(Bloomberg) — European stock futures followed Asian shares higher as gains in big U.S. technology stocks helped Wall Street hit fresh record highs.

Most read articles on Bloomberg

Euro Stoxx 50 Index futures rose 0.7% after the S&P 500 hit its 30th all-time high this year, defying concerns that a narrow range would make the market vulnerable to surprises.The dollar rose against most of the Group of 10 major currencies.

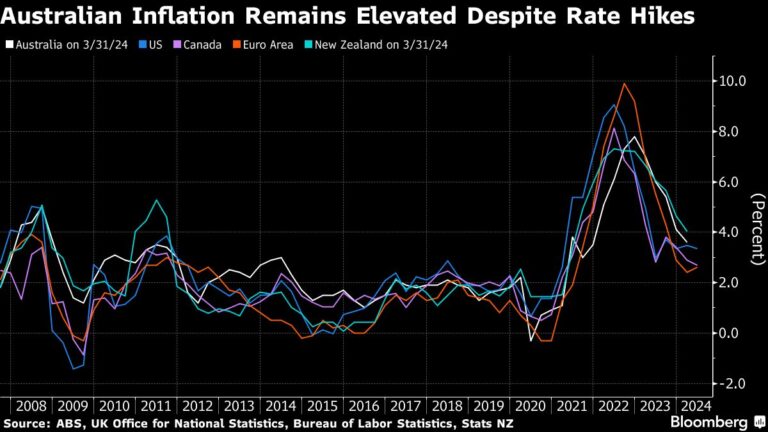

The Australian dollar extended early gains after Reserve Bank of Australia Governor Michelle Block said at a press conference that the central bank had discussed the need to raise interest rates at its policy meeting. Policymakers kept interest rates unchanged at 4.35%, a 12-year high, for the fifth consecutive meeting.

“The RBA’s hawkish stance remains, which is not a surprise to the market,” said Charu Chanana, head of forex strategy at Saxo Markets. “The AUD’s performance is likely to remain externally focused, which looks bearish in the near term given the US dollar’s recovery and slowing momentum in China and commodities.”

Asian semiconductor stocks were among the biggest contributors to the MSCI Asia Pacific Index’s gains. Shares in Chinese suppliers rose on news that electric car maker Tesla had been approved to test its advanced driver assistance system on some Shanghai roads. In South Korea, shares in semiconductor maker SK Hynix rose to a 24-year high after analysts said the company may be revising up its future profit forecasts.

Hong Kong will end the decades-old practice of closing markets during typhoons and major storms starting Sept. 23. The decision to allow trading during typhoons and major storms bodes well for liquidity and could make the market more competitive in the long run, analysts say.

Traders braced for retail sales data and a host of speeches from the Federal Reserve ahead of Wednesday’s U.S. holiday.In Asia, government bonds edged up after Monday’s decline amid a sale of more than $21 billion in high-grade corporate debt.

The main U.S. stock index topped 5,470 on Monday, with Tesla and Apple leading gains in large-cap stocks. The Nasdaq 100 Index approached the 20,000 mark as Micron Technology rose to a record high after several companies raised their price targets.

“We see the combination of improving corporate earnings and one or two rate cuts as a turbo boost for stocks, helping the S&P 500 reach 6,000 by the end of the year,” said James DeMaat of Main Street Research. “The Fed may not need to cut rates this year, but if it does, it would be even more bullish, especially for tech stocks.”

U.S. stocks have risen about 15% this year on optimism about a recovering economy, improving corporate earnings and the possibility of interest rate cuts starting. Philadelphia Fed President Patrick Harker said he thinks one rate cut this year would be appropriate, based on the current outlook.

Investors will be closely watching the implications of Beijing’s latest move in its trade dispute with the EU after China launched an anti-dumping investigation into EU pork imports. This comes as the EU is investigating Chinese subsidies in a range of industries and will impose tariffs on electric vehicle imports from July.

In commodities, crude oil notched its biggest gain in a week as broader market risk appetite masked a mixed outlook for crude. Copper rose from its lowest level since mid-April. Gold was little changed.

Major events this week:

-

Eurozone CPI, Tuesday

-

U.S. retail sales, business inventories, industrial production Tuesday

-

Federal Reserve Board members Thomas Barkin, Laurie Logan, Adriana Kugler, Alberto Mussallem and Austan Goolsby spoke on Tuesday.

-

UK Consumer Price Index, Wednesday

-

June 19th US National Holiday, Wednesday

-

China loan prime rate Thursday

-

Eurozone consumer confidence on Thursday

-

Bank of England interest rate decision on Thursday

-

U.S. housing starts, initial jobless claims Thursday

-

Eurozone S&P Global Manufacturing PMI, S&P Global Services PMI, Friday

-

U.S. Existing Home Sales, Conference Board Leading Index, Friday

-

Fed President Thomas Barkin to speak Friday

Some of the key market developments:

stock

-

S&P 500 futures were unchanged as of 2:41 p.m. Tokyo time

-

Nasdaq 100 futures little changed

-

Japan’s TOPIX rises 0.4%

-

Australia’s S&P/ASX 200 rose 0.9%

-

Hong Kong’s Hang Seng Index fell 0.1%

-

The Shanghai Composite Index rose 0.4%

-

Euro Stoxx 50 futures up 0.5%

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro fell 0.1% to $1.0722.

-

The Japanese yen was almost unchanged at 157.79 yen to the dollar.

-

The offshore yuan was little changed at 7.2729 yuan per dollar.

Cryptocurrency

-

Bitcoin fell 0.8% to $65,820.66.

-

Ether fell 1.5% to $3,460.07.

Bonds

-

The yield on the 10-year Treasury note fell 1 basis point to 4.27%.

-

Japan’s 10-year government bond yield rose 1.5 basis points to 0.940%.

-

Australia’s 10-year government bond yield rose 4 basis points to 4.15%.

merchandise

-

West Texas Intermediate crude fell 0.1% to $80.23 a barrel.

-

Spot gold rose 0.2% to $2,323.42 an ounce.

This story was produced with assistance from Bloomberg Automation.

–With assistance from Winnie Hsu, Tassia Sipahutar, and Swati Pandey.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP