The country has witnessed an increase in electricity generation installed capacity during the ongoing financial year 2024-25, placing an additional burden on consumers.

The capacity payments have been a result of an increase in electricity generation installed capacity, which touched 46000 MW. The consumers have been paying Rs 2.5 to Rs 2.8 trillion every year, which they pay to idle plants that have not been producing a single unit.

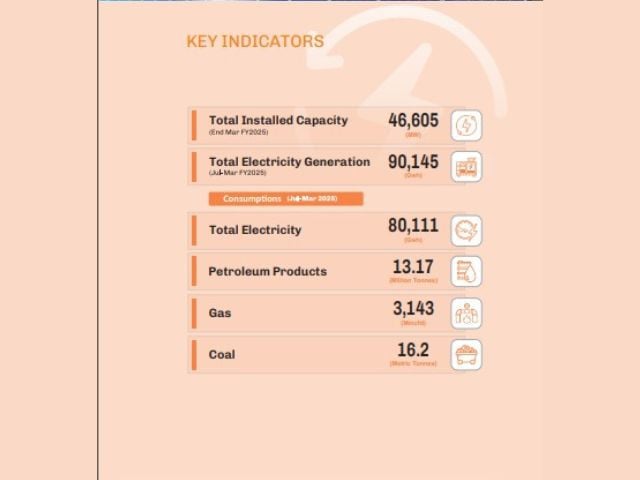

According to the Economic Survey 2024-25 released here on Monday, as of July–March FY2025, Pakistan’s total installed electricity generation capacity stood at 46,605 MW, reflecting a 1.6 percent increase compared to 45,888 MW recorded during the corresponding period of FY2024.

The government said that this increase is primarily attributed to the addition of 2,813 MW through net metering.

However, the Government of Pakistan terminated Power Purchase Agreements (PPAs) with several Independent Power Producers (IPPs)—notably HUB Power, Lalpir Power, Pakgen Power, Rousch Power, Saba Power, and Atlas Power—effective October 1, 2024.

The percentage shares of generation capacity by source were: hydel (24.4%), nuclear (7.8%), renewable (12.2%), and thermal (55.7%).

Although thermal power remains the dominant source, its share has declined in recent years, indicating an increasing reliance on indigenous energy sources.

Out of the total electricity generation of 90,145 GWh, the combined share of hydel, nuclear, and renewable sources stood at 53.7 percent, highlighting a significant shift towards more sustainable and environmentally friendly alternatives.

The energy sector remains a pivotal driver of Pakistan’s economic and industrial development, influencing productivity, trade competitiveness, and quality of life.

During the first nine months of FY2025 (July–March), Pakistan continued to face challenges in energy affordability, sustainability, and security.

Nonetheless, key reforms, capacity enhancements, and a shifting energy mix signaled gradual progress toward a more resilient and diversified energy landscape.

As of March 2025, total installed electricity generation capacity was 46,605 MW, reflecting a continued shift toward cleaner energy sources. Hydel, nuclear, and renewable sources collectively accounted for 44.3 percent of installed capacity—an improvement from previous years—while thermal power’s share declined to 55.7 percent. In terms of electricity generation, Pakistan produced 90,145 GWh during July–March FY2025, with 53.7 percent generated from hydel, nuclear, and renewable sources.

This transition reflects a positive move toward indigenous and environmentally friendly energy sources.

Sectoral consumption patterns show the household sector remained the largest consumer, accounting for nearly half of the country’s electricity usage. PPIB continued to play a critical role in enabling private sector participation in power generation and transmission.

During the review period, key milestones were achieved, including the operationalization of the 884 MW Suki Kinari Hydropower Project, along with ongoing progress on new solar, wind, and bagasse-based projects.

As of March 2025, PPIB had facilitated 88 operational IPPs with a cumulative capacity of 20,726 MW. The government’s focus on renewable and indigenous energy is evident from the project pipeline, 84 percent of which comprises clean energy initiatives.

In the petroleum sector, domestic production remained constrained, maintaining a high reliance on imports.

However, stable international oil prices helped moderate the energy import bill compared to the previous year.

Domestic refining capacity utilization remained suboptimal, though efforts to attract investment in refinery upgrades and new capacity continued.

On the natural gas front, the depletion of indigenous reserves remains a major concern. With no major discoveries, Pakistan increasingly relied on LNG imports to meet domestic demand, especially in the power and industrial sectors. In response, initiatives are underway to improve energy efficiency and expand LNG supply chain infrastructure.

Coal continues to play a significant role, especially through Thar coal-based power projects. The indigenization of coal energy is being actively pursued, with several Thar-based plants contributing to the national grid.

Nonetheless, environmental concerns and the need for clean technology adoption remain key policy considerations.