Over the past 12 months, market headlines have been dominated by technology, AI, and bull market news. It’s no secret that the explosive growth of AI has driven the rise of technology stocks on the market, but its success has led to the question: is this just a bubble?

That question may be answered soon, with early earnings numbers from companies including Alphabet, Texas Instruments and Seagate all showing positive results. Now, equity analysts at Deutsche Bank are keeping a close eye on two other big tech companies with upcoming earnings releases that could provide further insight into the direction of the market.

Microsoft (NASDAQ:MSFT) and Advanced Micro Devices (NASDAQ:AMD) are well-known leaders in their respective fields, the tech ecosystem, and the stock market at large, and both companies are inextricably linked to the AI boom.

But Deutsche Bank sees the two companies heading in different directions going forward. Let’s take a closer look at both companies and see which tech giants analysts have picked as the best tech stocks to buy ahead of earnings.

Microsoft

Starting with Microsoft, the technology blue chip has leveraged its widespread presence, dominance in the PC market, and strong brand power to become one of the largest publicly traded companies on Wall Street. Over the past year, Microsoft’s market capitalization has topped $3 trillion, tying it for the top spot with Apple.

Microsoft has used its scale and resources to successfully adapt to the new world of technology. The company was an early investor in AI, particularly generative AI, as a backer of OpenAI, the creator of ChatGPT. Microsoft’s cumulative investment in OpenAI has reached nearly $10 billion.

The investment has enabled Microsoft to integrate generative AI into its Bing search engine, one of the company’s several high-profile AI initiatives. By adding AI to its platform, Bing aims to make the search engine more user-friendly and intuitive, improve the quality of search results and make Bing more competitive against market-leading Google.

Additionally, Microsoft is integrating AI technologies into its Azure cloud computing platform, another AI move that puts Microsoft in fierce competition with Google and Amazon. Azure is a direct competitor to both Google Cloud and AWS. Microsoft’s cloud platform offers subscribers access to a package that includes more than 200 software tools and applications, and Microsoft is enhancing many of these with AI. From a user perspective, AI integration makes Azure a more powerful and flexible platform.

Finally, in one of Microsoft’s most public uses of AI technology, the company is using AI in Windows and Office software updates. The company has already released Copilot, an online assistant that uses AI technology to provide real-time user assistance, offering advice based on users’ work history and content creation history.

All of this adds up to an impressive portfolio of AI and cloud computing services, brought together on the foundation of Microsoft’s proven success — and the success of these businesses translates into robust revenue and profits.

Microsoft reported revenue of $61.9 billion in the third quarter of 2024, its final quarter of the year, up 17% from the same period last year and beating expectations by $1.01 billion. Net income was $2.94 per share, beating expectations by 11 cents per share.

Looking ahead, Microsoft is scheduled to report its fourth-quarter 2024 financial results on July 30, with analysts expecting revenue of $64.4 billion and earnings per share of $2.93.

This will be a strong quarter, and this expectation caught the attention of Deutsche Bank analyst Brad Zelnick, who wrote: “We expect another solid quarter, driven by sustained Azure momentum (both AI and non-AI workloads), with moderate upside potential in each of the three segments. With shares trading in line with Mag 7 averages for CY25 EPS and FCF, valuation remains reasonable, though not cheap, and in the near term Microsoft is one of the few tech companies reaping tangible benefits from its enterprise GenAI investments.”

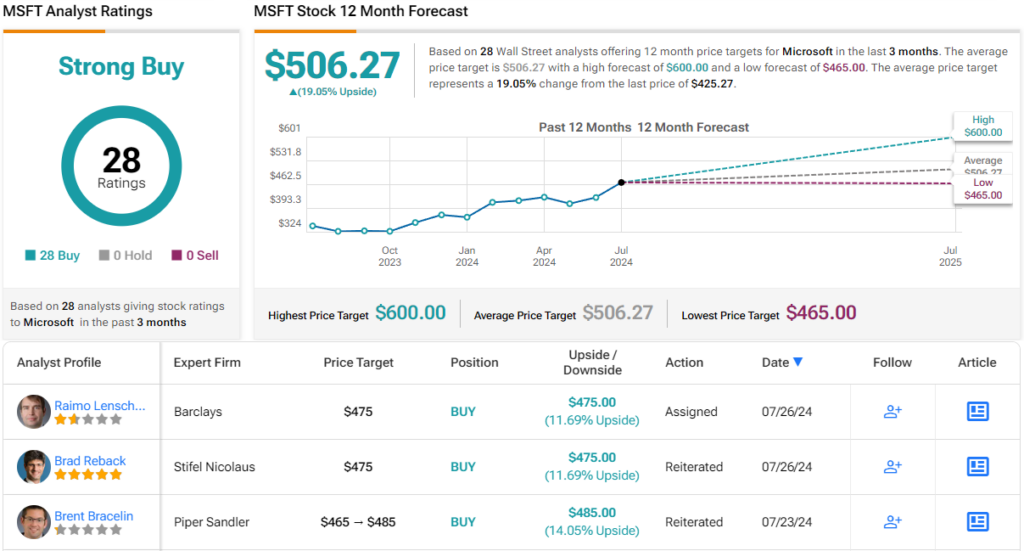

These comments support Zelnick’s buy rating on MSFT, and his $475 price target suggests room for upside of about 12% over the next 12 months. (To watch Zelnick’s track record, click here)

Overall, the Strong Buy consensus rating on Microsoft is unanimous, based on 28 recent positive analyst reviews of the stock. The company’s shares are trading at $425.27, and the average target price of $506.27 suggests an upside of 19% over the next 12 months. MSFT Stock Price Prediction)

Advanced Micro Devices (AMD)

The second stock we’ll look at is AMD, one of the world’s leading semiconductor chip companies. While not as large as the industry-leading multi-trillion dollar company Nvidia, AMD still boasts a respectable market cap of $226 billion, making it the sixth largest semiconductor manufacturer in the world.

AMD’s rise to the top 10 semiconductor companies is due to solid engineering, superior development, and strong marketing. The company is known for its successful line of high-end chipsets that have found acceptance among data center providers, generative AI application developers, and high-performance computing. These are all cutting-edge segments of the technology world, and AMD has grown alongside them by providing the high-quality, high-volume processors and other chips needed to power them.

The company’s new products are driving customer demand, especially in the areas of high-performance computing and generative AI. These applications require faster and higher-capacity chips, and AMD has risen to the challenge. The company’s MI300 and Ryzen series chips have already proven successful, and new lines such as the EPYC 4004 series and Instinct Accelerators are also on the market. AMD’s products are used by major PC manufacturers such as Dell and Lenovo, and Supermicro, an industry leader in high-performance computing, is also a major AMD customer.

For the first quarter of this year, AMD reported modest growth in total revenue to $5.47 billion, $20 million above expectations and up 2.2% year over year. The company’s non-GAAP EPS was 62 cents, beating expectations by 1 cent. The company’s results were buoyed by record revenue in its Data Center division, which grew 80% year over year to $2.3 billion.

When the company reports its second-quarter 2024 financial results on July 30, analysts expect quarterly revenue of $5.72 billion and non-GAAP earnings of 68 cents per share.

Deutsche Bank’s Ross Seymour is positive about AMD’s progress in AI technology, but he advises potential investors to exercise caution.

“To date, investors have largely ignored cyclical weakness across the company’s non-AI accelerator businesses (server CPUs, client, gaming and embedded) in favor of incremental improvements in AI… Overall, we applaud AMD for rapidly ramping up viable AI-related accelerators to compete in the AI era, and we believe a cyclical trough is near for many of the company’s non-AI businesses. However, with the stock trading near our $150 target price, we believe the stock is well valued at current levels,” Seymour explained.

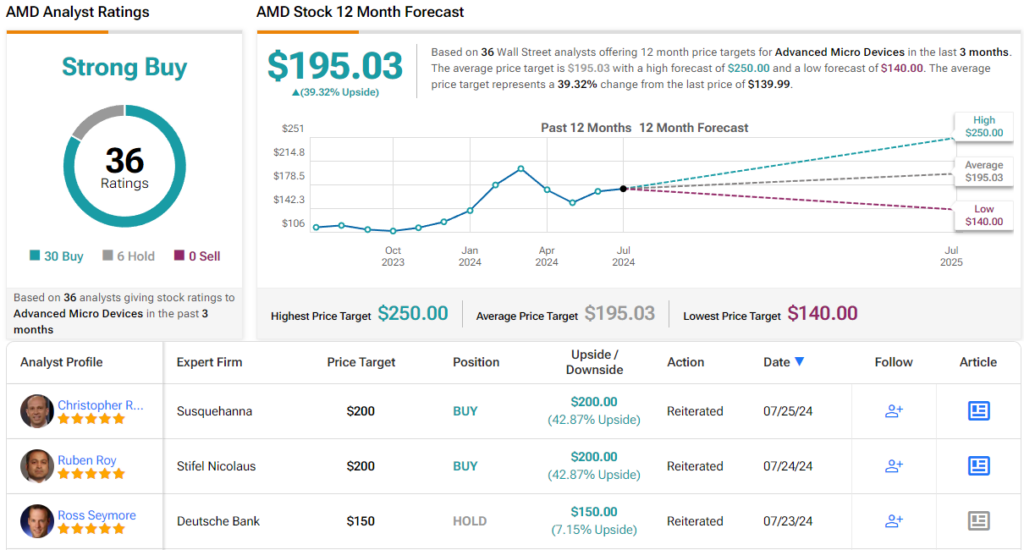

For this reason, Seymour rates AMD shares a Hold (i.e. Neutral), but his $150 price target suggests AMD will rise 7% over the next 12 months. (To watch Seymour’s track record, click here)

The Street is more bullish overall. AMD has received 36 recent analyst reviews, including 30 buys and 6 holds, for a consensus rating of “strong buy.” The average target price for the stock is $195.03, implying a 39% one-year upside. AMD Stock Price Prediction)

After considering these stocks, the data, and analyst commentary, Deutsche Bank’s conclusion is clear: Microsoft is a great tech stock to buy if investors want to take advantage of upcoming earnings releases.

To find great ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, our tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is for informational purposes only. It is extremely important that you conduct your own analysis before making any investment.