Morsa Images/DigitalVision (via Getty Images)

Copper is the primary base metal traded on the London Metal Exchange’s futures market and the CME’s COMEX sector of the futures sector. It is also an economic bellwether of health and well-being. of the world economy. Copper prices tend to rise during economic expansions and fall during economic contractions.

The fundamental supply and demand equation for copper has changed in recent years as new demand growth is expected from tackling climate change. In March 2022, copper futures prices rose to a record level of $5.01 per pound, with copper futures prices reaching $10,845 per tonne. After adjustment, non-ferrous and precious metals such as copper are on an upward trend.

Ivanhoe Mining Co., Ltd. (OTCQX:IVPAF) is a Canadian company that mines, develops and explores base and precious metals primarily in Africa. IVPAF shares have been transferred It has increased 10 times since its March 2022 low.

Prices of precious metals and non-ferrous metals are rising

Ivanhoe Mines Ltd.’s company profile highlights its mining activities.

IVPAF company profile (In search of alpha)

Most metal prices have risen significantly from their 2020 pandemic lows.

- Gold: At $2,300, gold is 58.5% above its 2020 low of $1,450.90.

- Silver: Silver at $26.50, 125.7% above the 2020 low of $11.74.

- Copper: Copper is at $4.48, 117.5% above its 2020 low of $2.0595.

- Platinum: Platinum is $960, 70.8% higher than the 2020 low of $562.

- Palladium: At $930, palladium is 35.9% lower than its 2020 low of $1,449.90.

- Rhodium: Rhodium is priced at $4,900, 24.6% below its 2020 low of $6,500.

- Nickel: Nickel is $18,879, 73.8% higher than its 2020 low of $10,865.

- Lead: At $2,180, lead is 38.9% higher than its 2020 low of $1,570.

- Zinc: Zinc was $2,866, 61.7% higher than its 2020 low of $1,772.

- Germanium: Germanium is at $9,650, 47.3% higher than its 2020 low of $6,550.

With the exception of palladium and rhodium, Ivanhoe’s projected metal and mine prices are significantly higher than their 2020 lows.

Founded by a mining legend who is bullish on copper prices

Billionaire Robert Friedland founded Ivanhoe Mine and has a long history as the founder, CEO, and chairman of numerous mining companies. He was inducted into the Canadian Mining Hall of Fame in 2016 and the U.S. Mining Hall of Fame in 2021 for his lifetime outstanding achievements in the global mineral resources industry.

In January 2024, Friedland characterized the copper market as follows:The situation is extremely tight and we are currently in the red.” He also added about copper.It’s like a powder keg ready to explode as soon as the Fed cuts policy in the second half.”

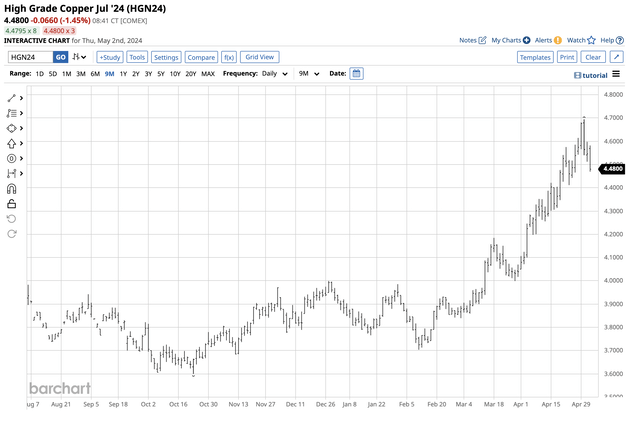

When Robert Friedland made his comments in January 2024, copper prices on the nearby COMEX were below $4 per pound.

