Some investors rely on dividends to grow their wealth. If you’re also a dividend expert, you might want to know: High Trend Technology (Shanghai) Co., Ltd. (SHSE:688391) is about to go ex-dividend in the next three days. Typically, the ex-dividend date is one business day before the record date, which is the date on which the company determines which shareholders are eligible to receive dividends. It is important to note the ex-dividend date, as trades in the stock must be settled on or before the record date. That is, an investor can purchase Hi-Trend Technology (Shanghai) shares before May 14th in order to receive the dividend that will be paid on May 14th.

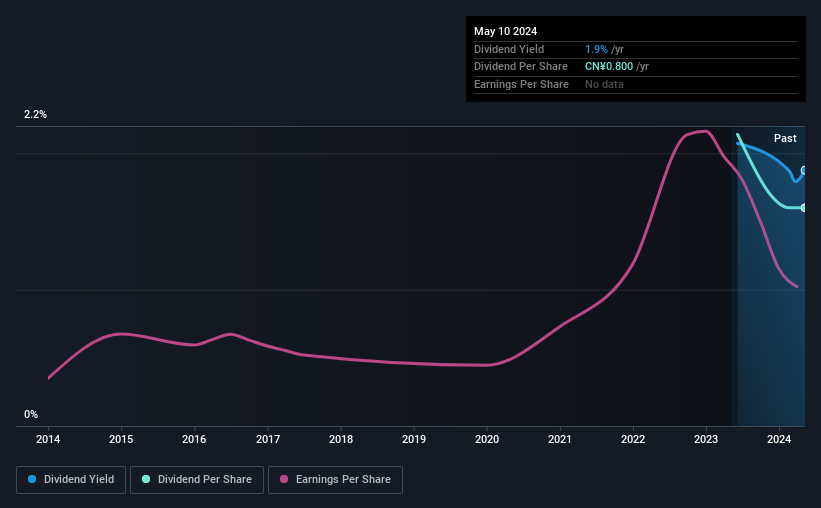

The company’s next dividend payment will be CA$0.80 per share, and in the last 12 months, the company paid a total of CA$0.80 per share. Calculating the last year’s worth of payments shows that High Trend Technology (Shanghai) has a yield of 1.9% on the current share price of CA$42.64. We love to see companies pay dividends, but it’s also important to make sure our golden goose doesn’t die by laying golden eggs. So we need to investigate whether Hi-Trend Technology (Shanghai) can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Hi-Trend Technology (Shanghai).

Dividends are usually paid out of a company’s profits. If a company pays more in dividends than it earned in profit, then the dividend might become unsustainable. Hi-Trend Technology (Shanghai) pays out 57% of its profit, which is a common payout level for most companies. However, cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if a company generated enough cash to pay its dividend. It paid out 86% of its free cash flow as dividends, which is within normal limits, but without growth the company’s ability to raise the dividend will be limited.

It’s reassuring to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don’t drop precipitously.

Click here to see how much profit Hi-Trend Technology (Shanghai) paid out in the last twelve months.

Are profits and dividends growing?

Stocks in companies that generate sustainable earnings growth often offer the best dividend prospects, since it’s easier to lift dividends when earnings are rising. If profits decline and the company is forced to cut its dividend, investors could see the value of their investments explode. We’re therefore pleased to see that Hi-Trend Technology (Shanghai)’s earnings per share have increased by 18% per year over the past five years. Despite strong results and rapidly growing earnings per share, the company paid out most of its profits as dividends last year. We’re surprised that management hasn’t chosen to increase reinvestment into the business to further accelerate growth.

Considering it’s only been one year since Hi-Trend Technology (Shanghai) paid a dividend, there’s not much past history to glean any insight from.

conclusion

Is Hi-Trend Technology (Shanghai) worth buying for its dividend? Generally speaking, as earnings per share increase, dividends from high-dividend stocks will increase over the long term. However, we also note that High Trend Technology (Shanghai) pays out more than half of its revenue and cash flow as profit, which could limit dividend growth if earnings growth slows. . In summary, Hi-Trend Technology (Shanghai) looks okay in this analysis, but it doesn’t seem like an outstanding opportunity.

With that in mind, the key to thorough stock research is to be aware of the risks currently facing a stock. According to our analysis, 1 warning sign for Hi-Trend Technology (Shanghai) You should be aware of this before purchasing any stocks.

Generally speaking, we don’t recommend just buying the first dividend stock you see.Here it is A curated list of interesting stocks with strong dividends.

Valuation is complex, but we help make it simple.

Please check it out High Trend Technology (Shanghai) Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.