(Bloomberg) — The euro rose after the first round of French parliamentary elections showed signs that Marine Le Pen’s far-right party will not take power, and Asian stocks will be in focus amid further signs that China’s economy is faltering.

Most read articles on Bloomberg

Early results showed Le Pen’s National Rally winning by a smaller margin than some polls had suggested, but opponents were already plotting a strategy to keep the far-right party out of power. The euro rose in Asian markets as the results allayed concerns that a landslide victory for Le Pen’s party would increase the likelihood of expansionary fiscal policy and further cloud the outlook for the common euro currency.

“The scenario of NR governing alone is now less likely,” said Rodrigo Catril, a strategist at National Australia Bank in Sydney, as the euro strengthened as concerns about fiscal stimulus eased. “Now we need to wait and see how round two goes and whether other parties can put together a united opposition to RN.”

Japanese shares rose at the open, while Hong Kong futures contracts fell.Investors will be focusing on Chinese stocks on Monday after factory activity contracted for a second straight month in June.The release of the privately funded Caixin China Manufacturing PMI is also due later on Monday.

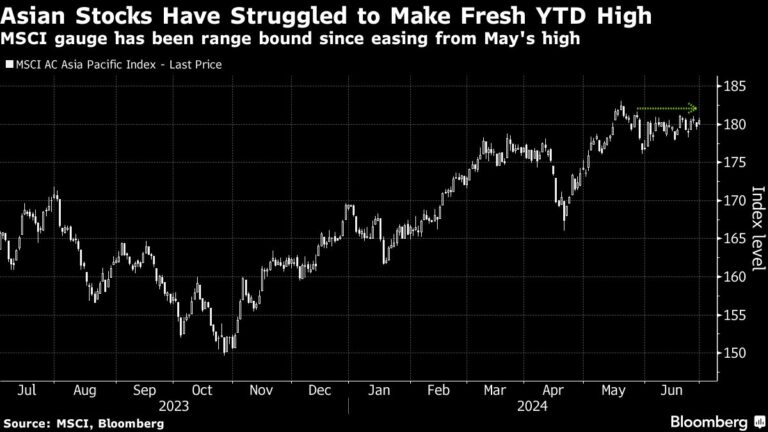

The moves come amid lingering concerns about whether Asia’s rally will be sustainable. The MSCI Asia Pacific Index rose 2.1% last quarter, its third straight quarterly gain, but China’s stocks entered a technical correction last week as the country’s economy weakened. Investors also worry that the pace of Japan’s stock market gains may slow later this year.

Elsewhere in Asia, currency traders in South Korea are on edge amid fears of increased volatility as the won starts new trading hours. Data on Monday showed business confidence at Japan’s biggest manufacturers rose, leaving room for the Bank of Japan to consider raising interest rates later this month. Yields on the country’s 10-year government bonds rose 3 basis points.

One in three economists surveyed by Bloomberg expects a rate hike at the next meeting.The yen slumped to its lowest since 1986 last week and some analysts have warned of rising risks after Governor Kazuo Ueda pledged to closely monitor the yen’s impact on inflation.

Economy Cooling

The U.S. quarter ended on Friday, with a wave of data showing the world’s largest economy cooling without causing lasting damage to consumers. U.S. consumer sentiment fell less than initially expected on hopes that inflationary pressures would ease, and the Fed’s favorite inflation gauge rose slightly for the first time in six months. U.S. Treasuries edged lower on Monday.

Traders will turn their attention to European assets later on Monday as Le Pen’s opponents try to form an alliance to stop her right-wing party from taking power in the second round of the vote. Bond markets will be in focus after the level at which investors demand a higher yield on 10-year French government bonds than safer German government bonds jumped by more than 80 basis points ahead of the vote, a level last seen during the euro zone’s sovereign debt crisis.

“If they start to look more credible, the French market could recover,” said Kathleen Brooks, research director at XTB. “If fears about a far-right government start to subside, that should first show up in the yield spread between France and Germany.”