COMEX Copper Futures 9 Month Chart (bar graph)

As the chart highlights, the July COMEX copper price ended 2023 at a level of $3.9270 per pound. The Fed has not yet cut short-term interest rates or halted its quantitative tightening program, but as of May 2, copper prices were more than 14% higher at $4.48 per pound. Goldman Sachs considers copper to benew oil,”, predicting that prices could rise above $15,000 per tonne and above $6.80 per pound in the ongoing COMEX copper futures contract. Robert Friedland pointed out that a price of $15,000 per tonne is needed to encourage new mines.

Impressive Element Grade – Challenging Mining Exposure

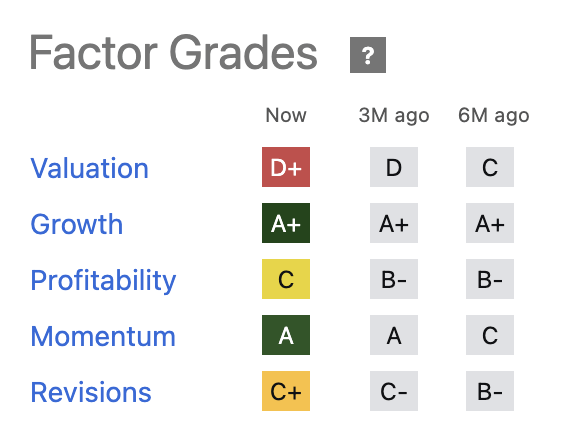

Friedland’s IVPAF passes most Seeking Alpha Factor Grades.

IVPAF factor grade (In search of alpha)

In Q4 2023, IVPAF reported 2.0 cents, missing EPS estimates by 6.0 cents. The market had expected the company to report EPS of 6.0 cents for the first quarter ending April 30, 2024, which was roughly in line with expectations.

One of IVPAF’s challenges is its mining interests in the Democratic Republic of Congo. Although the current government is concerned about conflicts in the eastern provinces, the Democratic Republic of Congo remains a difficult environment for business investment.according to privacy shield:

The unstable political and security situation continues to have a negative impact on the economy, creating a difficult environment for foreign investors despite the Democratic Republic of Congo’s vast natural resources.

Meanwhile, mining companies operating in the Democratic Republic of Congo, including Glencore, have been routinely implicated in corruption scandals over the past few years. Furthermore, China is one of the world’s leading metal consumers and has close ties with the Democratic Republic of Congo. The alliance between China and Russia and the polarization of the world’s nuclear powers after 2022 could pose challenges for Western mining companies with interests in the Democratic Republic of the Congo.

IVPAF stock has been bullish since March 2020 lows

IVPAF stock is also trending higher as most metal prices have risen significantly from their 2020 lows.

5 year IVPAF chart (bar graph)

This chart shows a more than 10x increase from $1.35 in March 2020 to the most recent high of $15.10 on April 29, 2024. IVPAF stock was above the $13.50 level in early May.

Mining stocks influence metal prices

Mining and exploration companies invest millions of dollars to identify and extract commodity reserves from the earth’s crust. Successful mining generates leveraged returns for companies and their shareholders.

At $13.53 per share, Ivanhoe Mines’ market capitalization was $16.95 billion. On average, approximately 484,000 shares are traded each day. Mining legend Robert Friedland is the company’s founder, executive officer, co-chairman, and non-independent director. His co-chairman is Weibao Hao, who is also vice chairman and general manager of the Chinese company CITIC Metal Group Co Ltd. IVPAF’s relationship with CITIC could protect his investments in the DRC.

Here are the factors driving IVPAF stock’s high price.

- Stock prices are on the rise, and trends are always on your side in any market.

- Metal prices are rising, supporting stock prices.

- IVPAF’s ties to China put the mining company in an enviable position in the Democratic Republic of Congo.

If Robert Friedland’s prediction comes true and copper prices rise to the $15,000 per tonne level, IVPAF stock is poised to follow suit. This could provide shareholders with leveraged returns that outperform copper’s upward trajectory in red metals and other commodities. This optimistic outlook highlights the potential for high investment returns on IVPAF stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.