The one-year-old company plans to use Hong Kong as a “window” to introduce its robots to overseas markets, primarily developed countries and areas with higher labor costs, Galbot co-founder Yao Tianzhou said in an interview with The Washington Post last Friday after a ceremony marking the partnership with the Hong Kong Investment Corporation.

That would put the company at odds with other big tech companies that are betting on humanoid robots to transform industries, including Tesla Inc. Tesla plans to develop a “really useful” humanoid robot for its own use next year and start producing them for other companies in 2026, Tesla’s Elon Musk said Monday.

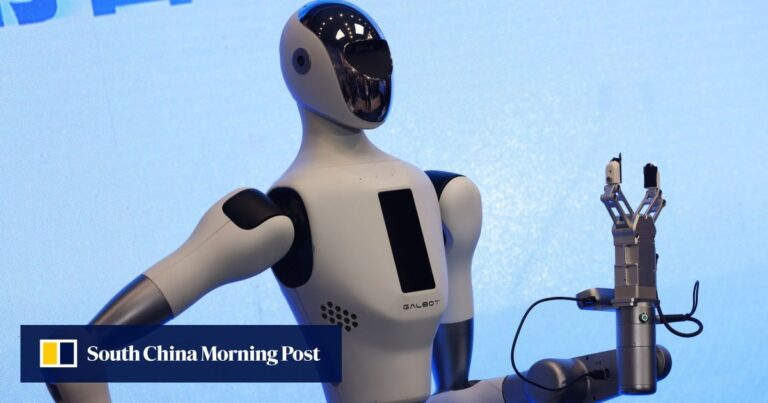

Yao said Galbot can compete with tech giants in developing embodied artificial intelligence (AI) – physical objects that are integrated with AI systems and interact with their environments.

The arrival of a new wave of technology will make the technical processes that incumbents have built up less important, leveling the playing field between small teams and larger companies, Yao said.

But the competition will be “extremely fierce,” Yao added.

As populations in major countries age, companies are looking to machines to replace humans in tedious or dangerous tasks, and a boom in generative AI has seen a surge in global investment in producing humanoid robots this year. Thirteen Chinese startups raised more than 2.5 billion yuan (US$344 million) in the first half of the year, according to local trade publication Robot China.

China’s biggest AI conference, held in Shanghai this month, featured around 20 humanoid robots developed by local startups, while Tesla showed off its second-generation Optimus robot in a glass display box.

China’s robotics companies are well positioned to compete with their U.S. peers thanks to the country’s strong hardware supply chain and vast amounts of data, Yao said. Low production costs allow Chinese companies to get to market quickly and develop new versions of their products at a fast pace, which allows them to collect “a wealth of real-world data from real-world scenarios,” the co-founder said.

“That data could be one of the big advantages we have in the future as we compete with other regions,” he said.

Founded in May 2023, Galbot has received investments from major institutions such as Chinese on-demand service giant Meituan, venture capital firms Qiming Venture Partners, Ranch Ventures and IDG Capital, and last week received backing of HK$62 billion (US$8 billion) from a Hong Kong government fund.

As part of its partnership with the Hong Kong fund, Galbot is considering when the “right time” is to set up a local subsidiary in Hong Kong and hire local research and development, business and services teams.

Hong Kong also expects the company to prioritize Hong Kong as a location for an IPO in the future, but Yao said there have been no internal discussions about a listing timeline as the company is only a year old.

Yao said Galbot aims to start taking pre-orders later this year and will formally deploy the robot in real-world application scenarios for some early customers toward the end of the year. He added that the company’s supply chain partners are “relatively optimistic” about production capacity in the humanoid robot industry.