Pakistan’s parliament on Friday moved to pass a finance bill that would impose heavy taxes for the government’s next fiscal year, ahead of further talks on a new IMF bailout to avert a debt default in South Asia’s slowest-growing country.

The government presented a budget proposal for tax increases two weeks ago, drawing harsh criticism from the opposition.

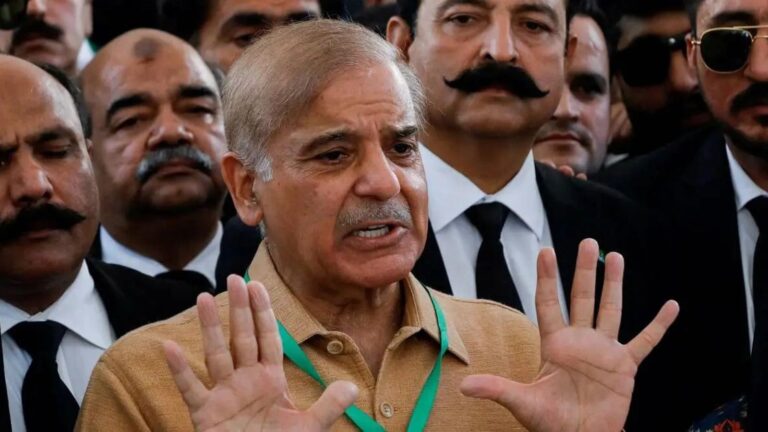

Finance Minister Muhammad Aurangzeb introduced the Finance Bill in Parliament, which was opened for amendments and discussion by the ruling coalition led by Prime Minister Shehbaz Sharif and the Opposition.

Speaker Sardar Ayaz Sadiq announced the introduction of the bill on live television.

In a draft national budget tabled on June 12, policymakers set a tax revenue target for the year starting July 1 at 13 trillion rupees ($46.66 billion), about 40 percent higher than this fiscal year, to shore up the case for a new bailout deal with the International Monetary Fund.

Pakistan is in negotiations with the IMF for a loan of $6-8 billion.

The increased tax revenue targets represent a 48 percent increase in direct taxes and a 35 percent increase in indirect taxes compared to the revised estimates for this fiscal year. Non-tax revenues, including petroleum taxes, are expected to rise by a staggering 64 percent.

In addition to raising tax rates on real estate capital gains, taxes on textile and leather products and mobile phones will also be increased to 18%.

Workers will also face additional direct taxes on their income.

The opposition, mainly lawmakers backed by jailed former prime minister Imran Khan, rejected the budget, saying it would be highly inflationary.

Pakistan projects a sharp decline in its fiscal deficit to 5.9 percent of gross domestic product (GDP) in the new fiscal year, from an upwardly revised estimate of 7.4 percent for the current fiscal year.

The State Bank of Pakistan also warned of the possible inflationary effect of the budget, saying increased revenues would have to be funded through higher taxes due to limited progress on structural reforms to broaden the tax base.

The growth target for next year has been set at 3.6%, with inflation forecast at 12%.

First uploaded: 28 Jun 2024 17:11 IST