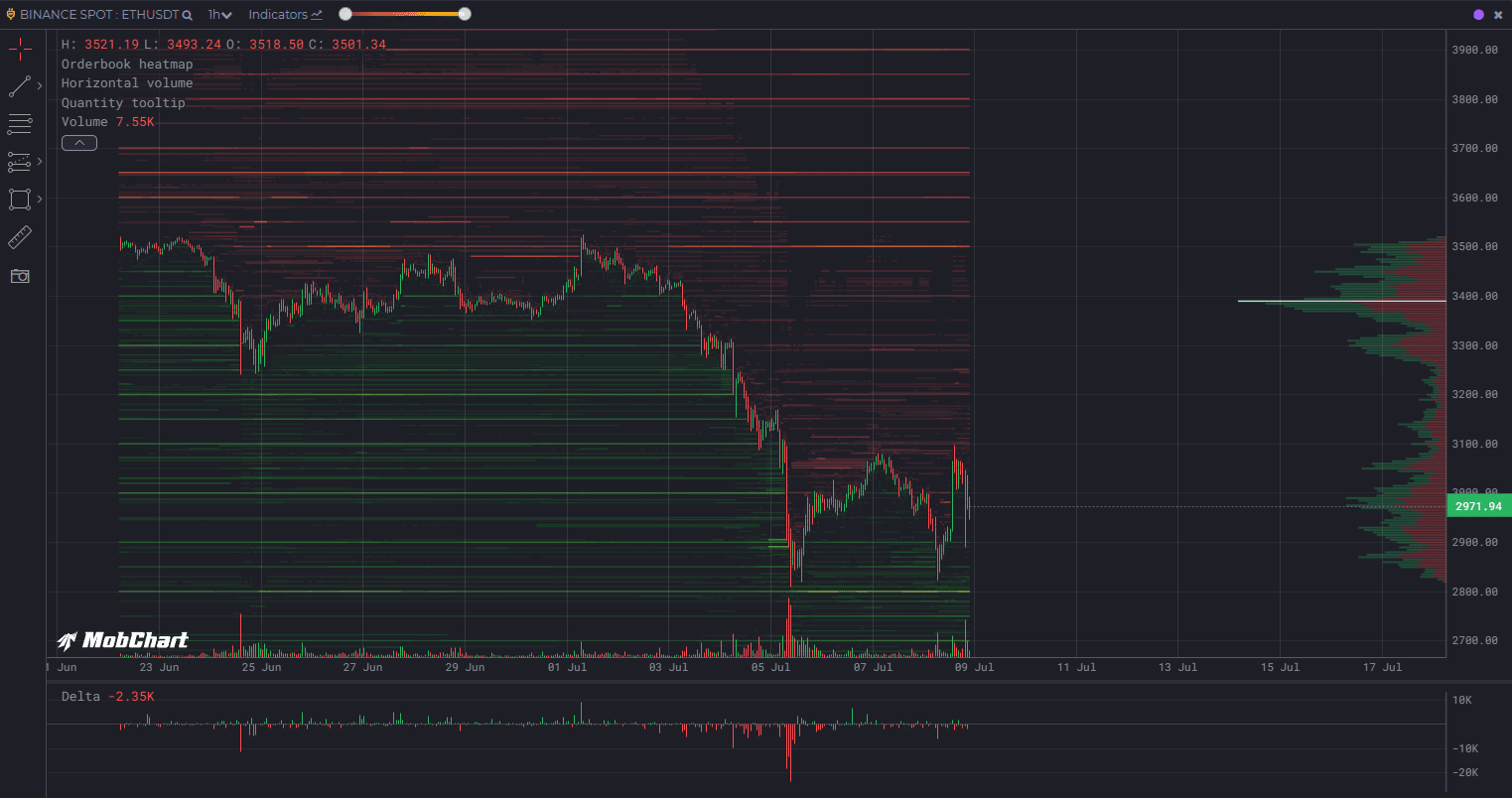

Source: MobChart

Data from MobCharts shows that Ethereum’s order book has large limit orders, with $3.7 million worth of limit orders at the $3,100 and $3,170 levels, and above that, the $3,220 to $3,250 area and $5 million-plus limit orders at $3,500, which act as strong short-term resistance.

Ethereum [ETH] Price Forecast 2024-25

The $2,800 level has just under $10 million in buy orders and may be retested. Overall, the indicators suggest that the bears have prevailed in the short term.

Exchange outflows in June have done little to stem the price decline, and the best that bulls can now hope for is a period of consolidation around the psychological support of $3,000.