ICMC 2025 underscores regional integration, Islamic finance innovation and women’s inclusion in capital market reform

KARACHI:

Pakistan Stock Exchange (PSX) CEO Farrukh H Sabzwari highlighted the Pakistan-China cross-border Exchange-Traded Fund (ETF) initiative as one of the most promising developments in the country’s capital market.

“These agreements will enable us to take the next step toward the joint launch of cross-border ETFs,” he said, noting that groundwork for the collaboration had already been laid.

Speaking at the International Capital Market Conference (ICMC 2025), held under the theme “Regional Integration and Innovation in Capital Markets,” Sabzwari said the initiative will link PSX with Chinese exchanges, allowing investors in both countries to trade selected shares through a single regulated product.

The partnership will open Pakistan’s market to more global investors while giving locals easier access to Chinese equities. It allows exposure to foreign firms without overseas accounts and boosts market liquidity and inflows.

Read: IMF staff deal reached, investment-led growth now priority

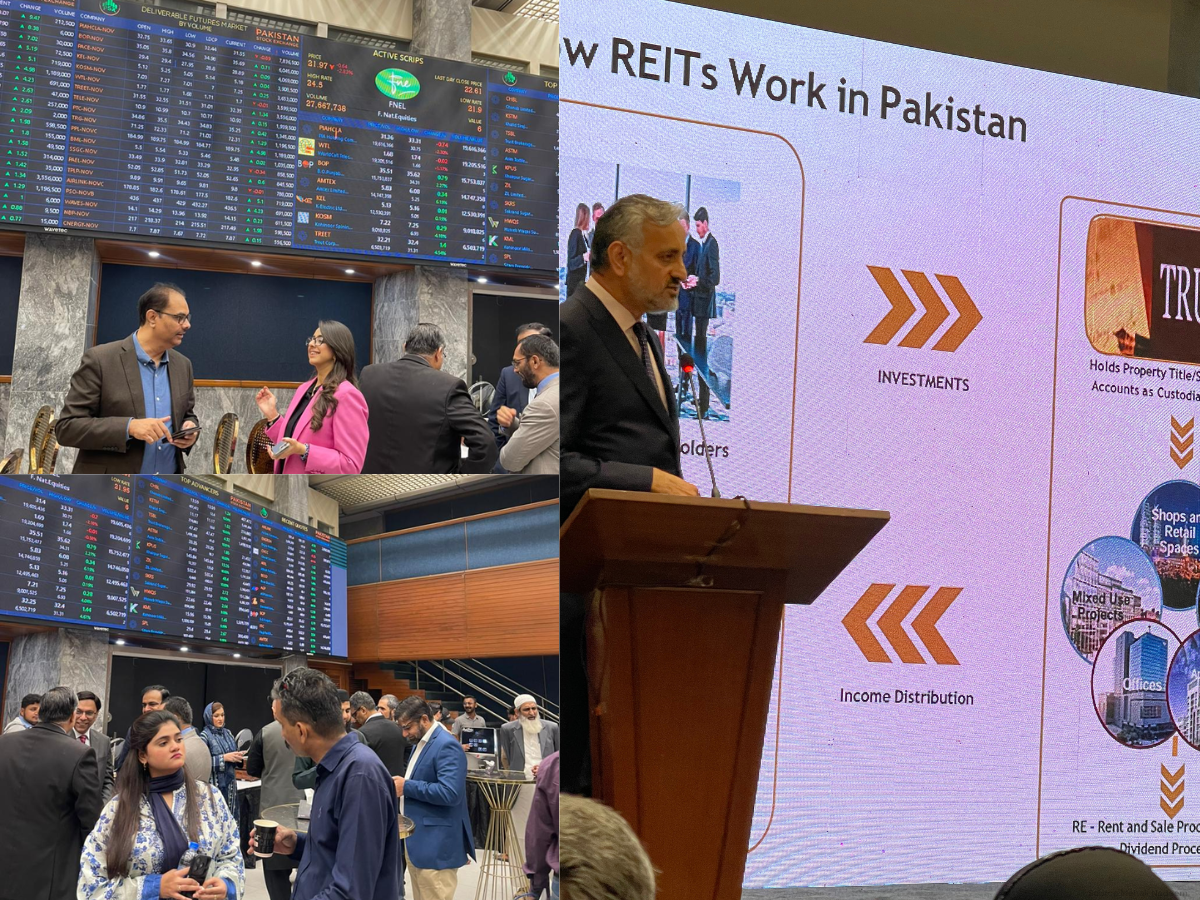

Organised by the Securities and Exchange Commission of Pakistan (SECP) in collaboration PSX and other institutions, ICMC 2025 brought together regulators, investors, and financial leaders to discuss regional cooperation, digitisation, and Islamic finance. Delegates from China, Bangladesh, Iran, the US, and Azerbaijan attended in person, while others joined virtually.

Azerbaijan’s delegation, including its largest bank ABB (International Bank of Azerbaijan), shared experience in fixed-income and stock markets and highlighted retail participation. Their model for corporate and government bonds was presented as a reference for Pakistan.

