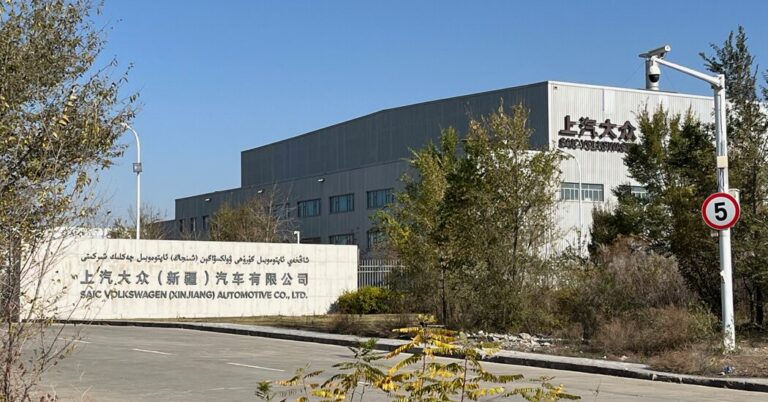

The high walls of the industrial building at the Volkswagen assembly plant in the heart of northwestern China’s Xinjiang region stretch for hundreds of yards, once a symbol of German industrial power, and now the Volkswagen assembly plant in China. It has become a symbol of the quagmire of business and politics.

For 40 years, the Volkswagen Group has been a market leader in China, with a wide range of cars that were highly valued by drivers, from the humble Volkswagen Santana to the powerful Audis and Porsches. However, VW has been replaced as China’s main automaker by Chinese electric car giant BYD.

BYD has rapidly expanded sales of all-electric vehicles over the past three years, forcing VW to make a big bet on that market last year. Then, earlier this year, BYD again caught VW off guard by expanding sales of plug-in gasoline-electric hybrid vehicles that have a small gasoline engine as backup and can travel long distances on battery power alone. Volkswagen has few products in this fast-growing category, leaving a gaping hole that won’t be completely filled until the end of next year.

“Chinese consumers see VW as the king of yesteryear, the king of the era when global brands reigned supreme,” said Michael Dunn, a Chinese auto industry consultant. “Today, many Chinese consumers shrug off VW products with indifference. They prefer fresher and more attractive products offered by home team brands.”

China’s state-owned banks and local governments have been injecting cash into local automakers, allowing some to sell cars far below the cost of manufacturing them. Volkswagen executives say they have refused to engage in the price war, giving up market share as a result.