As more people use online means of communication and scammers’ tactics become more diverse, scams targeting older consumers are on the rise.

June is Elder Abuse Awareness Month, and USA TODAY spoke with two financial experts about how older consumers can protect themselves from becoming victims of abuse.

What is Elder Fraud?

While fraud can affect consumers of all ages, there has been an increase in financial crimes against people over the age of 60. Various reports vary widely in the number of fraud victims and the amount of fraud losses.

The FBI’s Internet Crime Complaint Center said in a report released in April that complaints of elderly fraud are up 14% from the previous year, with 101,000 victims expected to be affected by the scams by 2023. Victims have suffered losses of $3.4 billion in total, the center said.

Meanwhile, a 2023 AARP report, using data from multiple reports including the FBI, estimated that victims over the age of 60 lose $28.3 billion to fraud each year.

Darius Kingsley, head of consumer banking at Chase, said the number is probably higher, noting that a certain degree of shame holds victims back from reporting crimes.

“Fraud is a personal issue and it’s very embarrassing and shameful, so people don’t want to admit it,” Kingsley told USA Today in an interview. But victims shouldn’t feel embarrassed, he said, because even savvy consumers can fall victim to sophisticated crimes.

“Whatever the number is, it’s probably higher than that just due to a lack of reporting,” he said.

The rise in scams involves “specifically targeting consumers and defrauding some of the most vulnerable in society,” said Jeffrey Bashore, senior vice president of bank fraud at USAA.

Bayshore told USA Today that one of the most important things is “helping to arm consumers with information about what to look out for and how to spot people who are trying to trick them with scams and frauds.”

What are some scams targeting seniors?

Here are some scams that often target seniors and tips from Chase and USAA on how to avoid them.

- Artificial intelligence scam. Scammers are using AI to replicate voices and pose as friends or family members. The calls sound like a loved one in need urgently requesting money. Kingsley recommends agreeing a secret phrase with a friend or family member to verify their identity. He also suggests hanging up and calling back a number they know.

- Romance scam. Be cautious if a romantic partner or new friend asks you to send them money, especially if you haven’t met them in person. Never send money to someone you don’t know well, met online, or have never met in person.

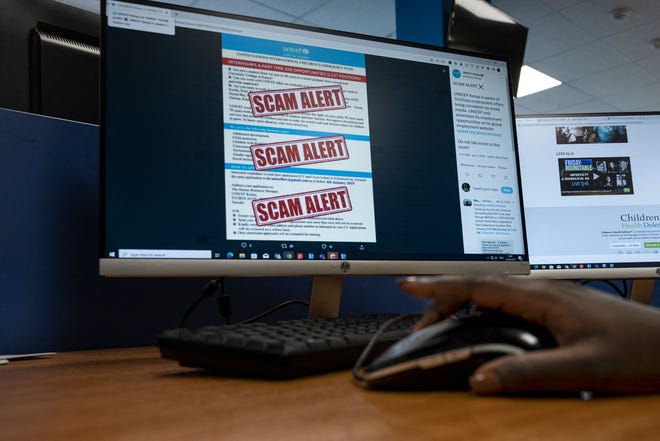

- Technical support scam. If you see a pop-up message on your computer or phone telling you there’s a problem, don’t be fooled. Don’t allow remote access to your computer or pay any fees. Also, beware of fake emails that pretend to be invoices for things you didn’t order or fake receipts for things you didn’t pay for, trying to get you to click for more information.

- Impersonation of well-known banks and companies. Scammers will pose as reputable companies and warn you about problems with your account or order. They try to trick consumers into providing personal or financial information. Don’t answer calls from numbers you don’t recognize or reply to unsolicited text messages, says Bashore.

- Impersonating a government or law enforcement agency. Scammers may pose as representatives of the IRS, the Social Security Administration, or law enforcement and demand immediate payment or threaten law enforcement action. The government will never call you to demand or threaten urgent action. In most cases, government officials will contact you by mail if there is a problem.

- Investment fraud. If it sounds too good to believe, it probably is.

Tips to avoid getting scammed

To help identify potential scams and fraudulent activity, use these tips from Chase:

- We request urgent action and sharing of personal information. Scammers usually have a sense of urgency and will threaten you with losing money, access to your accounts, or even arrest if you don’t comply.

- A sudden new relationship that is interested in your money. Financial abuse often comes from someone the victim knows, such as a caregiver or a new friend. Be wary of new friends who approach you with investment opportunities or express an interest in your finances.

- Unusual financial activity. If you notice any withdrawals or changes from your account, or if you notice a loved one making sudden changes to their financial accounts, contact your financial institution.

- Wrong number. Kingsley said some scammers will text or call someone in the hopes that you’ll answer and say it was a wrong number, then try to get friendly with them in order to lower your defenses.

What to do if you are a victim of fraud?

“Contact authorities and financial institutions as soon as possible. Don’t be ashamed of what happened, ask for help,” Bashore said.

“This demographic is at risk for intense fear, shame, anxiety, depression and loss of independence,” Bashore said. “It’s important that people understand how prevalent these scams are and how sophisticated and sophisticated they are becoming, especially as these identity theft scams become increasingly difficult to spot even for savvy consumers.”

“Don’t be embarrassed to reach out and engage with trusted members of your family and community,” he said. Those friends and loved ones can advocate for you.

Romance scams:A widow finds new love only to be scammed out of $1 million.

The sooner financial institutions realize there’s a problem, the better their chances of recovering some of the lost money, Bashore said, but liability for fraud varies from case to case, and if consumers knowingly sent money to scammers, it’s often harder to get it back, he said.

“Financial institutions will always do their best to recover funds,” he said. “It is very important that consumers contact their financial institution immediately if they believe they have been the victim of fraud, as time is valuable, especially given the speed of payments.”

If you’re being scammed and realize it, Kingsley says you should cut off contact.

Kingsley likens this response to the firefighting training tip of “stop, crouch, roll.”

“Stop and think for a second. Don’t panic. You don’t need to react in the moment to anything. Take a breather. And again, I recommend having a trusted point of contact.”

Betty Lynn Fisher is a consumer reporter for USA TODAY. Contact her at blinfisher@USATODAY.com or follow @blinfisher on X, Facebook and Instagram.. Sign up here for our free The Daily Money newsletter, which brings you top consumer news stories on Fridays.