Even when a company is losing money, shareholders can make a profit if they buy a good company at the right price. For example, biotechnology and mining exploration companies often lose money for years before they hit the sweet spot in discovering a new treatment or mineral. Still, only a fool would ignore the risk that a loss-making company could burn through its cash too quickly.

Considering this risk, we Star Pharma Holdings (ASX:SPL) shareholders should be concerned about the company’s cash burn. For the purposes of this article, cash burn refers to the annual rate at which an unprofitable company spends cash to fund growth, i.e. against its free cash flow. We first calculate the company’s cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Star Pharma Holdings

Does Star Pharma Holdings have a long-term cash runway?

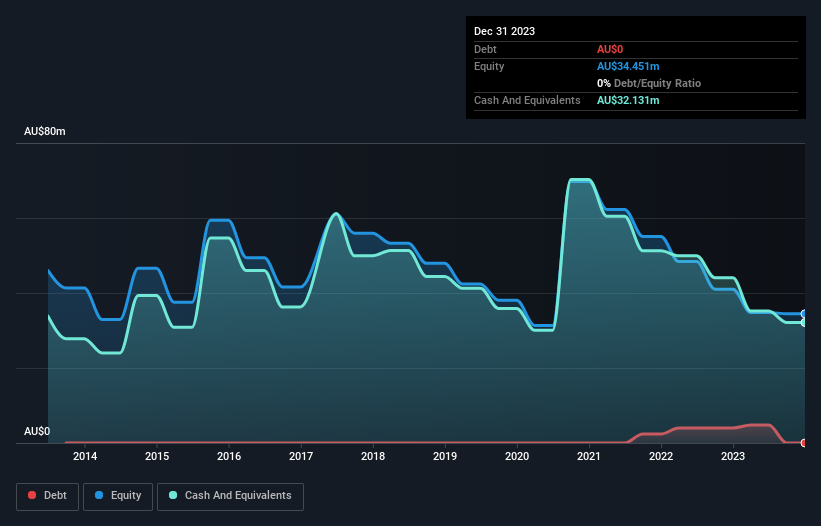

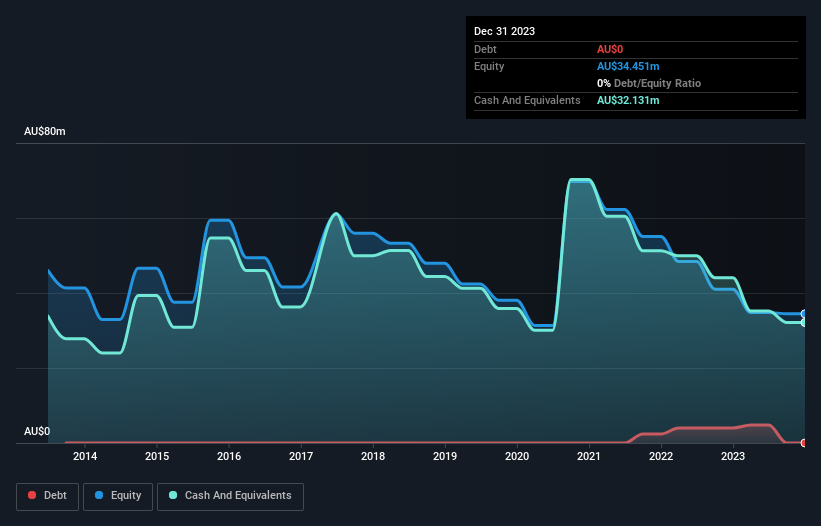

A company’s cash runway is the length of time it would take to burn through its cash reserves at its current cash burn rate. In December 2023, Star Pharma Holdings had cash of A$32m and no debt. Last year, its cash burn was A$6.5m, which means it had a cash runway of about 4.9 years from December 2023. With a runway this long, a company can buy itself the time and space it needs to expand its operations. The image below shows how its cash balance has changed over the past years.

How much has Star Pharma Holdings grown?

Overall, we think it’s a bit positive that StarPharma Holdings has reduced its cash burn by 20% over the last 12 months. But what really stands out is the 131% operating revenue growth. That’s pretty decent growth, if you think about it. Of course, we’ve only taken a quick look at the stock’s growth metrics here. This graph of historical revenue growth shows how StarPharma Holdings has built its business over time.

Can Star Pharma Holdings raise funds easily?

While we’re impressed with the progress StarPharma Holdings has made over the past year, it’s also important to consider how much it would cost to raise more capital to fuel growth. Companies can raise capital with either debt or equity. Typically, a company will sell new shares in its own company to raise cash to fuel growth. Looking at a company’s cash burn relative to its market capitalization can tell us how much shareholders’ equity would be diluted if the company needed to raise enough capital to cover its cash burn over the next year.

StarPharma Holdings’ A$6.5m cash burn represents about 14% of its market capitalization of A$45m. Given this, it wouldn’t be too difficult for the company to raise more capital to fund growth, although shareholder wealth would likely be diluted somewhat.

How risky is Star Pharma Holdings’ cash burn situation?

As you can probably tell by now, we’re not too worried about Star Pharma Holdings’ cash burn. For example, we think the company’s revenue growth shows it’s on track. Cash burn reduction was the weakest feature in this analysis, but we’re not worried about it. Taking all the metrics in this article together, we’re not worried about the cash burn rate. The company seems to be well ahead of its medium-term spending needs. On another note, we’ve done some in-depth research on the company and 2 warning signs for Star Pharma Holdings (Number 1 is a concern!) Things you should know before investing here.

of course, You may find a great investment by looking elsewhere. Take a look at this free A list of companies with significant insider holdings and a list of growth stocks predicted by analysts

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.