KARACHI:

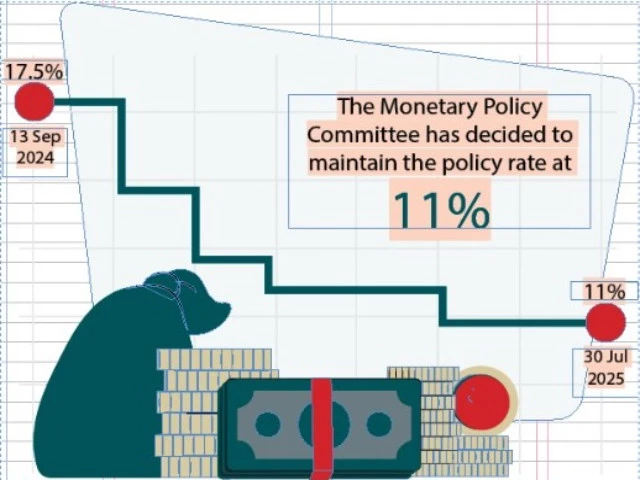

Despite apparent economic recovery and stable headline inflation, the Monetary Policy Committee (MPC) decided to maintain the policy rate at 11%, which reflects persistent and emerging vulnerabilities across Pakistan’s macroeconomic landscape.

SBP Governor Jameel Ahmad, conducting a press conference, admitted that the inflation outlook has deteriorated due to steep gas tariff hikes and looming energy adjustments, while external sector pressures are mounting from a widening trade deficit, slowing remittance growth, and fragile export performance. At the same time, fiscal vulnerabilities persist, as the Federal Board of Revenue (FBR) once again fell short of revenue targets, and ambitious consolidation goals for FY26 hinge on politically difficult reforms. Liquidity management remains a challenge amid rising reserve money growth and currency-in-circulation, while global uncertainties — including volatile commodity prices and uncertain trade dynamics — compound domestic risks.

The Committee reiterated its view that “without structural reforms, it would be difficult to achieve higher growth on a sustainable basis.”

Headline inflation decelerated to 3.2% year-on-year in June 2025, primarily driven by easing food prices, while core inflation also declined slightly to 7.6%. However, this relief appears short-lived as the MPC flagged a deteriorating inflation outlook due to a significant and higher-than-anticipated upward adjustment in gas tariffs, along with the phasing out of temporary electricity subsidies and the recent increase in motor fuel prices. With these developments, inflation in FY26 is now expected to hover within the 5-7% range, with potential breaches above the upper bound in certain months.

The economic recovery, though visible, comes with a new set of trade-offs. High-frequency indicators, including automobile sales, fertiliser offtake, and imports of intermediate goods, signal improving business activity. This revival has begun to reflect in large-scale manufacturing (LSM) data, which showed year-on-year growth in both April and May 2025 following five consecutive months of contraction. As a result, real GDP growth is projected to pick up to a range of 3.25-4.25% in FY26 from a provisional 2.7% in FY25. Encouragingly, agriculture is also expected to recover, supported by better water availability and improved crop prospects. Yet, flood-related risks and global economic headwinds remain persistent downside threats.

One of the most pressing concerns highlighted by the MPC is the deteriorating external balance outlook. Although the current account posted a $328 million surplus in June, bringing the cumulative surplus for FY25 to $2.1 billion (0.5% of GDP), this position is unlikely to be sustained. A widening trade deficit is anticipated in FY26 due to higher import demand amid stronger domestic activity, a slowdown in global demand, and unfavourable export prices, especially for key items like rice.

Compounding this is the projected moderation in workers’ remittance growth, owing to a high base effect and adjustments in the incentive structure. While the recent improvement in the sovereign credit rating is expected to encourage private inflows, the current account balance is projected to slip into a deficit of up to 1% of GDP, even under a stable remittance and financing outlook. FX reserves, which crossed $14 billion in June, are projected to rise further to $15.5 billion by end-December 2025, but highly sensitive to inflows and external shocks.

On the fiscal front, while the government achieved improvement in both primary and overall balances in FY25, driven by strong growth in tax and non-tax revenues, FBR still missed its revised revenue target by Rs200 billion, collecting Rs11.7 trillion. This shortfall occurred despite a healthy 26% growth in tax collection, underscoring the difficulty of mobilising sustainable revenues. Looking ahead, the government aims to achieve a primary surplus of 2.4% of GDP in FY26. However, this target appears ambitious and heavily contingent on effective revenue measures and expenditure rationalisation. The MPC warned that continued fiscal consolidation is essential to safeguard recent macroeconomic gains.

The monetary and credit landscape has also shifted. Broad money (M2) growth accelerated to 14% year-on-year by July 11, up from 12.6% at the previous MPC meeting, largely due to an increase in the Net Foreign Assets (NFA) of the banking system. Private sector credit growth also rose to 12.8%, with broad-based lending across sectors such as textiles, telecommunications, and wholesale and retail trade. Yet, the currency-to-deposit ratio, which had declined in June, increased again in July, prompting the SBP to inject massive liquidity to stabilise the interbank overnight repo rate. This intervention led to an uptick in reserve money growth, posing challenges for monetary management.