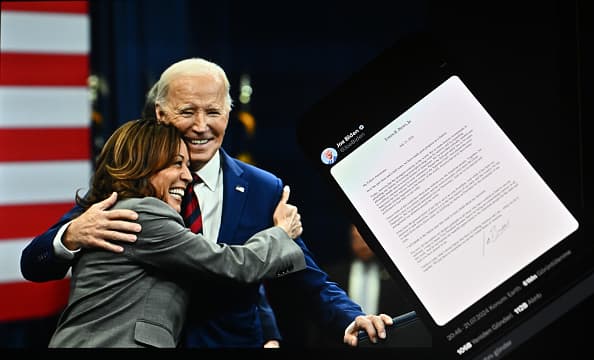

A letter from U.S. President Joe Biden announcing his withdrawal from the race is displayed on a cellphone screen in front of a computer screen showing a photo of President Biden and U.S. Vice President Kamala Harris, in Ankara, Turkey, July 21, 2024.

Anadolu | Anadolu | Getty Images

Trump trade refers to trading in stocks that are expected to profit if the former president returns to the White House.

CNBC previously reported that Wall Street sees a Trump victory as a positive for the stock market, given the Republican candidate’s platform of lower taxes and deregulation. Traders, in turn, expect green energy stocks to be hurt by Trump’s proposed tariffs, which some economists say could lead to higher inflation.

Asian markets were mostly lower on Monday morning, the first region to resume normal trading following Biden’s announcement.

Michael Brown, senior research strategist at Australia-based brokerage Pepperstone, told CNBC the withdrawal was all but expected given the growing pressure from Democrats and his “disastrous performance in the debates.”

Brown said he expects volatility to increase across asset classes given the uncertainty surrounding the presidential election and the fact that the race for the White House is now fairly open. He expects the U.S. dollar to weaken as some of the “Trump trade” unwinds, adding that he believes the chances of a Democratic victory have slightly increased.

He also said he expects stocks to fall in the short term, but that the decline should be viewed as a medium-term buying opportunity, given that the Federal Reserve is expected to continue cutting interest rates and that economic and profit growth are both strong.The U.S. is due to release second-quarter personal consumption expenditures figures on Thursday, the Fed’s preferred inflation gauge.

Quantum Strategies president David Roche wrote in a memo early Monday that Harris is likely to win the Democratic nomination, noting that “replacing Harris at this point would create further confusion and raise a number of questions about existing funding for the Biden-Harris joint candidacy.”

But Roche said that while Harris’ nomination would increase Trump’s chances of winning, it would decrease Republicans’ chances of winning both the House and the Senate.

In contrast, Charles Myers, founder and CEO of the consulting firm Signum Global Policy, took a different stance on Harris’ potential nomination.

Myers told CNBC’s “Squawk Box Asia” that Harris’ emergence as the front-runner for the Democratic nomination has created a “whole new race.”

“We have a new candidate who has a lot of unity and enthusiasm. She’s going to be a big driver for women, young people and black voters. I think people are going to underestimate her,” he added.

Harris has already made history as the first woman and first Black person to serve as vice president, and if she wins the Democratic nomination she will become just the second woman to run for president, following Hillary Clinton in 2016.

“I think it’s a little early for the markets to declare Trump the winner. I think she’s going to take him seriously,” Myers said.

Like Pepperstone’s Brown, Myers added that the “Trump trade” is risky, at least in the short term.

Meyers said Harris will likely have her running mate selected by the time the Democratic National Convention begins on August 19, and predicted she would “win the nomination with a bang” and overtake Trump in the polls.

“We’ve seen some pretty strong performances in a lot of stocks and asset classes that have been linked to a Trump victory, but assuming Trump is going to cruise to victory this far and with the election campaign in complete disarray, I would be very cautious and a little cautious.”