The federal government has signed a Rs1.225 trillion financing agreement with a consortium of 18 banks to address the country’s ballooning power sector circular debt, a transaction Finance Minister Muhammad Aurangzeb described as the largest restructuring deal in Pakistan’s history.

The Ministry of Finance facilitated the loan agreements with Habib Bank, Meezan Bank, National Bank of Pakistan, Allied Bank Ltd, United Bank Ltd, Faysal Bank Ltd, Bank Al Habib Ltd, MCB Bank Ltd, Bank Alfalah, Dubai Islamic Bank, Bank of Punjab, BankIslami Pakistan, Askari Bank Ltd, Habib Metropolitan Bank, Al Baraka Bank Ltd, Bank of Khyber, MCB Islamic Bank and Soneri Bank.

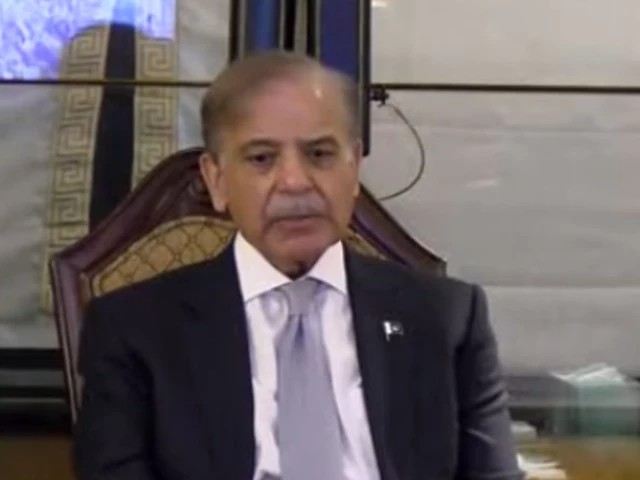

The signing ceremony was held in Islamabad and witnessed virtually by Prime Minister Shehbaz Sharif from New York. The premier termed the agreement a “significant milestone” in efforts to curb the mounting debt, crediting the task force for “fulfilling its responsibilities in an excellent manner.”

Read: Saudi loans help Pak economy stay afloat

Shehbaz added that during a recent meeting, the IMF managing director praised the government’s reform agenda. He stressed that the next step would be the privatisation of power distribution companies (DISCOs) and tackling the challenge of line losses, urging officials to move forward with “confidence and firm resolve.”

Aurangzeb said the financing facility is a “win-win situation for all” and will directly support efforts to resolve the circular debt crisis. He emphasised that the benefits of structural reforms in the power sector will ultimately reach consumers.

Federal Minister for Energy Sardar Awais Ahmad Leghari hailed the Circular Debt Financing Facility as a “landmark initiative” to restore the financial health of the power sector. He noted that the measure is not an isolated one but part of a broader reform agenda aimed at ensuring stability and providing relief to consumers.

According to an official statement, the signing ceremony at the prime minister’s house was hailed as a breakthrough in tackling the circular debt crisis, which has strained the energy supply chain, shaken investor confidence and swelled to nearly Rs2.4 trillion — 2.1% of GDP.

Leading banks participated in the agreement. The Pakistan Banks’ Association (PBA) worked closely with the Ministry of Finance, the Ministry of Energy, the State Bank of Pakistan (SBP) and the Central Power Purchasing Agency (CPPA) to build consensus on regulatory and financial hurdles. The restructuring is described as one of the most significant financial transactions in Pakistan’s history.

Read more: Banks seal Rs1.2 trillion circular debt deal

The arrangement includes Rs659.6 billion in restructuring of existing loans on banks’ books and Rs565.4 billion in fresh financing to clear overdue government payments to power producers. The release of sovereign guarantees worth Rs660 billion will unlock liquidity, enabling banks to inject financing into agriculture, SMEs, housing, education and healthcare.

The cashflow-backed structure adds no new burden on the government or consumers. Instead, the existing Rs3.23 per unit debt service surcharge will be redirected toward repayment. Loans will be priced at KIBOR minus 90 basis points — around 150 basis points lower than the current rate. This concession reflects banks’ willingness to absorb reduced earnings to make the transaction viable.

PBA Chairman Zafar Masud said the agreement reaffirmed the sector’s role as a partner in national development. “This transaction is not just about numbers; it is about reaffirming the banking industry’s role as an equal partner in Pakistan’s economic development. The resolution of the circular debt stock reflects PBA’s commitment to nation-building and shows what can be achieved when the public and private sectors work together with a shared vision,” he said.

Officials noted that the agreement provides a template for solving structural challenges through innovation and collaboration. By joining hands with the government, the banking sector has positioned itself as a trusted partner in delivering sustainable solutions and setting new standards for prudent fiscal management and public–private cooperation.