Palantir Technologies (NYSE: PLTR) The company went public in 2020, which has contributed significantly to business growth and financial improvement. The data analytics company has launched its artificial intelligence (AI)-driven platform, AIP, which promises to unlock further growth opportunities for the business in the long term.

The company is now profitable and is a popular AI and technology stock for retail investors to buy. Under CEO Alex Karp, the company has seen impressive growth. And in the latest shareholder letter, there was one statistic that caught my attention: it shows just how much the company has grown over the course of a decade.

Quarterly profits exceed full-year revenues from a decade ago.

In his quarterly letter to shareholders, Karp summed up the business’s impressive growth over the past decade: “We are currently generating more profit in one quarter than we generated in one year a little over a decade ago.”

This is an impressive feat, because to achieve it, the business must not only experience significant growth over several years, but also generate high profit margins along the way. Of course, 10 years ago, this business would have been much smaller, so the bar might not have been as high. But it’s still a remarkable achievement, especially for a technology company that wasn’t profitable just a few years ago.

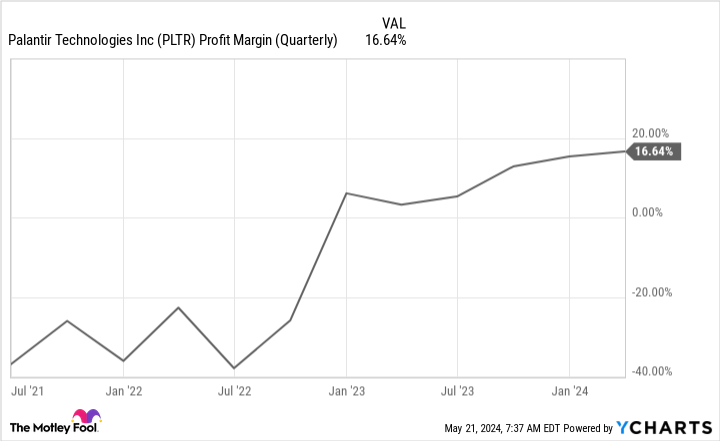

Palantir reported profits of $105.6 million in the last quarter, covering the first three months of the year. Not only was this an impressive 17% margin, but it was also the company’s sixth consecutive quarter of profitability. The company is no longer struggling with profitability, and its margins have grown over the past year.

Palantir’s sales growth has been impressive.

A big reason for Palantir’s success and strong revenue is that the company’s business is booming with sales growth in both the commercial and government sectors. Through its new platform, AIP, Palantir is finding use cases for AI in the enterprise, and commercial is set to see even greater growth in the future. Last quarter, government revenue grew 16% year over year, while commercial revenue grew 27%, outpacing overall growth of 21%.

However, as the company has grown so rapidly, its actual year-over-year growth rate has started to slow. What’s impressive, however, is that it still maintains a high growth rate of over 20%.

If Palantir continues to experience this kind of strong growth, it bodes well for the company’s valuation to remain fairly high. The company’s future growth will undoubtedly depend on demand for AIPs, which Palantir maintains are still strong. In his shareholder letter, Karp said the company plans to expand the reach of AIPs, making them more available to companies not only in the U.S. but also abroad, including government and academic institutions.

With more growth expected in the future, Palantir’s business could continue to expand, but its growth rate may slow versus stronger peers. The company expects revenue of $649 million to $653 million for the current quarter, which at the midpoint would represent year-over-year growth of just over 22%.

Is Palantir stock worth buying now?

Palantir shares are set to soar more than 230% since 2023 after a tough year that saw them fall 65% in 2022. Tech stocks have seen a resurgence last year, driven mainly by the growing popularity of ChatGPT, making Palantir one of the hottest stocks of recent times. But its valuation of 65 times estimated future earnings may be too high for many investors.

However, if you plan to hold the stock for the very long term (10+ years), it may be worth buying now given the long-term potential for the business to expand even further in the future. However, because Palantir’s stock price is so high, and significant growth is likely already priced into the current valuation, investors may be better off considering other growth stocks instead.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now: Palantir Technologies was not included. The 10 stocks selected could generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $652,342.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of May 13, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

1 Impressive statistics showing how much Palantir’s business has grown in a decade were originally published by The Motley Fool.