It’s easy to understand why investors are attracted to unprofitable companies: For example, Salesforce.com, the software-as-a-service company that lost money for years while its recurring revenue grew, would certainly have made a huge profit if you held its shares since 2005. But while history celebrates those rare successes, it tends to forget the failures. Anyone remember Pets.com?

That’s what you should do HLT Global Are (KLSE:HLT) shareholders worried about the company’s cash burn? In this report, we’ll look at the company’s negative free cash flow (hereafter referred to as “cash burn”) over the year. The first step is to compare the company’s cash burn with its cash reserves to arrive at its “cash runway”.

Check out our latest analysis for HLT Global Berhad

Does HLT Global Berhad have a long-term cash runway?

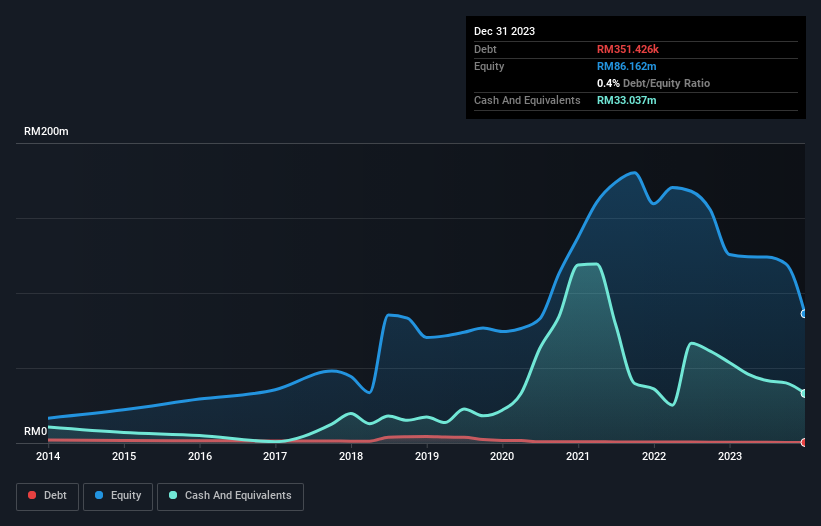

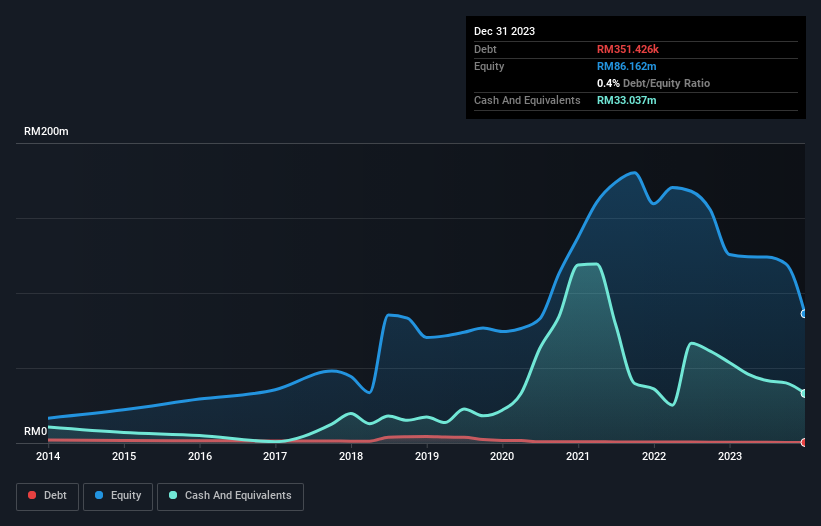

A cash runway is defined as the length of time it would take a company to run out of funds if it keeps spending at its current cash burn rate. HLT Global Berhad has very little debt, so we’ll leave that aside for now and focus on the RM33m in cash it has as at December 2023. Its cash burn last year was RM23m, which means it had about 17 months of cash runway from December 2023. While this cash runway isn’t something to worry about too much, any smart holder would peer too far into the distance and consider what would happen if the company ran out of cash. The image below shows how its cash balance has changed over the past years.

How much is HLT Global Berhad growing?

One thing shareholders should keep in mind is that HLT Global Berhad has increased its cash burn by 666% over the last twelve months. That alone is concerning, but the fact that operating revenue actually fell 18% over the same period makes us very uneasy. Given the above, we’re pretty cautious about this company’s trajectory. Of course, we’ve only taken a quick look at the stock’s growth metrics here. You can see how HLT Global Berhad’s business has developed over time by looking at this visualization of its revenue and profit history.

How easily can HLT Global Berhad raise cash?

As HLT Global Berhad is yet to boast improving growth metrics, the market will likely be looking at ways the company can raise more capital if necessary. Generally, publicly listed companies can raise new capital through issuing shares or borrowing. Many companies will issue new shares to fund future growth. Comparing a company’s cash burn to its market capitalization can give us an idea of how many new shares a company would have to issue to fund its operations for one year.

HLT Global Berhad has a market capitalization of RM143m, so its cash burn of RM23m represents about 16% of its market capitalization. Given this situation, it would not be too difficult for the company to raise more cash for growth, although shareholder wealth would be diluted somewhat.

Are you concerned about HLT Global Berhad’s cash burn?

Our analysis of HLT Global’s cash burn shows that while the cash runway is reassuring, the increasing cash burn is a bit of a concern. In summary, based on the factors we’ve mentioned in this article, we think HLT Global’s cash burn is a risk. Digging deeper, we see: 4 warning signs for HLT Global Berhad There are three things you need to know, and three of them you can’t ignore.

of course HLT Global Berhad may not be the best stock to buySo you might want to take a look at this free A collection of companies boasting high return on equity, or a list of stocks with high percent of insider ownership.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.