Vertigo 3d

The big banks will start reporting their earnings next Friday, 7/12/24. Keep an eye on JPMorgan (JPM), Citigroup (C), and Wells Fargo (WFC).

June CPI and PPI data are also due to be released this week, with the CPI on Thursday, July 11th and the PPI on Tuesday, July 23rd. It is scheduled to be released on Friday, July 12, 2024.

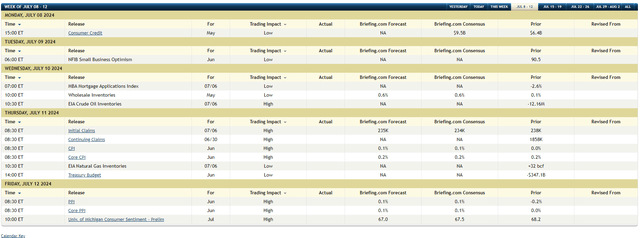

This table from Briefing.com shows readers projected economic data for the week of July 7, 2024.

Consumer credit is due to be released on Monday afternoon and, although it doesn’t usually get much coverage, has been somewhat weak in recent months.

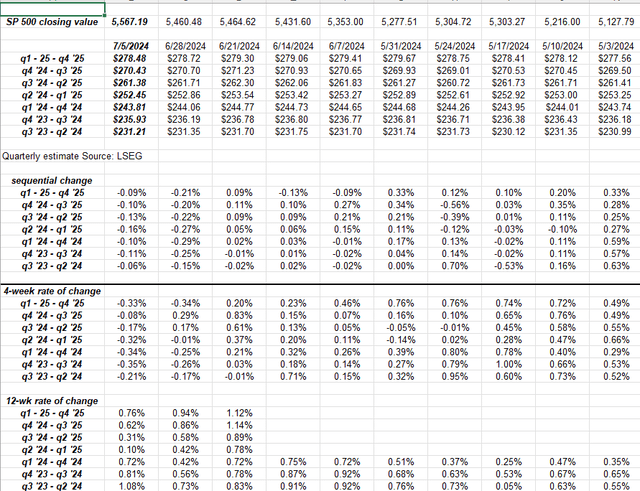

S&P 500 Data

- This week, the next 4 quarter forecast increased by $9, bringing the new next 4 quarter forecast to $261.39, as the old quarter (Q2 2024 – Q1 2025) dropped and a new quarter (Q3 2024 – Q2 2025) was added. The next 4 quarter forecast in the first week of January 2024 was $243.98.

- of The stock is now trading at 21.3 times forward earnings, down from 21.6 last week, and 19 times by early 2024.

- Despite the S&P 500 rising 1.5% this week, the S&P 500 earnings yield surged to 4.69% from 4.63% last week due to a large increase in future expectations.

- LSEG said only 19 companies have reported their second-quarter 2024 financial results so far, so any “upside surprises” or better-than-expected performance are not yet meaningful.

There’s no question that the S&P 500 earnings data supports the bull market outlook: S&P 500 earnings have been strong (for now).

Rate of change

Using quarterly EPS forecasts for the S&P 500, this internal table gives forecasts for the next four quarters from Q3 2024 through 2025, then calculates the percentage change in forecasts for the next four quarters over four and 12 weeks in turn.

The exceptional strength in May and June 2024 is beginning to wane, but this occurs during the last two weeks of each quarter and the first two weeks of the following quarter, and continues thereafter until the earnings release schedule begins to pick up steam.

We should see renewed strength in the week ending July 19th.

But remember, the S&P 500 will peak before EPS estimates for the S&P 500 start to reverse. While the S&P 500 itself is a leading indicator, after 20 years of doing this weekly post, I would say that S&P 500 earnings are more of a contemporaneous indicator.

Given the amount of work put into the weekly blog, readers should be on the lookout for negative pre-announcements from major large caps. I hate talking about market history all the time, but going all the way back to 2000, after the S&P 500 and Nasdaq hit their peaks in March 2000, Intel (INTC) warned in September 2000 that GE’s Jack Welch was using the mainstream media (mainly CNBC) to attack Greenspan and warn about a rapidly slowing US economy. This was right around the time the mainstream media was starting to wake up to GE’s “earnings manipulation” over the past 20 years.

One thing that is rarely talked about today is that when it comes to the quality of earnings, the S&P 500 today is much more advanced than it was in the late 1990s, and nowhere is this more evident than in the cash flow statement.

Technology EPS and Revenue Trends:

- Q2 2024 (Estimated): Technology EPS is expected to grow 16.9% year over year, and revenue is expected to grow 9.5% year over year.

- Q1 2024 Results: Technology EPS up 27% YoY, revenue up 8.5% YoY.

- Q4 2023 Results: Technology EPS increased 24.2% year over year, revenue increased 7.8% year over year.

- Q3 2023 Results: Technology EPS increased 15.3% year over year, revenue increased 2.8% year over year.

- Q2 2023 Results: Technology EPS up 5% year over year, revenue flat year over year.

- Q1 2023 Results: Technology EPS down 8.3% YoY, revenue down 2.9% YoY.

The trend is on your side. What’s even more interesting to me is that as we look at Q4 2023 and Q1 2024 (see the first table in the late June blog post), we see some “upside surprises” in technology as each month of Q4 2023 and Q1 2024 progresses.

While the technology industry faces tough conditions in the second half of 2024, it is also worth noting that technology industry revenue growth began 2Q24 at its highest level in the past 18 months.

Summary/Conclusion

This blog has been cautious on the S&P 500 and Nasdaq given poor market breadth and overall market participation (according to Bespoke, only two sectors have outperformed the S&P 500 YTD in 24 years: technology and communication services), but this “affliction” could continue indefinitely, as we saw in the late 1990s.

Some stocks are in a bull market, so act accordingly.

These are not advice or recommendations and are personal opinions only. Past performance is no guarantee of future results. Investments involve the risk of losing capital, even in the short term. All EPS and revenue forecast data is taken from LSEG.com.

thank you for reading.

Original Post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.