PUBLISHED

March 16, 2025

KARACHI:

Two years ago, when flipping her graduation cap at her convocation ceremony, Ayesha Ali was self-confident that getting a degree from one of the most reputed business schools would land her a good job. Her dreams and expectations were shattered when, after trying for nine months, she couldn’t secure a decent job that matched her expertise.

After the frustrating and exhausting search for a job, 22-year-old Ali started asking around if anyone among her contacts could help her get a job. Nothing was helping until one day, while scrolling through her Instagram, she saw a story posted by her classmate from school about earning in dirhams while working from home.

“The story was from a women-led event where they said that women can earn from home, and they will train you as well,” said Ali. “It looked appealing, and being desperate to earn some money to support my family, who invested millions in my studies, I texted that classmate to ask her more about it and if she herself is working with this company or not,” shared Ali. This was how she fell into the most organised and legal scam of Multi-Level-Marketing (MLM) schemes.

How it works

MLM programmes, which target young adults and usually recent graduates looking for financial security, have grown in popularity in Pakistan in recent years. These programmes seem like a profitable possibility given the country’s high unemployment rates, growing inflation, and rising cost of living. But in practice, they frequently operate as frauds, leaving victims disillusioned and broke.

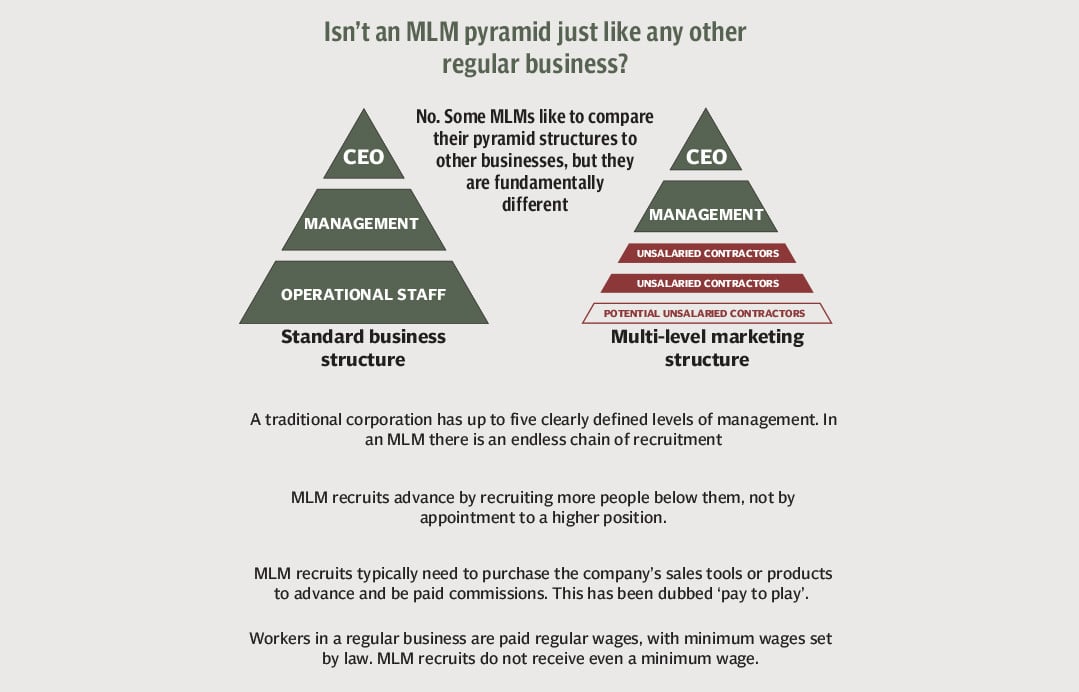

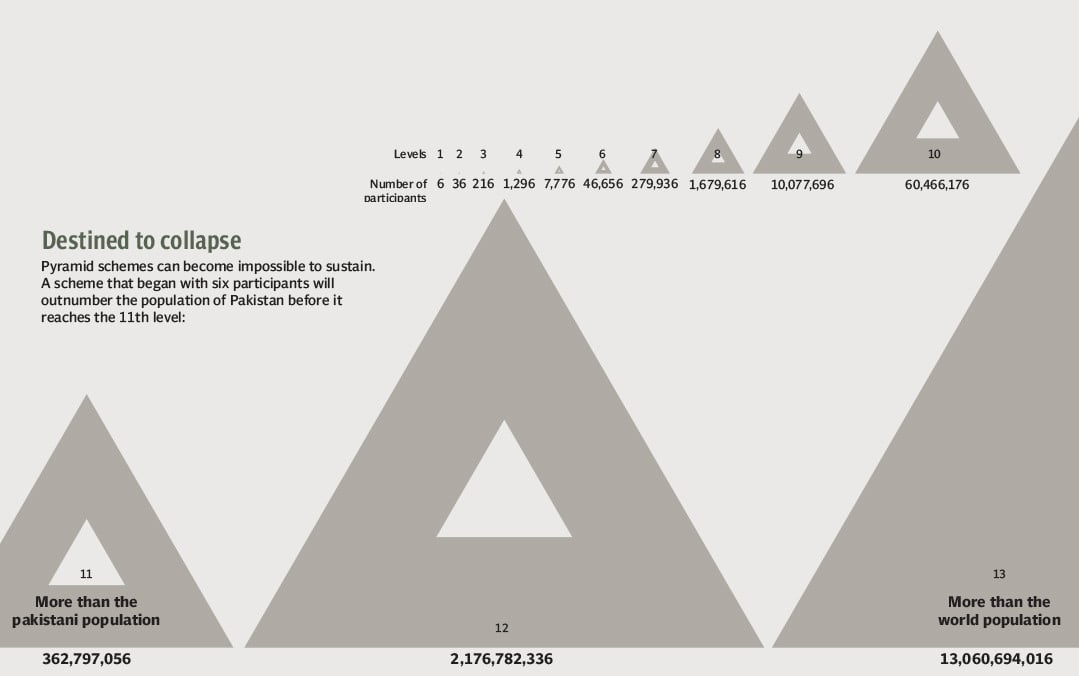

A business concept known as multi-level marketing allows participants to make a profit by selling goods or services and enlisting new members. These ideas, in contrast to traditional businesses, place a greater emphasis on recruiting than on real product sales. While people at the bottom of the pyramid find it difficult to regain their initial contributions that they have invested, those at the top of the pyramid reap the greatest benefits.

Although some multilevel marketing companies are legitimate, many of them are dishonest and resemble pyramid schemes, which are prohibited in many nations because they are exploitative. According to the Companies Act of 2017 and the Prize Chits and Money Circulation Schemes (Banning) Act of 1978, pyramid schemes are prohibited in Pakistan. Such schemes nevertheless exist despite regulatory constraints, frequently luring young people with the help of social media sites.

According to the Pakistan Bureau of Statistics, the country’s youth unemployment rate is over 8.5 percent, which is making it difficult for youngsters to find steady employment. Desperate to succeed financially, many turn to these schemes.

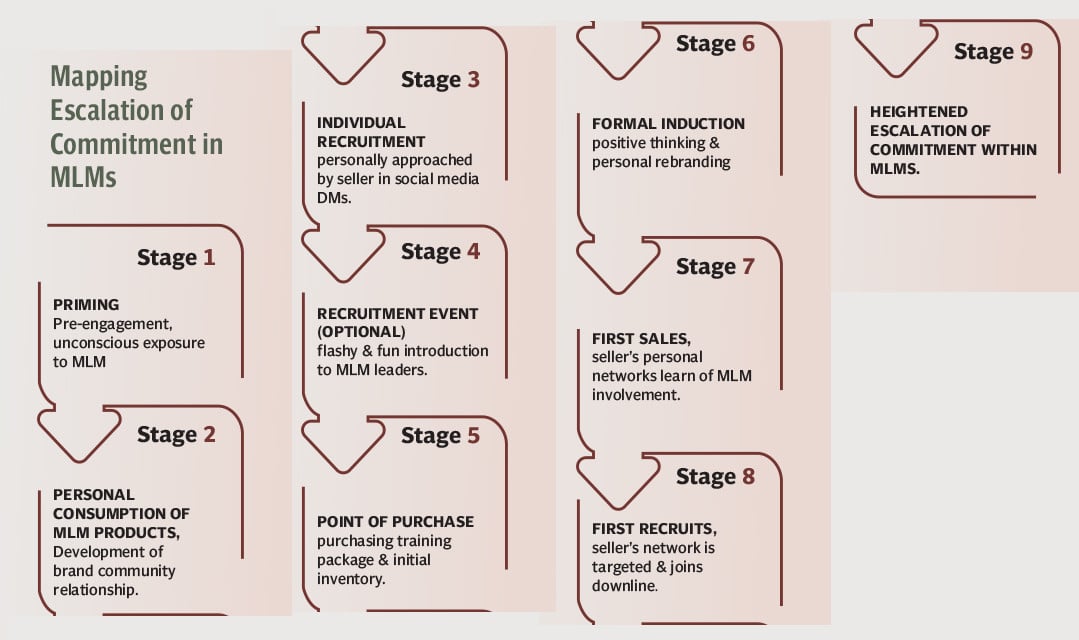

A specific sum must be paid up front by new hires in order to buy products or a starter package. In reality, these goods frequently have low market worth or are overpriced. Recruiting others is where the true profits are made rather than selling the goods. Recruits are coerced into thinking it is their fault if they don’t succeed in the programme. They are assured that they will eventually become wealthy if they put in more effort or hire more staff. They remain looped in the system because of this psychological deception.

With the Consumer Price Index (CPI) rising to over 30 percent in 2023, Pakistan has been struggling with extreme inflation. Young professionals are under tremendous financial burden due to the rising cost of food, fuel, and other necessities. Many youngsters struggle to find employment that pays enough to maintain a respectable standard of living. They consequently become prime targets for multilevel marketing recruiters who make promises of financial independence.

Shattered dreams

Many recent graduates are eager to find any kind of income because the employment market is contracting and there are few career options. MLMs seem to provide a flexible income stream, which makes them a desirable choice for jobless individuals. Young people are under pressure to contribute financially as home expenses continue to rise. Such schemes take advantage of this desperation by luring those who cannot afford to wait for steady employment with the promise of instant profits.

“The recruiters use success stories, lavish lifestyles, and extravagant revenues to lure in young people. They entice those who are having financial difficulties by promising that being a member of their network will result in financial independence,” said Ali. She was lured into this trap and after investing around 200,000 rupees, she was stuck; she had to get more and more registered. Eventually after a few months, she realised that the only people getting the benefit out of it were at the top of this pyramid scheme and everyone like her was just struggling.

These MLM companies target young people with promises of business opportunities and entrepreneurial freedom using social media sites like Facebook, Instagram, and WhatsApp. Unaware that these promises are too good to be true, many vulnerable grads sign up. “I saw a post on a Facebook group where a woman who looked genuine shared how she is earning from working at home, and mothers and housewives can also do the same, and that her monthly turnover is around between 1.5 and two lakhs,” said Sabreena Khadim, a mother of two.

When Khadim commented on the post, the lady contacted her through Whatsapp and shared a few links regarding training. When she asked her that she had heard it’s a systematic scam, Khadim was blocked right away.

“I posted about my experience in the same group so that any naïve women don’t fall into this trap,” continued Khadim. “That is where many women spoke up about how they have been scammed and are stuck because they secretly took out loans, not telling their husbands, a few sold their jewellery to make the investment.”

In Pakistan, a lot of graduates are borrowing money to pay for their studies in the hopes of earning a steady job in return. MLMs appear to be a means of escaping financial hardship when individuals are having trouble finding employment. However, individuals frequently wind up with more debt rather than having their issues resolved.

A 25-year-old master’s in Chemistry, Ahmed Hameed was having trouble finding work when he saw a post online for a business opportunity. “I was persuaded by the recruiter that a health supplement company would provide a passive income if I invested 50,000 rupees. I entered the programme after borrowing money from a family friend. I was thrilled about the possibility of financial independence,” he shared.

Ahmed quickly discovered that hiring additional people was the only way to make money and not by making sales. He quit the plan after months of work with little results, leaving him with debt and a tainted reputation among his colleagues.

Sarah, a recent IT graduate, was approached by an old classmate who gave her access to an exclusive business network. A monthly income of up to 100,000 rupees was offered to her. She was apprehensive at first, but she made the decision to invest after seeing images of prosperous entrepreneurs and even some influencers promoting the company on social media.

“I was disappointed to see that the alleged business plan was solely focused on hiring more employees. When I failed to persuade friends and relatives to join, I was called out for lacking in dedication, and the ongoing dilemma caused me to not just lose my investment, but also I went into depression that I couldn’t even do something as easy as just working from my home,” she lamented.

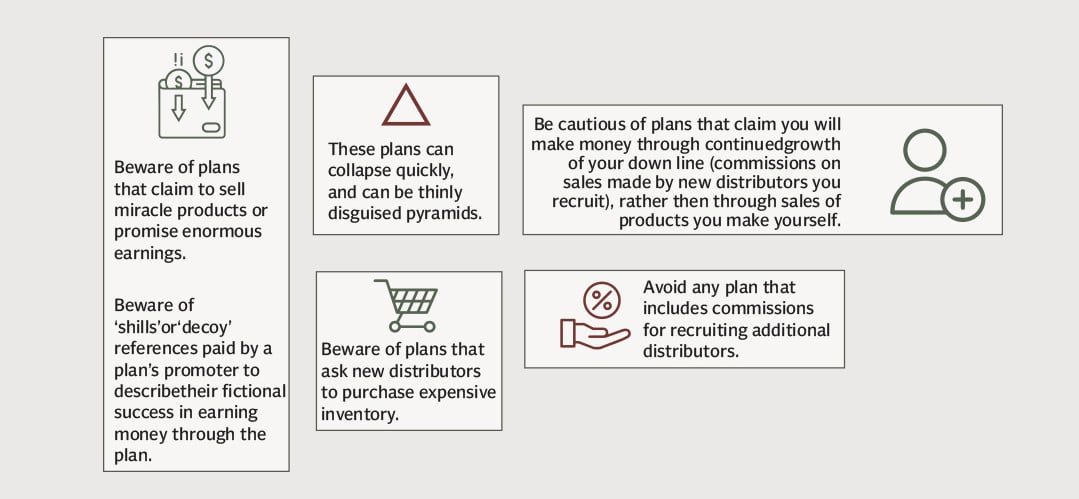

There are a few things that one can keep in mind while being observant of whether what they are signing up for is a scam or a genuine business model. “A business is probably a scam if it makes exaggerated claims of unattainable profits with little work. Also, it is a pyramid scam if the goal is to recruit new members rather than sell a product,” economist Muzammil Amjad said, adding that people can begin working for legitimate companies without having to pay hefty startup costs. Another things to keep in mind and should be taken as a warning sign is if the company won’t give precise details regarding its financial model.

Legal loopholes

MLMs flourish in Pakistan despite the existence of legal frameworks because of regulatory gaps and lax enforcement. Although the Federal Investigation Agency (FIA) and the Securities and Exchange Commission of Pakistan (SECP) keep advertising and issuing warnings against these scams, enforcement is still a far-fetched idea.

To avoid detection, fraudulent multilevel marketing organisations frequently register under false identities and alter their tactics. Additionally, a lot of them use offshore bank accounts, which makes it challenging for local law authorities to monitor their financial activity.

“Authorities must actively monitor and shut down fraudulent MLM activities to combat the growing threat of MLM fraud. Other than that, students should be taught about financial scams by universities and other institutions to keep young people from slipping into such traps,” said Amjad, adding that the government must concentrate on developing real employment prospects.

Fraudulent multilevel marketing schemes are taking advantage of young adults’ financial worries as Pakistan’s economy is in a shambles. Despite their claims of prosperity and security, these frauds frequently cause monetary losses as well as psychological suffering. To prevent the nation’s youth from slipping into such dishonest traps, awareness and regulation are essential. “Young professionals should prioritise skill development, entrepreneurship, and respectable employment options above pursuing impractical cash shortcuts. Pakistan can only protect its future generations from the growing threat of such frauds by implementing strict enforcement measures and providing education,” the economist advised.