Semiconductor Business Intelligence recently published a differing view on China’s plans for Taiwan and TSMC. There have been numerous predictions of what would happen if China were to invade Taiwan, with most theories predicting that Taiwan or the US would destroy TSMC’s factories, preventing China from owning what is arguably the most important factory in the world. However, semiconductor analyst Klaus Asholm takes the opposite view: What if China’s strategy for dealing with TSMC’s presence in Taiwan is to simply destroy it?

“What if China is not deterred by potentially mined TSMC factories or ASML kill switches? What if their reunification plans are based on the eradication of TSMC factories and the semiconductor supply chain in Taiwan and beyond?” Asholm wondered in the blog.

It’s no secret that the Chinese Communist Party (CCP) has ambitions to control Taiwan as part of China, but many in the tech world believe that plans are somewhat tempered by threats of destruction to TSMC and the People’s Liberation Army (PLA) if they fail to seize the facility at the start of an invasion.

Many of the world’s advanced semiconductors come from Taiwan, so a regional conflict would affect chip supplies. TSMC and its advanced chip factories are considered a strategic resource for the United States and its allies, and the U.S. Secretary of Commerce has said the U.S. would be devastated if China were to seize the company. The U.S. has even been said to be prepared to personally bomb TSMC facilities in the event of a Chinese invasion, and the company has added a remote self-destruct capability to its EUV machines.

Washington has imposed some sanctions to thwart Beijing’s semiconductor ambitions, but even as China’s hardware development has slowed, Chinese tech companies have managed to achieve some innovations, allowing them to pursue increasingly advanced technologies while separating themselves from the West.

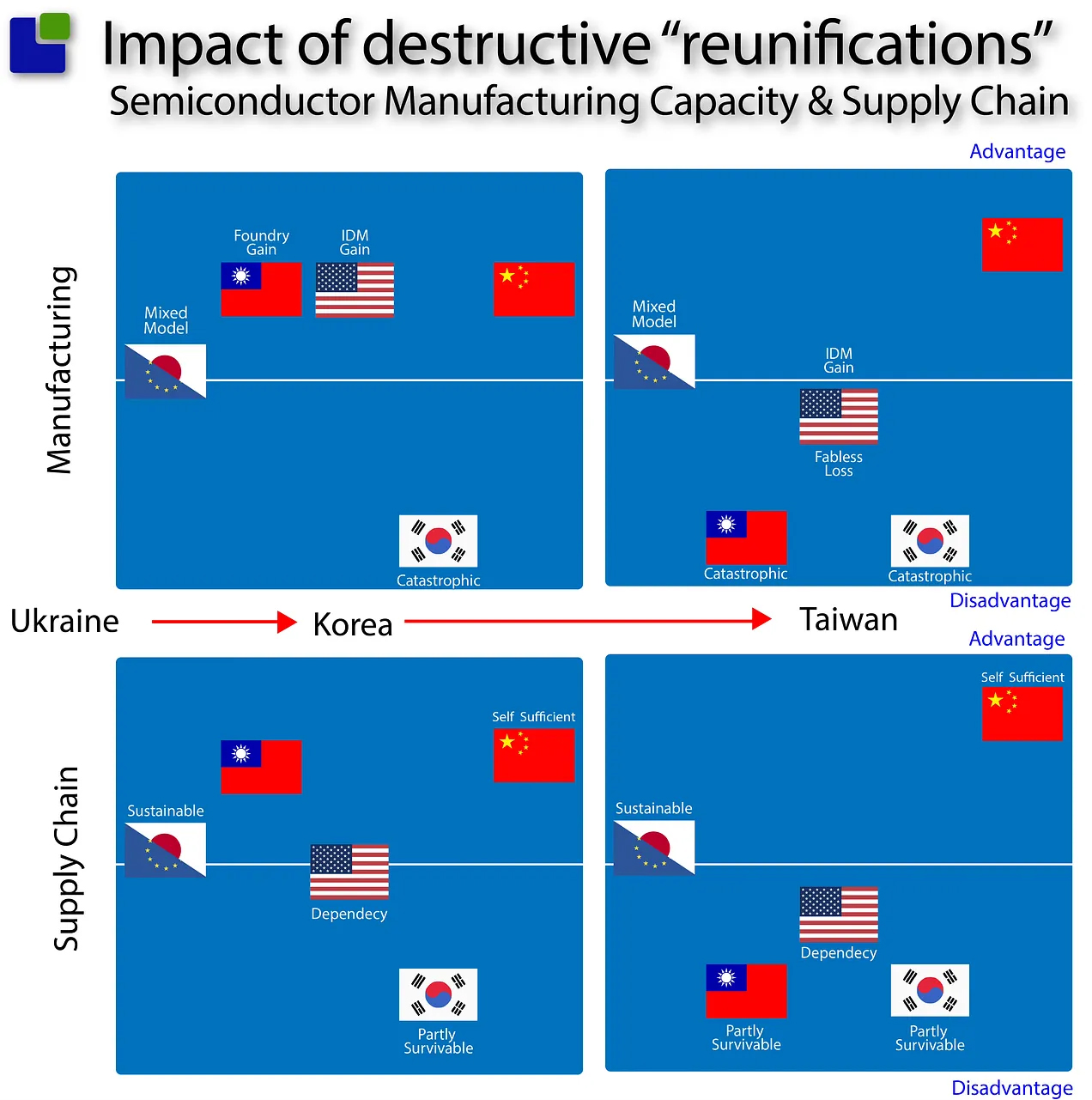

Taiwan and South Korea own 22% and 28% of the world’s semiconductor capacity, respectively, with China in third place at 12%, according to Asholm. But if you exclude those two countries, China’s 12% would quickly jump to about a third of global capacity.

In this scenario, Asholm says, China’s share of semiconductor production would only grow each year, even as the U.S. rapidly grows its semiconductor manufacturing industry. The CHIPS Act rejected investments in semiconductor factories at levels higher than the previous 28 years combined. After all, Beijing is also investing billions of dollars in the high-tech industry to boost development.

If a conflict breaks out between South Korea and Taiwan, the two largest semiconductor manufacturing nations will lose out and China will come out on top. Moreover, if Taiwan falls into armed conflict, it is analyzed that US semiconductor manufacturing will only suffer minor losses while integrated device manufacturers (IDMs such as Intel) will gain market share. Meanwhile, fabless companies will suffer huge losses. Meanwhile, the semiconductor supply chain will be severely affected as the US will have to rely on other sources of supply that are not affected. However, in either scenario, China will become a self-sufficient country in the long run.

When the dust settles, China, with most of its supply chains domestic, will likely be the world’s leading supplier of electronics, especially with Taiwan and South Korea in tatters. Even if our electronics will be outdated by 15 to 20 years, we will be happy to buy them from the cheapest, highest quality source, especially as our society moves toward an electronic, interconnected one.

Fortunately, as Asholm points out, this is just a scenario. But war is irrational and for some people it is just a way to maintain power. History shows that even the most important trading partners can quarrel because of one dictator. Let’s hope that cool heads will prevail and we can continue to live in peace.