Speakers from Hong Kong’s Securities and Futures Commission discussed virtual asset governance and fintech oversight, showcasing Hong Kong’s regulatory model. Panels on equity and debt markets stressed expanding Global Depository Shares, ETFs, and derivatives to attract investors and deepen liquidity.

A key segment focused on Islamic finance. Dr Irum Saba of IBA’s Centre for Excellence in Islamic Finance said Islamic banking should complement conventional finance. She cited Singapore’s mosque-based self-financing model and Akhuwat’s interest-free microfinance as examples of socially driven systems.

Meezan Bank’s Farhanul Haq Usmani called for legislation distinguishing Sukuk and Mudarabah from conventional instruments. Speakers also flagged delays in updating Shariah-compliant company lists, which create uncertainty for ethical investors.

Shariah-compliant path

A major segment of the conference centered on Islamic finance. Dr Irum Saba, Director of the IBA Centre for Excellence in Islamic Finance, said Islamic banking should complement, not compete with, conventional finance.

“I have seen land allotted in Singapore for a mosque, with the basement used for shops and small businesses so that it can be self-financing,” she said, describing a model that blends social and financial inclusion.

She cited Singapore’s mosque-based revenue model and Akhuwat’s interest-free microfinance system as examples of how social finance can promote self-sustainability and poverty alleviation rather than profit alone.

Read More: SBP injects Rs3.21tr liquidity

Participants also pointed out delays in updating Shariah-compliant company lists, which create uncertainty for investors managing ethical portfolios. Timely disclosure, they said, is crucial to maintaining market confidence.

Iran’s Shariah Committee Secretary, Dr Majid Pouyanmehr, urged collaboration between SECP and the State Bank to introduce short-term Sukuk and Islamic commercial papers as liquidity tools. Pakistan Mercantile Exchange CEO Khurram Zafar cited Iran’s experience with futures and called for updated laws to enable Shariah-compliant instruments.

Iranian scholar Ayatollah Dr Gholamreza Mesbahi Moghaddam said ethical finance is the foundation of sustainable growth. Speakers on Tijarat Sukuk stressed that only tangible assets can back leasing-based Sukuk, advocating Pakistan-Iran cooperation to expand trade-based Islamic bonds.

Women take the stage in capital markets

One important aspect of the conference was women’s inclusion in finance, particularly capital markets, as most board members and speakers were men. Zeinab Riazat, Board Member of Iran’s Securities and Exchange Organization, said she initially hesitated to visit Pakistan but was encouraged by its hospitality and professionalism.

“I came here with reservations, but I’m leaving with a changed perspective,” she said. “We need more women on these platforms—our voices must be heard.”

Mother industry

Arif Habib Dolmen REIT CEO Muhammad Ejaz said Real Estate Investment Trusts (REITs) could formalise Pakistan’s vast informal real estate sector, valued at PKR 100 trillion. He urged policy reforms to make it accessible and tax-efficient.

He called real estate the “mother industry” linking construction, services, and finance but said it continues to lag in civic infrastructure. REITs, he noted, offer a transparent and regulated model that allows investors to pool funds into property portfolios and earn dividend-like returns.

Ejaz listed barriers including an unfavorable tax regime, fragmented regulation, restricted financing, and low investor awareness. Section 99A of the Income Tax Ordinance, designed to facilitate REITs, “has not been effectively implemented,” he added, noting that unregulated players still dominate the sector.

Despite these challenges, Ejaz said institutional interest is rising, particularly in Shariah-compliant REITs. “With acute housing demand and the need for formal financing, REITs can drive urban development, create jobs, and generate tax revenue if the policy environment improves,” he said.

Digitization and market reform

SECP Chairman Farrukh Sabzwari reviewed market activity in Pakistan after years of limited public listings, urging renewed focus on the country’s competitive advantages.

He noted that, at the international level, the key question is, “What is a country’s competitive edge?” Pakistan needs a clearly defined advantage, he said, citing China as an example of a nation that successfully leveraged the unique strengths of its IT sector.

He further added that one thing worth mentioning is that Pakistan is not far behind. He also praised the Pakistan Stock Exchange’s (PSX) IT team for strengthening the exchange’s systems.

Also Read: Understanding Takaful from the Islamic perspective

Speakers discussed Environmental, Social, and Governance (ESG) standards and Green Sukuk—Islamic bonds that finance renewable energy and sustainability-linked projects—as key tools for responsible investment.

They noted that company size matters less than ESG participation. Pakistan is working with the London Stock Exchange to align with international ESG disclosure standards.

The ICMC Expo 2025, held alongside the conference, featured exhibitors from banks, brokerage houses, asset management firms, fintech startups, and insurance companies.

Speakers agreed that ethical finance, Shariah compliance, and regional collaboration are central to Pakistan’s market reform. They reaffirmed that Pakistan’s markets cannot grow in isolation and must strengthen regional linkages to attract long-term investment and ensure stability.