-

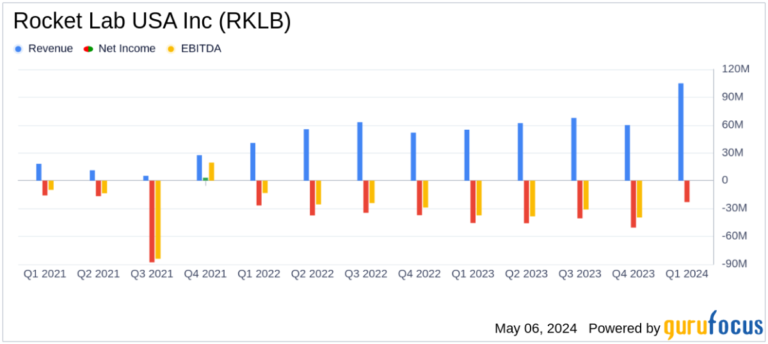

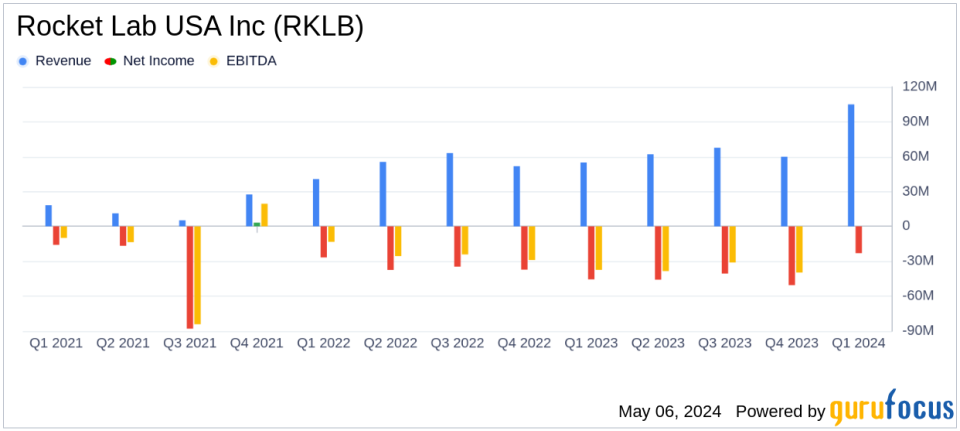

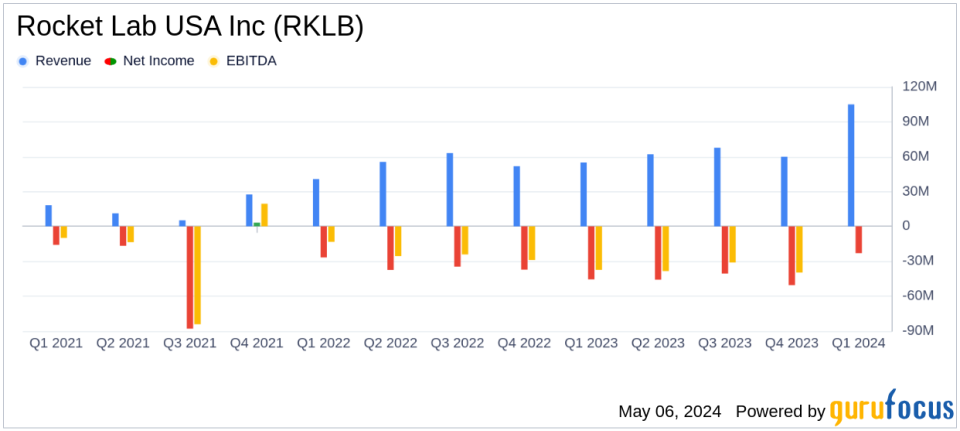

Revenue: It was reported to be $92.77 million, an increase of 69% year-on-year, and below expectations of $94.99 million.

-

Net loss: The company posted a loss of $44.26 million, an improvement from $45.62 million a year ago and above its estimated net loss of $50.1 million.

-

Earnings per share (EPS): The company reported a loss of $0.09 per share, which exceeded expectations of a loss of $0.11 per share.

-

Gross profit: Achieved gross profit of $24.17 million, with gross margin increasing from 12% to 26% year over year.

-

Operating expenses: Total operating expenses were $67.25 million, an increase from $52.37 million in the prior year, reflecting continued investment in research and development.

-

Cash position: Cash and cash equivalents ended the quarter at $365.93 million, a significant increase from $162.52 million at the end of the previous year.

-

Guidance for Q2 2024: Revenues are expected to be between $105 million and $110 million, with GAAP gross margins of 24% to 26%.

Rocket Lab USA Inc (NASDAQ:RKLB) announced its first quarter financial results on May 6, 2024, reporting strong year-over-year revenue growth of 69% and subsequent quarterly growth of 55%. I showed it. Details of the company’s earnings were disclosed in an 8-K filing. Rocket Lab, a prominent aerospace company, reported first-quarter revenue of $92.77 million, beating analyst expectations of $94.99 million. However, its net loss widened to $44.26 million from $45.61 million a year ago, resulting in a loss per share of $0.09, slightly above expectations of $0.11.

About Rocket Lab USA Inc.

Rocket Lab is involved in the aerospace sector and provides comprehensive space mission services including the design, manufacture, and launch of rockets and spacecraft. The company operates primarily through its Launch Services and Space Systems segment, with the majority of its operations in the United States, and its services worldwide, including in Japan and Germany. Rocket Lab’s notable products include Electron and Neutron rockets and Photon satellite platforms, serving diverse customers across the civil, defense, and commercial sectors.

Quarterly performance highlights

In the first quarter, Rocket Lab successfully executed four Electron missions, strengthening its position as the second most frequently launched rocket in the United States. The company also won significant contracts after the quarter, including a nearly $50 million contract with the U.S. Space Force Space Systems Command. These contracts highlight Rocket Labs’ capabilities and reliability in delivering critical national security payloads.

In the space systems sector, Rocket Lab made significant progress with a $515 million contract with the Space Development Agency, marking a significant step in its constellation-building program. This includes completing preliminary designs for 18 spacecraft. The company also reported progress on its Neutron rocket development, including completing initial assembly of the Archimedes engine and preparing for a test campaign in Mississippi.

Financial status and future outlook

Rocket Lab ended the quarter with a backlog of more than $1 billion, indicating solid future earnings. The company expects second quarter 2024 sales to be between $105 million and $110 million. Gross margins are expected to be 24% to 26% on a GAAP basis and 30% to 32% on a non-GAAP basis. However, the company expects next quarter’s adjusted EBITDA to be a loss of $25 million, up from his $23 million.

The balance sheet remains strong with cash and cash equivalents of $365.93 million, a significant increase from $162.52 million at the end of 2023. This financial stability is critical as Rocket Lab continues to invest in growth initiatives and capital-intensive projects.

Strategic development and market position

Rocket Labs’ strategic developments, particularly the expansion of its Neutron rocket program and launch capabilities, position the company well for future growth. Successful test milestones and infrastructure development at the launch site highlight our commitment to strengthening our service offering and market reach.

Overall, Rocket Labs’ Q1 2024 results reflect a solid start to the year with solid revenue growth and strategic progress, despite the challenge of widening net losses. The company’s ongoing projects and future revenue outlook suggest a positive trajectory, supported by a strong order backlog and continued market demand for aerospace and defense solutions.

For more information, see Rocket Lab USA Inc’s full 8-K earnings release here.

This article first appeared on GuruFocus.