In corporate news, Boeing Co. shares will be in focus when U.S. markets open after the company agreed on Sunday to buy Spirit AeroSystems Holdings Inc. in an all-stock deal valuing the deal at $4.7 billion, according to people familiar with the matter. Still, the U.S. Department of Justice plans to bring fraud charges against the company, forcing the plane maker to choose between pleading guilty or risking a trial.

In commodities, crude oil prices were little changed as traders focused on China’s economic outlook and geopolitical risks in Europe and the Middle East. Gold prices were slightly lower after being shaken on Friday as traders digested U.S. inflation data.

Major events this week:

-

Australian retail sales, Monday

-

Japan Tankan Report, Monday

-

China Caixin Manufacturing PMI, Monday

-

Eurozone S&P Global Eurozone Manufacturing PMI, Monday

-

Indonesia CPI, Monday

-

India HSBC Manufacturing PMI, Monday

-

UK S&P Global/CIPS UK Manufacturing PMI, Monday

-

US Construction Spending, ISM Manufacturing, Monday

-

European Central Bank President Christine Lagarde speaks on Monday

-

Bundesbank President Joachim Nagel speaks on Monday

-

RBA to release minutes of June policy meeting on Tuesday

-

South Korea Consumer Price Index, Tuesday

-

Eurozone CPI, unemployment rate on Tuesday

-

Fed Chairman Jerome Powell to speak Tuesday

-

European Central Bank President Christine Lagarde to speak on Tuesday

-

China Caixin Services PMI, Wednesday

-

Eurozone S&P Global Eurozone Services PMI, PPI, Wednesday

-

Poland interest rate decision Wednesday

-

US FOMC minutes, ISM services, factory orders, trade, initial jobless claims, durable goods, Wednesday

-

ECB President Christine Lagarde to speak on Wednesday

-

New York Fed President John Williams to speak Wednesday

-

Sweden’s Riksbank releases minutes of its June meeting on Wednesday

-

Australian trade Thursday

-

Brazil trades Thursday

-

UK general election on Thursday

-

European Union to impose temporary tariffs on Chinese-made electric vehicles on Thursday

-

ECB to publish report on June policy meeting on Thursday

-

US Independence Day holiday, Thursday

-

Philippine CPI, Friday

-

Taiwan Consumer Price Index, Friday

-

Thailand CPI, foreign exchange reserves on Friday

-

Eurozone retail sales on Friday

-

French trade, industrial production on Friday

-

German industrial production on Friday

-

ECB President Christine Lagarde to speak on Friday

-

Canadian unemployment rate on Friday

-

U.S. unemployment rate, nonfarm payrolls on Friday

-

New York Fed President John Williams talks about Frida

Some of the key market developments:

stock

-

S&P 500 futures were up 0.2% as of 9:15 a.m. Tokyo time.

-

Hang Seng futures fell 0.4%

-

Japan’s TOPIX rises 0.9%

-

Australia’s S&P/ASX 200 fell 0.7%

-

Euro Stoxx 50 futures fell 0.2%

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro rose 0.2% to $1.0739.

-

The Japanese yen was almost unchanged at 160.94 yen to the dollar.

-

The offshore yuan was little changed at 7.2997 to the dollar.

-

The Australian dollar was little changed at $0.6673

Cryptocurrency

-

Bitcoin rose 1% to $62,542.6.

-

Ether rose 0.4% to $3,430.15.

Bonds

-

The yield on the 10-year Treasury note rose 2 basis points to 4.41%.

-

Japan’s 10-year government bond yield rose 3 basis points to 1.080%.

-

Australia’s 10-year government bond yield rose 11 basis points to 4.42%.

merchandise

-

West Texas Intermediate crude rose 0.3% to $81.75 a barrel.

-

Spot gold fell 0.2% to $2,323 an ounce.

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP