ISLAMABAD:

The government on Tuesday proposed over Rs415 billion worth of new tax measures to extract an additional Rs2.2 trillion from the sluggish economy by taxing digital earnings, online services, solar panels, and cars used by the middle class. It also proposed drastic reductions in import taxes to open the economy to foreign competition.

The Finance Bill 2025-26, kept secret from the media by cancelling the press briefing, shows the government favouring a 19th-century-style economy by giving some relief on property purchases while taxing 21st-century digital platforms. The bill also proposes banning economic transactions of ineligible persons, including the purchase of property, cars, and investments in securities where assets don’t match the purchase.

Despite promoting green energy, the government has imposed an 18% sales tax on imported solar panels, raised sales tax on 850cc cars from 12.5% to 18%, and introduced a Rs2.5 per litre carbon levy. A new levy has also been imposed on conventional cars to subsidise electric vehicles.

Through the finance bill, the government also amended various non-tax laws and introduced two new ones: the Digital Presence Proceeds Act, 2025, and the New Energy Vehicles Adoption Levy Act, 2025.

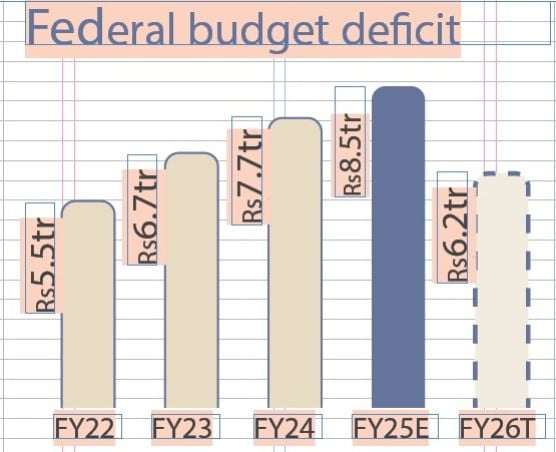

A senior tax official said the government proposed over Rs415 billion in tax measures: Rs292 billion from Federal Board of Revenue (FBR)-related steps, Rs111 billion by imposing a Rs2.5 per litre carbon levy on petrol, diesel, and furnace oil, and Rs9 billion from the levy on conventional cars. These are part of the plan to collect Rs2.2 trillion in additional taxes to hit the Rs14.13 trillion revenue target for FY26. The petroleum and carbon levy target is set at Rs1.47 trillion.

Going after the youth

In a highly unusual move, the government aims to collect Rs64 billion by taxing digital and online platforms and courier services. The move appears to protect non-taxpaying retail businesses.

Digitally delivered services are defined as those delivered via the internet or electronic networks with minimal or no human input. These include music, video and audio streaming, cloud services, software, telemedicine, e-learning, online banking, architectural design, research and consultancy, digital accounting, and other online facilities. E-commerce is defined as buying or selling goods and services over computer networks via websites, apps, or platforms that allow digital ordering, including via phones, tablets, or automated systems.

A new law introduces a Digital Presence Proceeds Tax. It applies to all foreign vendors with a significant digital presence in Pakistan and will charge a 5% tax on proceeds from digitally ordered goods and services, whether delivered digitally or physically.

These vendors must provide client-wise information for any local or foreign vendors whose advertisements are relayed in Pakistan. Banks must deduct a 5% tax.

For local platforms, a 1% tax will be charged if the supply amount is up to Rs10,000, 2% if up to Rs25,000, and 0.25% if above Rs25,000.

Cash on delivery by courier services is now taxed: 0.25% on electronics, 2% on clothing, and 1% on other goods.

Online marketplaces allowing unregistered vendors to sell will be fined Rs1 million if those vendors are not registered under the Sales Tax Act or Income Tax Ordinance.

Banks, payment gateways, or couriers failing to deduct or pay the tax under Section 160 will be fined 100% of the tax involved. The debt servicing surcharge, currently capped at 10% of electricity costs, will be relaxed to help retire Rs1.3 trillion in circular debt.

Income tax

There was confusion over the withholding tax on cash withdrawals. The finance minister announced a rise from 0.6% to 1%, but Deputy PM Ishaq Dar later set it at 0.8%.

Withholding tax on service provision (excluding IT services) rises from 4% to 6%. Non-specified services are taxed at 15%, and sportsmen now pay 15%, up from 10%.

Tax on profit on debt will rise from 15% to 20%. Dividend tax goes up to 25%, and 15% on mutual fund dividends.

For the first time, a 5% tax will apply to pensioners with annual pensions of Rs10 million or more.

Some relief is given to lower and upper-middle-income salaried groups. The tax rate for incomes up to Rs1.2 million is cut from 5% to 2.5%. It was originally proposed at 1%, but the rate was raised due to a 10% salary increase for government employees.

For annual incomes up to Rs2.2 million, the rate drops from 15% to 11%. For Rs3.2 million earners, the rate is reduced from 25% to 23%. There’s no relief for those earning over Rs4.1 million. However, the top slab surcharge has been reduced from 10% to 9% to curb “brain drain”.

Super tax for individuals earning Rs200-500 million is reduced by 0.5 percentage points.

Tax exemption on electricity bills in former FATA areas continues for another year. A flat 4% fair market value tax applies on rental income from commercial properties.

Buyers from unregistered vendors will be penalised: 10% of purchase-related expenses will be disallowed.

If payment is received in cash for a single invoice exceeding Rs200,000, 50% of purchase-related expenses will be disallowed. All entities in a group must derive income under the Normal Tax Regime to claim group relief.

The income tax exemption for Special Economic Zones (SEZs) and Special Technology Zones (STZs) developers and entities is limited to 2035 or ten years from the start of exemption, whichever is earlier.

Real estate

Advance tax on property sale or transfer is raised: from 3% to 4.5% for properties worth Rs50 million, from 3% to 5% for Rs100 million, and from 4% to 5.5% for properties over Rs100 million.

Purchase tax rates are reduced: from 3% to 1.5%, from 3.5% to 2%, and from 4% to 2.5%, depending on property value.

Economic transactions by ineligible persons are banned if the purchase exceeds 130% of their declared total assets.

Custom duty

The government proposes new tariff slabs of 5%, 10%, and 15%, replacing the existing 3%, 11%, and 16% slabs. The zero-duty slab expands from 2,201 to 3,117 tariff lines.

Duty is proposed on 479 tariff lines that were previously exempt. Additional customs duties of 2% on slabs of 0%, 5%, and 10% (covering 4,383 lines) are abolished.

Additional duties on 518 lines under the 15% slab are cut from 4% to 2%. Duties on 2,166 lines under the 20% slab drop from 6% to 4%. On 468 lines under slabs above 20%, the rate is cut from 7% to 6%.

Regulatory duties are removed on some goods, and reduced for 595 PCT codes. The maximum regulatory duty rate falls from 90% to 50%.

Sales tax

An 18% sales tax based on market price has been imposed on imported pet food (including food for dogs and cats) in retail packaging, as well as on imported coffee, chocolates, and cereal bars in retail packaging.

The government has introduced a 10% sales tax on the supply and import of plant and machinery by industrial units located in the erstwhile FATA/PATA regions.

An 18% sales tax has been imposed on the import and supply of solar panels, whether or not assembled in modules or made up into panels. These were previously exempt from sales tax.

The government has increased the sales tax on small cars from 12.5% to 18%. The current reduced rate of 10% on local supplies of vermicelli and sheer malls has also been raised to 18%.

The government has doubled the sales tax rate to 2% on sales made through e-commerce and online marketplaces. The tax will be collected by banks, financial institutions, exchange companies, and payment gateways for digital payments, while couriers will handle tax collection for cash-on-delivery transactions.