According to TrendForce’s latest report, spot prices of DRAM and NAND flash memory are not expected to rise anytime soon for two reasons. First, there is ample inventory in the market. Second, the Chinese government’s recent measures against smuggling of refurbished DRAM have further impacted DRAM prices.

In the DRAM market, spot prices, as opposed to contract prices, continue to decline. This is due to excess inventory levels at module houses that tend to buy DRAM in the spot market. Weakness in the consumer products market is also contributing to the price decline. Hardware manufacturers do not need more memory than they already have, so they are not buying in the spot market.

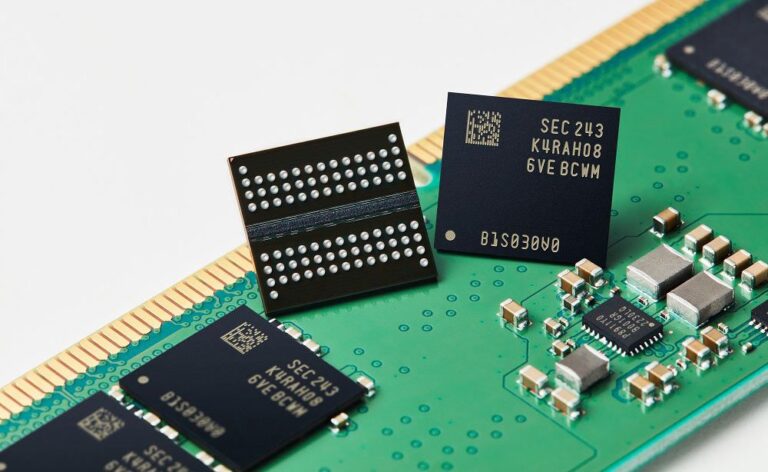

Another major factor in the decline was a crackdown on smuggling in the Chinese market, which further depressed the price of reballed DRAM chips. Reballing is a technique for repairing DRAM chips by replacing the solder balls on the back of the chip that connect it to the circuit board. In many cases, this makes the chip work again, but such chips are not as reliable as new DRAM.

Returning to pricing, since the end of May, the average spot price for a DDR4 1Gx8 2666MT/s chip has fallen 2.54%, dropping from $1.881 to $1.835 in the past week alone. The drop may not seem large, but it is consistent.

Similarly, the spot NAND flash market is trading weakly due to ample inventory levels at SSD makers (including those producing the world’s best SSDs), preventing demand recovery despite price cuts by spot suppliers. This has led to a continued disconnect between spot and contract prices, as well as uncertainty over potential demand for inventory replenishment in Q3 2024. Notably, spot prices for 512Gb 3D TLC NAND wafers fell 0.57% this week to $3.309.

In general, both the DRAM and NAND flash sport memory markets are facing significant challenges in terms of pricing due to weak demand, and TrendForce does not expect prices to recover in the near term due to market forces and external pressures such as government crackdowns.

Earlier this week, we reported that Kioxia plans to stop cutting back on its 3D NAND memory production and increase production, potentially increasing its market share. This move alone could have a significant impact on 3D NAND supply and prices.