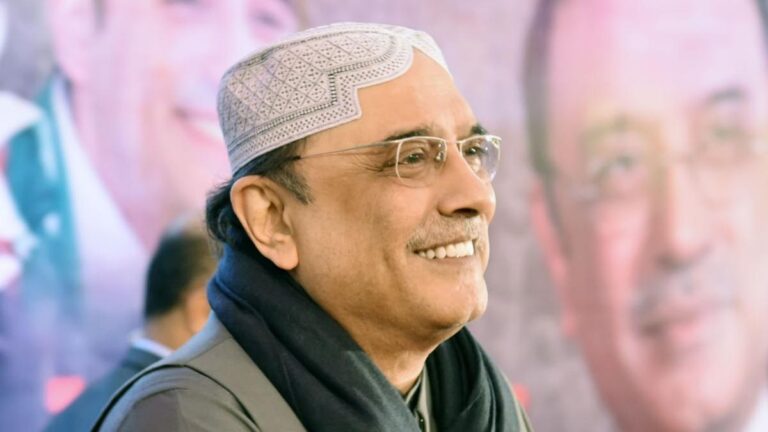

Pakistan President Asif Ali Zardari | Photo Credit: PTI

Pakistan President Asif Ali Zardari on June 30 approved the government’s heavily taxed Finance Bill 2024, which was heavily criticised by the opposition as an IMF-driven document and detrimental to the people in the new financial year, according to media reports.

Finance Minister Muhammad Aurangzeb presented the budget in parliament on June 12 but drew sharp criticism from opposition parties, particularly the Pakistan Tehreek-e-Insaf (PTI), led by jailed former prime minister Imran Khan, and the Pakistan People’s Party, which is in the ruling coalition led by former foreign minister Bilawal Bhutto Zardari.

On June 28, parliament passed Pakistan’s Rs18.877 trillion budget for 2024-25, detailing government expenditure and revenues.

The opposition, led by members of parliament backed by the now-imprisoned former prime minister, Khan, rejected the budget as highly inflationary.

During the parliamentary session, opposition lawmakers criticized the budget, claiming that it was now an open secret that the document was dictated by the International Monetary Fund (IMF). Opposition Leader Omar Ayub Khan denounced the budget as “economic terrorism against the people.”

The PPP, which had boycotted the debate on the initial budget earlier this week, has now decided to vote in favour of the Finance Bill despite having certain reservations.

Parliament passed the budget with several amendments on Friday. Ahead of the motion, the Opposition made fiery speeches, describing the budget as unrealistic, anti-people, anti-industry and anti-farmer, according to a report in the Dawn newspaper.

President Zardari on Sunday gave his assent to the bill under Article 75 of the Constitution, the Presidency Media Cell reported, adding that the bill will come into effect from July 1. Under Article 75(1), the President has no power to veto or challenge a Finance Bill, which is deemed a Finance Bill under the Constitution.

The government on June 28 announced new tax measures in several sectors as well as expanding tax exemptions in certain areas to generate additional revenue in the coming fiscal year to meet International Monetary Fund standards.

Pakistan is reportedly in talks with the IMF for a loan of between $6 billion and $8 billion, and earlier this week Prime Minister Shehbaz confirmed that the budget had been prepared in coordination with the IMF.

The proposed changes include the introduction of a capital value tax on real estate in Islamabad, implementing new tax measures for builders and developers, and increasing the Petroleum Development Lease (PDL) on diesel and gasoline to PKR 10 instead of the initially proposed PKR 20.

According to the budget document, total revenue is estimated at PKR 17,815 billion, which includes tax revenue of PKR 12,970 billion and non-tax revenue of PKR 4,845 billion.

The provinces’ share in federal revenue will be 7,438 billion Pakistani rupees. The growth target for the next fiscal year has been set at 3.6%. Inflation is expected to be 12%, fiscal deficit 5.9% of GDP and primary surplus 1% of GDP.