(Bloomberg) — China has taken its most extreme steps yet to restrict short selling and quantitative trading strategies to shore up its sagging stock market as a closely watched economic policy meeting approaches.

Most read articles on Bloomberg

The China Securities Regulatory Commission approved raising margin requirements for short selling from July 22, which will raise the cost of short selling for hedge funds and other investors. Meanwhile, China Securities Finance Corp., China’s largest stock lender, will stop lending securities to brokerages from July 11.

The move, announced late Wednesday after the benchmark CSI 300 index fell for the sixth time in seven sessions, sent a clear signal that authorities want to halt a downturn that has wiped out about $1 trillion in domestic market value since mid-May. While that’s provided a knee-jerk boost to sentiment — Chinese stocks rose on Thursday — the long-term impact may be limited given the limited role of short sellers in China.

Chinese authorities, along with those in South Korea and Thailand, have been the most aggressive in Asia in restricting short selling and quantitative trading strategies aimed at boosting stock prices. But the measures have done little to address the underlying causes of China’s market slump, including lingering concerns about a housing crisis, resurgent trade tensions and waning consumer confidence.

“The move sends another signal that regulators are concerned about risks to the securities industry, given the potential for concentrated short selling,” said Redmond Wong, market strategist at Saxo Capital Markets. “We may see a rise in prices for some stocks with large short positions and difficulty finding borrowing. The overall impact on the market is likely to be limited.”

The CSI 300 index rose more than 1%, looking to halt its weekly decline.The Hang Seng China Enterprises Index, which tracks large Chinese companies, rose 1.6% in Hong Kong.

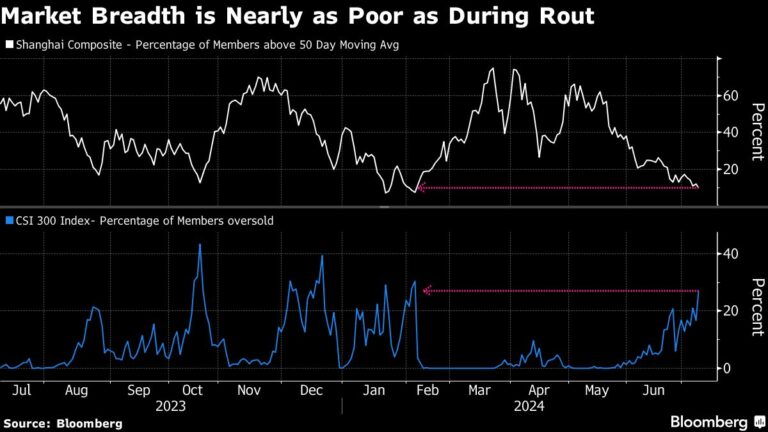

Chinese stocks have been falling since May after soaring since February amid growing fears about sluggish corporate earnings. The CSI 300 has given up almost all of its gains this year, while the MSCI China Index entered a technical correction earlier. There are signs that China’s sovereign wealth fund is once again supporting the market through purchases of exchange-traded funds.

President Xi Jinping will convene the once-every-five-years Third Plenum of the Central Committee of the Communist Party of China on July 15. Expectations for a major stimulus package are low, and analysts from Goldman Sachs Group Inc. to JPMorgan Chase & Co. have said the Chinese government will probably just sell off existing measures.

Regulators said Wednesday that the new rules will require investors to deposit margin equal to 100% of the value of the securities they want to borrow for short sales. Before the change, the ratio was at least 80%. Margin requirements for private funds participating in stock lending have also been raised to at least 120%, up from 100%.

“In the short term, it will encourage the unwinding of existing short positions and limit the initiation of new short selling activity,” said Steven Leung, executive director at UOB Kay Hian Hong Kong. In the medium term, “the A-share market will still be driven by economic fundamentals and corporate earnings,” he said.

The CSRC’s latest move is in line with other measures the regulator has taken since Wu Qing took over as chairman. In February, the agency said quantitative funds would be scrutinized and new entrants would have to report their strategies to regulators before trading. Beijing has also expanded reporting for offshore investors through trading links between mainland China and Hong Kong.

The regulator said the market needed to strengthen daily supervision and take other adjustment measures in a timely manner. These changes would be “conducive to preventing risks and safeguarding the stable and orderly development of the market,” it said.

Regulators are also now considering charging for extra traffic in high-frequency quantitative trading, but noted that the number of HFT accounts in China has fallen by more than 20% so far this year to around 1,600 accounts.

China had already seen a sharp decline in short selling following a ban on some stock lending in February, with the balance of short selling transactions and securities lending falling by 64% and 75%, respectively, since August 2023, according to authorities.

Short selling accounts for just 0.05% of the market’s total value, according to the China Securities Regulatory Commission.Outstanding securities lending has halved since the end of 2023 to 31.8 billion yuan ($4.4 billion) as of Tuesday, according to data compiled by Bloomberg.

Of this, 29.6 billion yuan was raised through shares offered by China Securities Finance Corp, according to Huachuang Securities.

“While this may boost sentiment to some extent, it will impact long-short strategies through higher securities borrowing costs, reduced efficiency and weaker outperformance,” the analysts, including Xu Kang, wrote in a note.

–With assistance from Jing Jin, Charlotte Yang, and Foster Wong.

(Adds market reaction in third and sixth paragraphs. Details of short trade in 15th paragraph)

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP