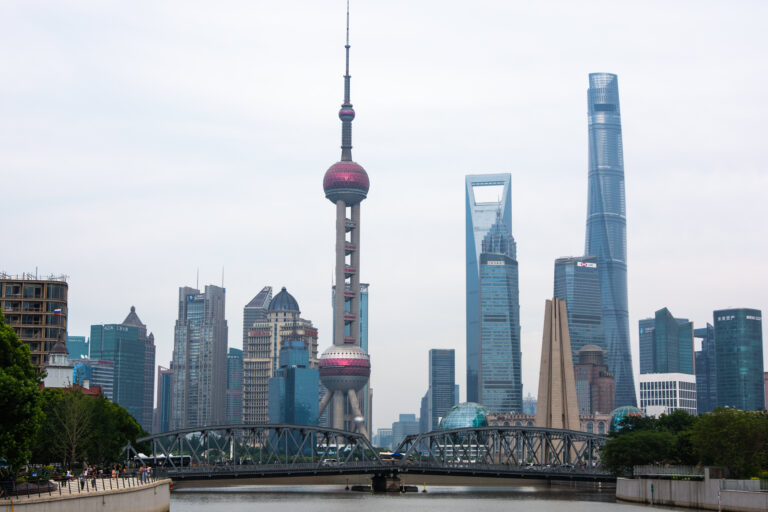

Skyscrapers are seen along the Suzhou River in Shanghai, China on July 5, 2023.

Ying Tan | NurPhoto | Getty Images

Asia-Pacific markets were across the board lower on Monday as investors focused on key economic data coming out of China.

China, the world’s second-largest economy, is due to release figures for retail sales, industrial production and urban unemployment for May.

Meanwhile, the People’s Bank of China kept its one-year medium-term lending rate for 182 billion yuan ($25.09 billion) of loans unchanged at 2.5 percent, as expected.

The PBOC also injected 4 billion yuan through seven-day reverse repo operations and kept the seven-day interest rate unchanged at 1.8 percent.

| Ticker | company | name | price | change | %change |

|---|---|---|---|---|---|

| .N225 | Nikkei Stock Average | Nikkei | 38,104.07 | -710.49 | -1.83% |

| .HSI | Hang Seng Index | HSI | 17,993.30 | +51.52 | +0.29% |

| .AXJO | S&P/ASX 200 | ASX 200 | 7,710.20 | -14.10 | -0.18% |

| .SSEC | Shanghai | Shanghai | 3,021.99 | -10.65 | -0.35% |

| .KS11 | KOSPI Index | Korea Composite Stock Price Index | 2,752.85 | -5.57 | -0.20% |

| .FTFCNBCA | CNBC 100 Asia IDX | CNBC 100 | 9,673.78 | -50.46 | -0.52% |

Hong Kong’s Hang Seng Index fell 0.34% after the MLF announcement, while mainland China’s CSI 300 lost 0.45%.

Japan’s Nikkei stock average fell 2% at the open, led by energy and real estate stocks, while the Topix also fell 1.71%.

South Korea’s KOSPI fell 0.23%, while the small-cap index rose 0.17%, making it the only index in positive territory.

Australia’s S&P/ASX 200 fell 0.1% as traders prepare for the Reserve Bank of Australia’s interest rate decision on Tuesday.

In U.S. markets on Friday, the Nasdaq Composite Index rose 0.12%, recording its fifth consecutive day of gains, while the S&P 500 fell 0.04%, ending its four-day winning streak.

The Dow Jones Industrial Average fell 0.15%, marking its fourth consecutive day of declines.

—CNBC’s Lisa Kailai Han and Brian Evans contributed to this report.