“A positive step” but still a major issue that “needs to be urgently addressed”

IATA director general Willie Walsh said the reduction in frozen funding was a “positive development” but that $1.8 billion remained a “significant problem which must be addressed urgently”.

Efficient repatriation of airline revenues is guaranteed by bilateral agreements and is a prerequisite for airlines to be able to provide economically significant connections.

“No business can survive for the long term without access to its legitimate revenues,” Walsh said.

The main driver of the reduction was the significant release of frozen funds in Nigeria. Egypt also approved the release of large amounts of frozen funds.

However, IATA noted that in both cases, airlines were adversely affected by the devaluation of the Egyptian pound and the Nigerian naira.

Nigeria removes almost all frozen funds

At its peak in June 2023, Nigeria’s frozen funds reached US$850 million, significantly impacting the operations and finances of the country’s airlines.

Airlines faced difficulties repatriating US dollar-denominated revenues and the volume of frozen funds led some airlines to scale back operations, with one airline suspending services to Nigeria, severely impacting the country’s aviation industry.

IATA noted that 98% of these funds had been settled as of April 2024. It said the remaining outstanding $19 million was due to central banks currently reviewing outstanding forward claims submitted by commercial banks.

IATA applauds the efforts of Nigeria’s new government and the Central Bank of Nigeria to resolve this issue, which will “ensure that Nigerians and the entire economy benefit from reliable air connectivity where access to revenue is vital,” Walsh explained.

“We are on the right path and we call on the government to pay the remaining $19 million and continue to prioritise aviation,” he added.

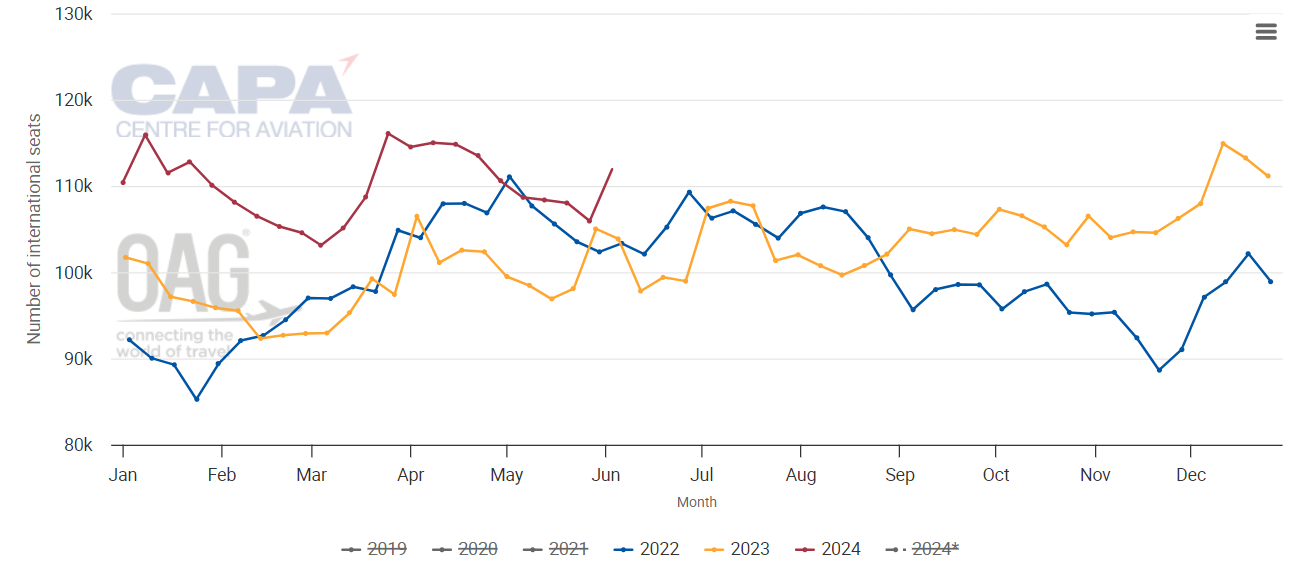

According to CAPA (Center for Aviation) and OAG data, the Nigerian market’s international capacity has shown an inconsistent profile, peaking at over six million seats in 2014 and 2015 before declining and approaching six million seats again in 2018 before falling again, continuing even before the COVID-19 pandemic.

It will surpass the 5 million seats mark again in 2022, before growing by just 2.4% in 2023, although strong performance in the first quarter of 2024 will see international capacity increase in 2024.

As of early June 2024, Ethiopian Airlines is the largest foreign airline serving Nigeria, surpassing Qatar Airways, British Airways and Turkish Airlines. While local carrier Air Peace is Nigeria’s largest international airline, foreign airlines account for 85.4% of the country’s external connections.

87% of frozen funds come from just eight countries

Following the unfreezing of high-profile freezes in Nigeria and Egypt, eight countries now account for 87% of the total frozen funds, or $1.6 billion out of a total of $1.8 billion. Also on the list are Algeria, Ethiopia, Lebanon, Eritrea and Zimbabwe, with the last two countries having held the funds for the longest time.

‘Serious’ freeze on funds in Pakistan and Bangladesh

IATA said the situation in Pakistan and Bangladesh had become “acute”, with airlines unable to repatriate $731 million in revenue earned in those markets – $411 million in Pakistan and $320 million in Bangladesh.

Walsh said Pakistan and Bangladesh “must immediately release” these frozen funds so airlines can “continue to serve vital air routes”.

In Bangladesh, the solution lies with the central bank, which IATA said must “prioritize the aviation industry’s access to foreign exchange” in accordance with international treaty obligations. In Pakistan, IATA said the solution is to find “an efficient alternative to the system of audits and tax exemption certificates” that cause long processing delays.

Foreign airlines account for similar levels of capacity in Pakistan and Bangladesh, accounting for 60.1% and 60.2% of international capacity respectively, according to CAPA (Center for Aviation) and OAG data for the first week of June 2024. Middle Eastern carriers Emirates, Qatar Airways, Air Arabia, Saudia and Flydubai are the largest foreign airlines in these markets.