When you want to find potential multi-baggers, there are often underlying trends that can give you clues. First, you want to identify stocks that are growing. return Return on Invested Capital (ROCE) and in parallel, base 20% of invested capital, which indicates a company that is reinvesting profits at a growing rate of return. Royal Caribbean Cruises We’ve taken a look at (NYSE:RCL) and its ROCE trend and really like it.

What is Return on Invested Capital (ROCE)?

For those who don’t know, ROCE is the ratio of a company’s annual pre-tax profit (revenue) to the capital employed in the business. The formula for calculating this metric for Royal Caribbean Cruises is:

Return on Invested Capital = Earnings Before Interest and Taxes (EBIT) ÷ (Total Assets – Current Liabilities)

0.13 = $3.4 billion ÷ ($35 billion – $9.9 billion) (Based on the trailing 12 months ending March 2024).

So, Royal Caribbean Cruises’ ROCE is 13%. In absolute terms, this is a satisfactory return, but compared to the hospitality industry average of 10%, it is far better.

Read our latest analysis for Royal Caribbean Cruises

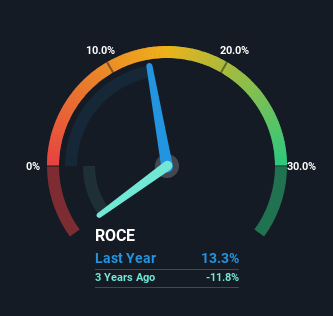

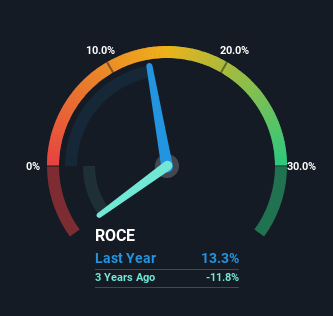

Above you can see how Royal Caribbean Cruises’ current ROCE compares to its prior returns on capital, but the history can only tell you so much, and if you want to see what analysts are predicting going forward you can check out this free analyst report on Royal Caribbean Cruises.

What are the trends in returns?

Investors will be pleased with where Royal Caribbean Cruises is at. Over the past five years, return on invested capital has increased significantly to 13%. Essentially, the business is increasing its profitability per dollar of invested capital, and on top of that, invested capital has also grown by 23%. This could indicate ample opportunity to invest capital internally, and at ever higher rates than ever before, a common combination for multi-baggers.

Conclusion

In summary, it’s great to see Royal Caribbean Cruises being able to generate compound interest by continually reinvesting capital and increasing rates of return, as these are some of the key ingredients of a highly popular multi-bagger. And with a respectable 41% return for those who have held shares over the past five years, it’s fair to say these developments are starting to get the attention they deserve. That said, we still believe the company has promising fundamentals and is worth doing some further due diligence on.

One more thing: we Two Warning Signs There’s bound to be at least one thing that’s a bit unsettling about a Royal Caribbean cruise, but understanding these will definitely help.

While Royal Caribbean Cruises isn’t currently the most profitable company, we’ve compiled a list of companies that are currently earning a return on equity of 25% or more. Check it out here. free I’ll list them here.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com