By Jesslyn Lahr

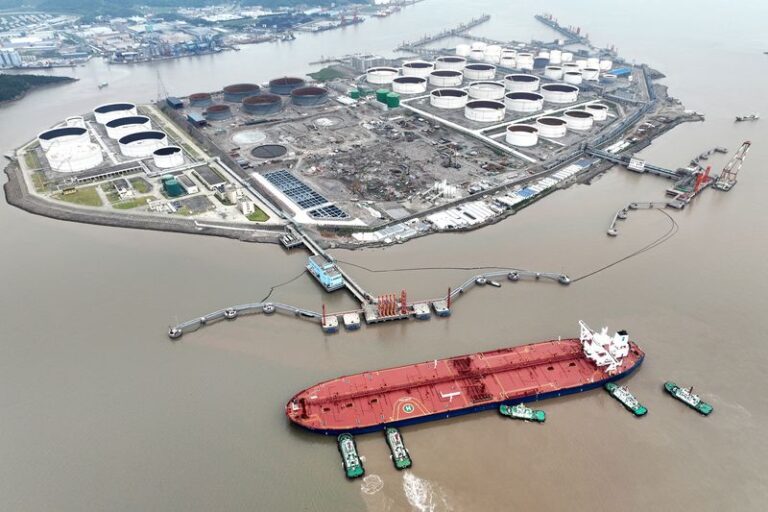

SINGAPORE (Reuters) – Oil prices fell on Tuesday, extending a day earlier’s losses on concerns about demand in China, the world’s biggest importer, while markets downplayed the risk of an escalation in conflict in the Middle East.

Brent crude futures were down 40 cents, or 0.5 percent, at $79.38 a barrel as of 0640 GMT. U.S. crude futures were down 43 cents, or 0.6 percent, at $75.38 a barrel.

Markets have been rattled by a string of disappointing economic news coming out of China recently. A Reuters survey on Monday showed that Chinese manufacturing activity is expected to contract for a third straight month in July.

Citi also cut its growth forecast for China to 4.8 percent from 5 percent on Monday, noting that economic activity slowed further in July after second-quarter growth fell short of analysts’ expectations.

“We see further downside to the market in the near term due to continued weakness in domestic demand from China and the possibility that some OPEC+ countries will restore production in the fourth quarter,” Emril Jamil, senior analyst at LSEG Oil Research, said, referring to the Organization of the Petroleum Exporting Countries (OPEC) and its allies led by Russia.

“Tariff tensions with Europe and the United States will also have an impact on China’s oil demand going forward,” Jamil said.

Markets are closely watching a meeting of China’s top decision-making body, the Politburo, expected to take place this week, which could elicit further economic policy support.

However, hopes are limited as the third major policy meeting in mid-July largely reiterated existing economic policy goals and failed to boost market sentiment.

Oil prices fell 2% in yesterday’s trading after Israel indicated its response to a Hezbollah rocket attack on the Israeli-occupied Golan Heights on Saturday would be calculated to avoid plunging the Middle East into all-out war.

The pressure was intensified by U.S. diplomatic pressure to limit Israel’s response and prevent it from attacking the Lebanese capital, Beirut, or key civilian infrastructure in retaliation, Reuters reported on Monday.

In Venezuela, the opposition announced it had won 73% of the vote, even as national electoral authorities declared incumbent President Nicolas Maduro the winner of the election, granting him a third term in office.

“The victory of Nicolas Maduro in Venezuela’s latest elections is a headwind for global supplies as it could lead to tougher US sanctions,” ANZ analysts said in a note, estimating Venezuelan exports would fall by 100,000 to 120,000 barrels per day.

Protesters gathered in towns and cities across Venezuela on Monday as Washington and other governments questioned the election results and demanded a full count of the vote.

(Reporting by Colleen How in Beijing and Jesslyn Lell in Singapore; Editing by Sonali Paul)